you position:Home > us energy stock > us energy stock

Understanding US Capital Stock Securities: A Comprehensive Guide

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the dynamic world of finance, capital stock securities play a pivotal role. For investors and businesses alike, understanding these financial instruments is crucial for making informed decisions. This article delves into the intricacies of US capital stock securities, providing a comprehensive guide to help you navigate this complex domain.

What are US Capital Stock Securities?

US capital stock securities refer to the various financial instruments issued by companies to raise capital. These instruments can include common stock, preferred stock, and additional securities like warrants and bonds. Each type of security offers different rights and benefits to investors.

Common Stock: The Cornerstone of Ownership

Common stock represents ownership in a company. When you purchase common stock, you become a shareholder, entitling you to a portion of the company’s profits. Additionally, shareholders have the right to vote on corporate matters, such as the election of the board of directors.

Preferred Stock: Stability with Benefits

Preferred stock offers a fixed dividend payment and, in some cases, priority over common stockholders in the event of a company’s liquidation. While preferred stockholders do not typically have voting rights, they enjoy a more secure investment compared to common stockholders.

Warrants and Additional Securities

Warrants are financial instruments that give the holder the right, but not the obligation, to purchase a specific number of shares of stock at a predetermined price within a specified time frame. These instruments can be a valuable addition to a portfolio, especially for those looking to benefit from potential stock price increases.

Benefits of Investing in US Capital Stock Securities

Investing in US capital stock securities offers several benefits:

- Potential for Profit: As a shareholder, you stand to benefit from the company’s success, including increased stock prices and dividends.

- Dividend Income: Some types of securities, such as preferred stock, provide fixed dividend payments, offering a steady stream of income.

- Corporate Governance: As a shareholder, you have the right to vote on corporate matters, allowing you to influence the direction of the company.

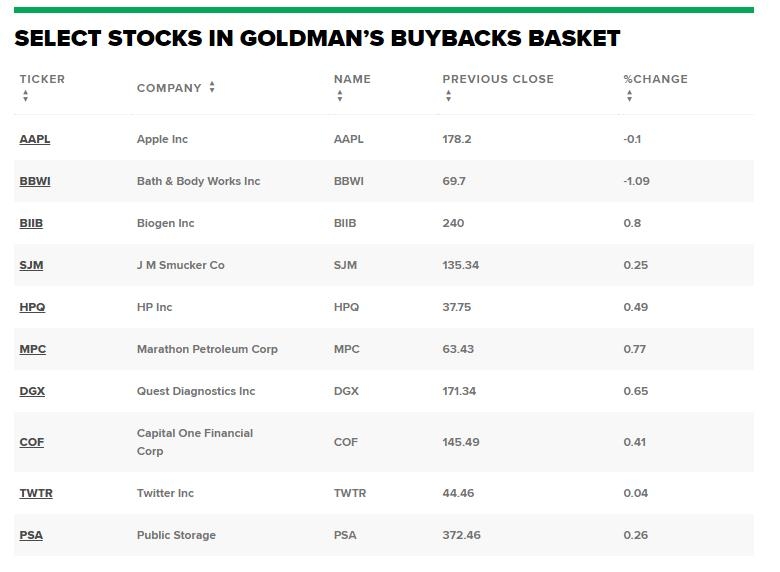

Case Study: Apple Inc.

One of the most successful companies in the tech industry, Apple Inc., has utilized capital stock securities to raise capital and expand its business. By offering both common and preferred stock, Apple has been able to attract a diverse range of investors, from individual retail investors to institutional investors.

Conclusion

Understanding US capital stock securities is essential for anyone looking to invest in the stock market. By familiarizing yourself with the different types of securities and their benefits, you can make informed decisions that align with your investment goals and risk tolerance.

so cool! ()

last:Title: Australia US Stock: A Comprehensive Guide

next:nothing

like

- Title: Australia US Stock: A Comprehensive Guide

- Is US Steel on the Stock Market? A Comprehensive Guide

- Art Company US Stock Market: A Thriving Sector in the Financial Landscape

- List of US Blue Chip Stocks: The Ultimate Guide to Investing in Market Leaders

- US Small Cap Stock Picks: Unveiling the Hidden Gems

- How Many US Stocks: A Comprehensive Guide to the American Stock Market

- US Graphene Companies Stock: A Comprehensive Overview

- Best US Stock to Buy in 2021: A Comprehensive Guide

- Best US Rare Earth Stocks: A Guide to Investment Opportunities

- DNK.US Stock: A Deep Dive into the Emerging Biotechnology Giant

- It Stocks Us: How Tech Giants Are Transforming the American Economy

- Can I Trade in the US Stock Market from Canada?

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Understanding US Capital Stock Securities: A C

Understanding US Capital Stock Securities: A C

Good US Stocks to Buy Now for Long-Term Invest

US Small Cap Stock Picks: Unveiling the Hidden

Title: TD US Stock Price: A Comprehensive Anal

Title: Best Performing US Stocks Past Week: Mo

Questrade Buy US Stock: A Comprehensive Guide

DNK.US Stock: A Deep Dive into the Emerging Bi

How U.S. Stock Market Performed in 2019

US News Articles on Stock Valuation: Unveiling

Canadian ETFs Traded on US Stock Exchanges: A

US Congress Stock Holdings: What You Need to K

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- International ETFs: A Guide to Diversifying Yo"

- Is US Steel on the Stock Market? A Comprehensi"

- Title: Understanding Capital Gains Tax on Stoc"

- When to Sell Stocks: A Comprehensive Guide for"

- Nintendo Switch Back in Stock in US: The Ultim"

- ADRs: Unlocking the Potential of U.S. Stocks f"

- Indian Banks Listed in US Stock Exchange: A Co"

- MSFT Price Target: A Comprehensive Analysis"

- Nike Stock Forecast: What the Experts Are Sayi"

- Linde US Stock Symbol: A Comprehensive Guide t"