you position:Home > us energy stock > us energy stock

Tencent Holdings US Stock Price: Current Trends and Future Prospects

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the ever-evolving landscape of the tech industry, Tencent Holdings Ltd. (TCEHY) has emerged as a global leader in social media, gaming, and finance. As investors and traders keep a close eye on its performance, understanding the current and future trends of its US stock price is crucial. In this article, we will delve into the factors influencing Tencent's stock price and analyze its potential trajectory.

Market Performance

As of the latest available data, Tencent's US stock price has seen a rollercoaster ride over the past few years. The stock has experienced significant volatility, driven by various internal and external factors. Historical trends suggest that the stock's performance is closely tied to the company's financial results and overall market sentiment.

Factors Influencing Stock Price

Financial Performance: Tencent's revenue and earnings reports are major drivers of its stock price. A strong financial performance, characterized by robust revenue growth and healthy profit margins, tends to positively impact the stock. Conversely, a weaker performance can lead to a decline in share value.

Regulatory Environment: The regulatory landscape in China, where Tencent operates its core businesses, plays a pivotal role in determining its stock price. Any regulatory changes, such as restrictions on social media platforms or gaming, can significantly impact the company's revenue and profitability.

Global Economic Conditions: The global economic environment also influences Tencent's stock price. A slowdown in the global economy can affect consumer spending, leading to a decrease in advertising revenue for Tencent's social media platforms and gaming business.

Technological Advancements: As a tech giant, Tencent's stock price is influenced by its ability to innovate and adapt to new technologies. Investments in emerging technologies, such as artificial intelligence and cloud computing, can positively impact the stock.

Market Sentiment: Investor sentiment plays a crucial role in determining Tencent's stock price. Factors such as market trends, geopolitical events, and economic indicators can sway investor sentiment and, subsequently, the stock price.

Case Study: WeChat's Growth

One of Tencent's most successful products, WeChat, has been a key driver of its growth. The platform, which combines social media, messaging, and payment services, has become an integral part of daily life in China. WeChat's success has contributed to Tencent's robust revenue growth and has played a significant role in driving its stock price.

Future Prospects

Looking ahead, Tencent's future prospects appear promising. The company is diversifying its business portfolio by investing in areas such as cloud computing, online gaming, and artificial intelligence. These strategic moves are expected to drive revenue growth and mitigate risks associated with regulatory changes and economic fluctuations.

However, potential challenges remain, including increased competition from other tech giants and the ongoing regulatory scrutiny in China. Investors should keep a close eye on these factors as they could impact Tencent's stock price in the long term.

In conclusion, understanding the factors influencing Tencent's US stock price is essential for investors and traders. By analyzing the company's financial performance, regulatory environment, and global economic conditions, one can gain valuable insights into its potential trajectory. As Tencent continues to innovate and diversify its business portfolio, the future looks bright for this tech giant.

so cool! ()

like

- Top Stocks to Buy in July 2025: A Strategic Investment Guide for the US Market

- Unlock the Power of Soybean Futures: A Comprehensive Guide

- Isaac Mizrahi Live Watch: Unveiling the Fashion Genius in Real-Time

- Space Related Stocks in the US: A Guide to Investment Opportunities

- Best Performing US Stocks This Week: Momentum That Can't Be Ignored

- Unlocking the Power of FinanceW: A Comprehensive Guide

- Stock Lookup Free: Discover the Best Free Stock Lookup Tools in 2023

- Unveiling the Distinctions: Stock Market vs. Share Market"

- Unlocking the Secrets of the News Stock Market: A Comprehensive Guide

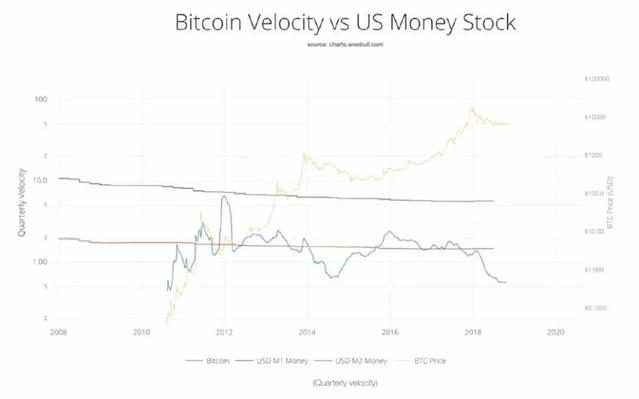

- Understanding US Money Stock Measures: A Comprehensive Guide

- S and P Heat Map: A Comprehensive Guide to Understanding Market Trends

- Day Trading US Stocks Offshore: A Comprehensive Guide

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Tencent Holdings US Stock Price: Current Trend

Tencent Holdings US Stock Price: Current Trend

Nasdaq Stock Quotes After Hours: Unveiling the

Buy Foxconn Stock in US: A Smart Investment Op

Kver Stock: Contact Us for Exceptional Investm

Best Brokerage for US Stocks in Singapore: You

Costco Stock Price in US Dollars: Current Tren

Conver Paso Stock to US Dollar Calculator: You

Bloomberg Stocks US: The Ultimate Guide to Nav

What Will the Markets Do on Monday? A Comprehe

Title: Top Performing US Stocks: 5 Trading Day

Finance US Stock Future: Your Ultimate Guide t

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Questrade Canada: Your Gateway to US Stocks"

- Understanding Dividend ETFs: A Comprehensive G"

- PFE US Stock: A Comprehensive Guide to Underst"

- Understanding the US Stock Market Average Dail"

- Title: US Digital Currency Stock: The Future o"

- Moody's US Credit Rating Downgrade: Stock"

- Stock Market Forecast 2025: What to Expect and"

- Unlocking the Potential of KKR & Co. I"

- Nintendo US Stock Market: A Comprehensive Anal"

- OpenDoor US Stock: The Comprehensive Guide to "