you position:Home > us energy stock > us energy stock

Title: Market Sentiment and US Stocks: Understanding the Dynamics

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

Introduction: In the world of finance, market sentiment plays a crucial role in shaping the performance of the stock market. As investors, it is essential to understand how market sentiment impacts US stocks and how to navigate through the volatile landscape. This article delves into the dynamics of market sentiment and its influence on the US stock market, providing insights for both seasoned investors and beginners.

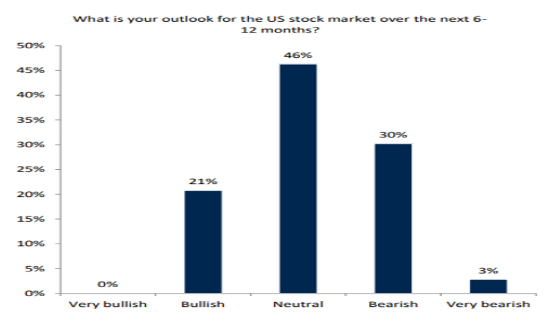

Understanding Market Sentiment: Market sentiment refers to the overall attitude and outlook of investors towards the financial markets. It encompasses various factors such as economic indicators, political events, corporate earnings, and global economic conditions. The sentiment can be categorized into three main types: bullish, bearish, and neutral.

Bullish Sentiment: A bullish market sentiment is characterized by optimism and optimism. Investors believe that the market will continue to rise, leading to increased buying activity. This sentiment is often driven by positive economic indicators, strong corporate earnings, and favorable political conditions. Historically, bullish sentiment has been associated with strong stock market performance.

Bearish Sentiment: On the other hand, a bearish market sentiment is characterized by pessimism and skepticism. Investors are concerned about the future of the market and tend to sell off their holdings. This sentiment is often driven by negative economic indicators, weak corporate earnings, and unfavorable political conditions. Bearish sentiment can lead to significant declines in the stock market.

Neutral Sentiment: Neutral sentiment is when investors are neither overly optimistic nor pessimistic. It reflects a balanced view of the market, with investors neither actively buying nor selling. Neutral sentiment can persist for extended periods and is often a precursor to a market reversal.

Impact of Market Sentiment on US Stocks: Market sentiment has a significant impact on the performance of US stocks. Here's how it affects the market:

Stock Prices: Bullish sentiment typically leads to higher stock prices, as investors are willing to pay more for shares. Conversely, bearish sentiment can lead to lower stock prices, as investors sell off their holdings.

Trading Volume: Increased trading volume often accompanies strong market sentiment, as investors are more active in the market. Conversely, lower trading volume can indicate a lack of confidence among investors.

Sector Performance: Market sentiment can also influence sector performance, with certain sectors benefiting from bullish sentiment and others suffering from bearish sentiment. For example, during a bull market, technology and consumer discretionary sectors tend to outperform, while during a bear market, defensive sectors such as healthcare and utilities may do better.

Investment Strategies: Understanding market sentiment helps investors develop appropriate investment strategies, such as diversifying their portfolios or focusing on sectors that are likely to perform well during a particular sentiment.

Case Study: One notable example of market sentiment impacting the US stock market is the 2008 financial crisis. The crisis was marked by a bearish sentiment, as investors were concerned about the stability of the financial system. This led to a significant decline in stock prices, with the S&P 500 index falling over 50% from its peak.

Conclusion: Market sentiment is a critical factor in the performance of the US stock market. By understanding the dynamics of market sentiment and its impact on US stocks, investors can make informed decisions and navigate through the volatile landscape. Whether you are a seasoned investor or a beginner, keeping a close eye on market sentiment is essential for successful investing.

so cool! ()

like

- Honour Us Latex Stocking Size: Finding the Perfect Fit for Your Fashion Needs

- Title: Stock BJJN US: Unveiling the Potential of This Emerging Market

- Global X SuperDividend US ETF Stock: A Comprehensive Guide

- Fidelity Canada US Stock: A Comprehensive Guide

- US Steel Corporation Stocks: A Comprehensive Guide to Investing in the Steel Gian

- US Steel Stock News Today: Key Updates and Analysis

- Toys "R" Us Stock Crew Job Review: What You Need to Know

- Title: Top ETFs for US Stocks: Your Ultimate Guide to Investment Success

- US Stock Holidays 2025: A Comprehensive Guide

- US Military Prepositioned Stocks: The Strategic Reserve

- Title: US All Stock: Unveiling the Ultimate Investment Portfolio

- Stock Market US Prediction: What to Expect in 2023

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Title: Market Sentiment and US Stocks: Underst

Title: Market Sentiment and US Stocks: Underst

Market Sentiment: US Stocks in October 2025

Honour Us Latex Stocking Size: Finding the Per

US Stetek Stock: The Ultimate Guide to Underst

US Stocks to Buy Now: Top Picks for Investors

Percent of US Population in the Stock Market:

Top US Tech Stocks: Your Guide to Investment O

US Large Cap Momentum Stocks: September 2025 T

Title: Stock X Contact Us: Your Gateway to Exc

US Stock Futures: Hot Stocks to Watch

Title: "Clinton Campaign's Misst

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Ev Stocks: The Future of Transportation and En"

- ARM Holdings Stock: A Comprehensive Guide to U"

- LCID Stock: A Comprehensive Guide to Understan"

- Understanding Term Loans: Your Ultimate Guide"

- Title: Japan Stock Banks in US Markets: Opport"

- Questrade Buy US Stock: A Comprehensive Guide "

- Pharmaceutical Stocks: A Lucrative Investment "

- US Stock Market Symbol for IVN: Everything You"

- Understanding US Capital Stock Securities: A C"

- Copper Stocks: The Investment Opportunity You "