you position:Home > us energy stock > us energy stock

Stock Market US Prediction: What to Expect in 2023

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

The stock market is a dynamic entity that can be influenced by a multitude of factors. Whether you're a seasoned investor or just starting out, understanding the future trends of the US stock market can help you make informed decisions. In this article, we'll delve into the predictions for the stock market in 2023, focusing on key sectors and market trends.

Economic Outlook and Inflation

One of the primary factors that affect the stock market is the overall economic outlook. Experts predict that the US economy will continue to grow in 2023, although at a slower pace compared to previous years. This growth is expected to be driven by factors such as consumer spending and business investment.

However, the issue of inflation remains a concern. The Federal Reserve has been actively working to control inflation, and their policies are likely to have a significant impact on the stock market. As inflation remains high, it could lead to interest rate hikes, which might affect the performance of various sectors.

Key Sectors to Watch

Several sectors are expected to perform well in the upcoming year. Here are some of the key sectors to keep an eye on:

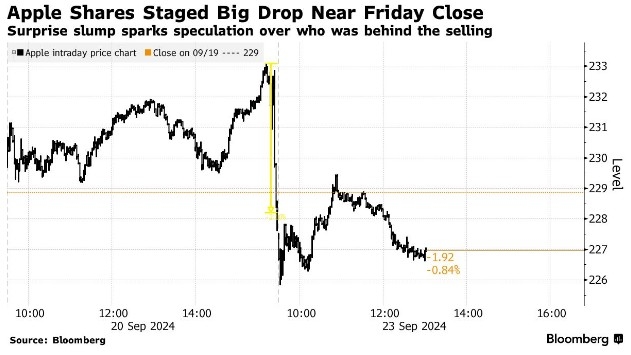

- Technology: The technology sector has been a major driver of stock market growth over the past few years. Companies like Apple, Microsoft, and Amazon are expected to continue performing well in 2023.

- Healthcare: With the aging population and the increasing demand for healthcare services, the healthcare sector is likely to see significant growth. Companies in this sector, such as Johnson & Johnson and Merck, are expected to benefit.

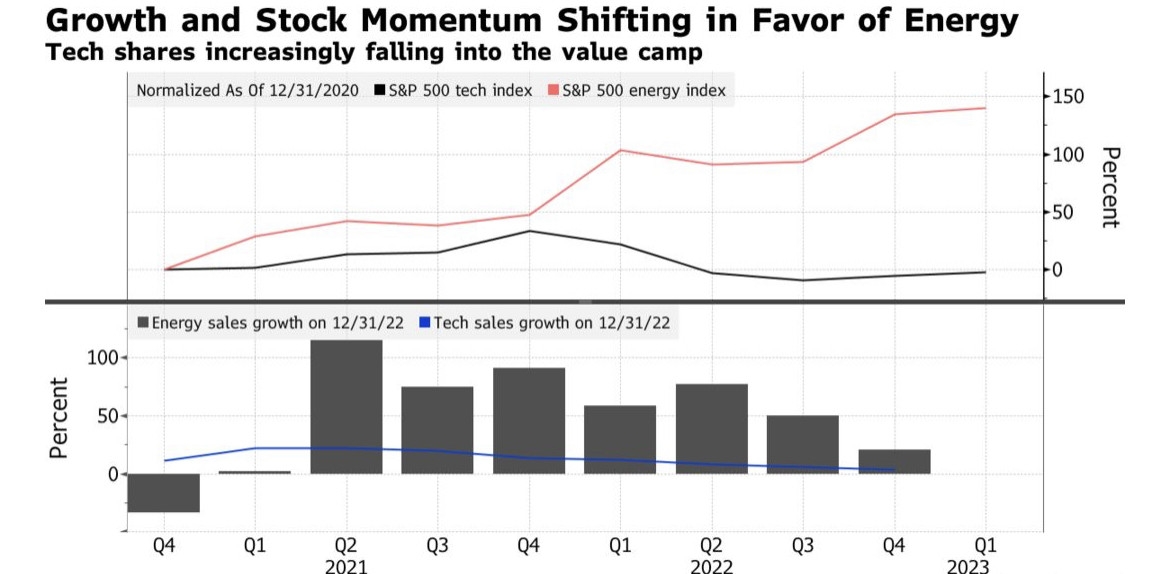

- Energy: The energy sector has seen a surge in interest due to the shift towards renewable energy sources. Companies like Tesla and NVIDIA are expected to play a significant role in this sector's growth.

Market Trends to Monitor

Several market trends are likely to shape the stock market in 2023:

- Dividend Stocks: As investors seek stable income, dividend stocks are expected to remain popular. Companies with strong financial health and a history of paying dividends are likely to attract investors.

- ESG Investing: Environmental, Social, and Governance (ESG) investing is gaining traction, and more investors are considering these factors when making investment decisions.

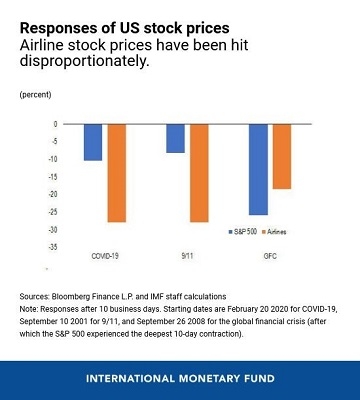

- Globalization: The increasing interconnectedness of the global economy means that US companies will be affected by events and trends worldwide. Investors need to be aware of these factors when making investment decisions.

Case Studies

Let's take a look at a couple of case studies to understand how these predictions might play out:

- Tesla: Tesla has been a standout performer in the stock market, with its stock price soaring over the past few years. As the company continues to expand its product line and invest in renewable energy, it's expected to remain a leader in the technology sector.

- Johnson & Johnson: Johnson & Johnson has a strong history of paying dividends and investing in research and development. With the aging population and increasing demand for healthcare services, the company is likely to continue performing well.

In conclusion, the stock market in 2023 is expected to be influenced by various factors, including the economic outlook, inflation, and market trends. By focusing on key sectors and monitoring these trends, investors can make informed decisions and potentially achieve significant returns. Remember, investing in the stock market always comes with risks, so it's important to do your research and consider your own financial situation before making any investment decisions.

so cool! ()

like

- US Stetek Stock: The Ultimate Guide to Understanding and Investing in This Emergi

- US Steel Corporation Stock Percentages: Understanding the Investment Landscape

- Title: Is Stocks More Powerful Than the US Dollar Index?

- Pharmacielo Stock US: A Breakdown of the Investment Opportunity

- US Economy Stock 2018: A Comprehensive Review

- Title: Quantitative Easing and Its Impact on the US Stock Market

- Title: "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&

- Title: List of Stocks in the US: Your Ultimate Guide to Investment Opportunities

- Nintendo US Stock on NASDAQ: An In-Depth Analysis

- Is the US Stock Market in Trouble?

- Are the US Stock Markets Open on Presidents Day?

- The 25 Biggest Pharmaceutical Stocks Trading in the US

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Stock Market US Prediction: What to Expect in

Stock Market US Prediction: What to Expect in

Are the US Stock Markets Open on Presidents Da

Paytm Money US Stocks: A Comprehensive Guide f

High Potential US Stocks: Your Guide to Invest

How Major US Stock Indexes Fared Wednesday

Top Performing US Stocks Q1 2025: A Deep Dive

CS Stock Price: What You Need to Know

Top Momentum Stocks: US Large Cap 5 Days Perfo

PlayStation 5 Console in Stock US: Your Ultima

Title: Free Stock Photos: Road Map of the US

Title: How Much Money Has the US Stock Market

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Solar Energy Stocks: A Lucrative Investment Op"

- Title: Understanding Short Interest: A Compreh"

- Cybersecurity Stocks: The Digital Shield Again"

- Title: "Clinton Campaign's Misst"

- Top US Stocks Momentum Short Term: A Comprehen"

- Title: Best Tech Stocks to Invest In for Long-"

- Best Performing US Large Cap Stocks: Recent Mo"

- Title: How Much Money Has the US Stock Market "

- US Small Cap Stock Picks: Unveiling the Hidden"

- Understanding Commodity ETFs: A Comprehensive "