you position:Home > us energy stock > us energy stock

Unlock the Power of Soybean Futures: A Comprehensive Guide

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the vast world of agricultural commodities, soybean futures have become an essential tool for both farmers and investors alike. These financial contracts allow participants to mitigate risks and capitalize on market fluctuations. If you're looking to understand the intricacies of soybean futures, you've come to the right place. This article delves into the fundamentals, strategies, and benefits of trading soybean futures, offering a comprehensive guide to help you navigate this dynamic market.

Understanding Soybean Futures

Soybean futures are standardized contracts that represent the sale of a specified amount of soybeans at a predetermined price on a future date. These contracts are traded on futures exchanges, such as the Chicago Board of Trade (CBOT). By purchasing a soybean futures contract, you're essentially locking in a price for the soybeans you intend to sell or buy at a later date.

Key Features of Soybean Futures

- Standardized Contracts: Soybean futures contracts have standardized specifications, including the quantity of soybeans, delivery date, and quality standards.

- Leverage: Investors can control a large amount of soybeans with a relatively small amount of capital, thanks to the leverage provided by these contracts.

- Market Liquidity: Soybean futures are among the most actively traded agricultural commodities, providing a highly liquid market for buyers and sellers.

Why Trade Soybean Futures?

Risk Management for Farmers

- Price Protection: Farmers can lock in a selling price for their soybeans, ensuring a stable income regardless of market fluctuations.

- Hedging: By entering into soybean futures contracts, farmers can offset potential losses due to falling soybean prices.

Opportunities for Investors

- Profit from Market Trends: Investors can profit from rising or falling soybean prices by buying or selling soybean futures contracts.

- Diversification: Soybean futures offer an opportunity to diversify an investment portfolio, as they tend to be less correlated with other asset classes.

Strategies for Trading Soybean Futures

Technical Analysis

- Trend Analysis: Identifying trends in soybean prices can help traders make informed decisions about entering or exiting the market.

- Indicators: Using indicators like the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) can provide additional insights.

Fundamental Analysis

- Supply and Demand: Monitoring soybean supply and demand factors, such as crop yields and export data, can help traders predict price movements.

- Global Events: Political events, trade disputes, and other global factors can impact soybean prices and should be considered in trading strategies.

Real-World Example: 2019 Soybean Crop

In 2019, the United States experienced a significant reduction in soybean yields due to adverse weather conditions. This led to a sharp increase in soybean prices, as supply fell short of demand. Traders who had anticipated this situation by entering into soybean futures contracts could have capitalized on the price increase.

Conclusion

Soybean futures offer a powerful tool for managing risk and capitalizing on market opportunities. Whether you're a farmer looking to protect your income or an investor seeking diversification, understanding the nuances of soybean futures trading can be incredibly valuable. By incorporating technical and fundamental analysis, you can develop a robust trading strategy that aligns with your financial goals. So, if you're ready to unlock the potential of soybean futures, now is the perfect time to get started.

so cool! ()

last:Isaac Mizrahi Live Watch: Unveiling the Fashion Genius in Real-Time

next:nothing

like

- Isaac Mizrahi Live Watch: Unveiling the Fashion Genius in Real-Time

- Space Related Stocks in the US: A Guide to Investment Opportunities

- Best Performing US Stocks This Week: Momentum That Can't Be Ignored

- Unlocking the Power of FinanceW: A Comprehensive Guide

- Stock Lookup Free: Discover the Best Free Stock Lookup Tools in 2023

- Unveiling the Distinctions: Stock Market vs. Share Market"

- Unlocking the Secrets of the News Stock Market: A Comprehensive Guide

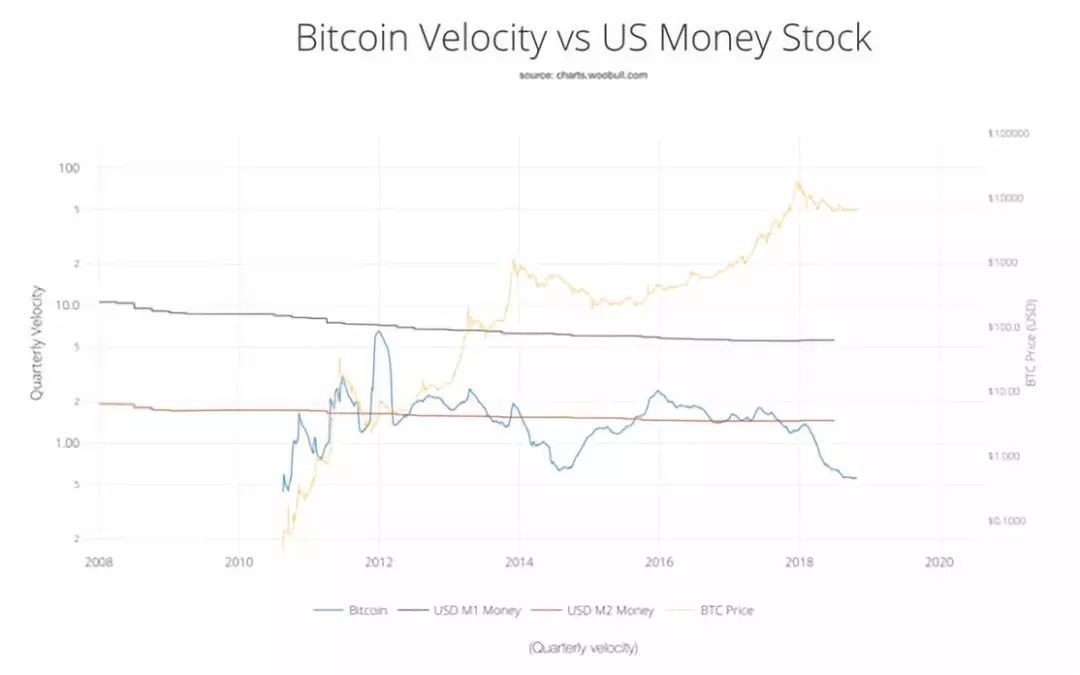

- Understanding US Money Stock Measures: A Comprehensive Guide

- S and P Heat Map: A Comprehensive Guide to Understanding Market Trends

- Day Trading US Stocks Offshore: A Comprehensive Guide

- Us Homebuilders Stocks: A Comprehensive Guide to Investing in the Housing Market

- Us Mail Stock: A Comprehensive Guide to Understanding and Investing in USPS Stock

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Unlock the Power of Soybean Futures: A Compreh

Unlock the Power of Soybean Futures: A Compreh

US Stock Fuse: Understanding the Importance of

Current US Stock Market Conditions June 2025

Polymer Black Stock Set NATO US: A Comprehensi

Best Stocks Platform US: Unveiling the Ultimat

Buy Us Stocks in South Africa: Your Guide to I

EDR Stock US: A Comprehensive Guide to Underst

ADRs: Unlocking the Potential of U.S. Stocks f

TLS Stock US: The Ultimate Guide to Investing

Understanding the Minimum Lot Size for US Stoc

Top Cannabis Stocks in the US: Your Guide to I

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Blue Chip Stocks: A Solid Investment in the US"

- US Defense Stocks Down: What It Means for Inve"

- The Best Way to Buy US Stocks in Australia"

- Top Natural Gas Stocks in the US: Investing in"

- Big Losing Stocks Today: What You Need to Know"

- Top US Cannabis Stocks to Watch in 2020: A Com"

- Unlocking the Potential of US Green Coffee Sto"

- US Offshore Drilling Stocks: A Deep Dive into "

- 30 Blue Chip Stocks of US Companies: Your Ulti"

- Top US Dividend Stocks 2021: Secure Your Finan"