you position:Home > us energy stock > us energy stock

Understanding the US Stock Market Average Daily Trading Volume

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

The Importance of Tracking the US Stock Market Average Daily Trading Volume

The US stock market has always been a beacon of financial activity, and its average daily trading volume is a crucial metric for investors, traders, and financial analysts alike. This figure offers insights into market liquidity, investor sentiment, and potential market trends. In this article, we will delve into the significance of the US stock market average daily trading volume and explore its impact on the financial world.

What is the US Stock Market Average Daily Trading Volume?

The US stock market average daily trading volume refers to the total number of shares bought and sold on the major US stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ, over a specific period, typically a day. This volume is an essential indicator of market activity and liquidity.

The Significance of the US Stock Market Average Daily Trading Volume

Market Liquidity: High trading volume suggests that there is ample liquidity in the market. This means that investors can easily buy and sell stocks without significantly impacting their prices. Conversely, low trading volume may indicate liquidity issues, making it more challenging for investors to execute trades at desired prices.

Investor Sentiment: The trading volume can provide insights into investor sentiment. For instance, a surge in trading volume might indicate increased optimism, while a decline in volume could signal a lack of interest or concern.

Market Trends: Analyzing the trading volume over time can help identify potential market trends. For example, a consistent increase in trading volume could indicate a growing trend, while a sudden spike followed by a decline might suggest a temporary market frenzy.

Case Studies: Analyzing the US Stock Market Average Daily Trading Volume

COVID-19 Pandemic: During the COVID-19 pandemic, the US stock market experienced unprecedented volatility. The average daily trading volume soared to record highs, reflecting heightened investor activity and concern. This period demonstrated how trading volume can serve as a barometer of market sentiment and potential trends.

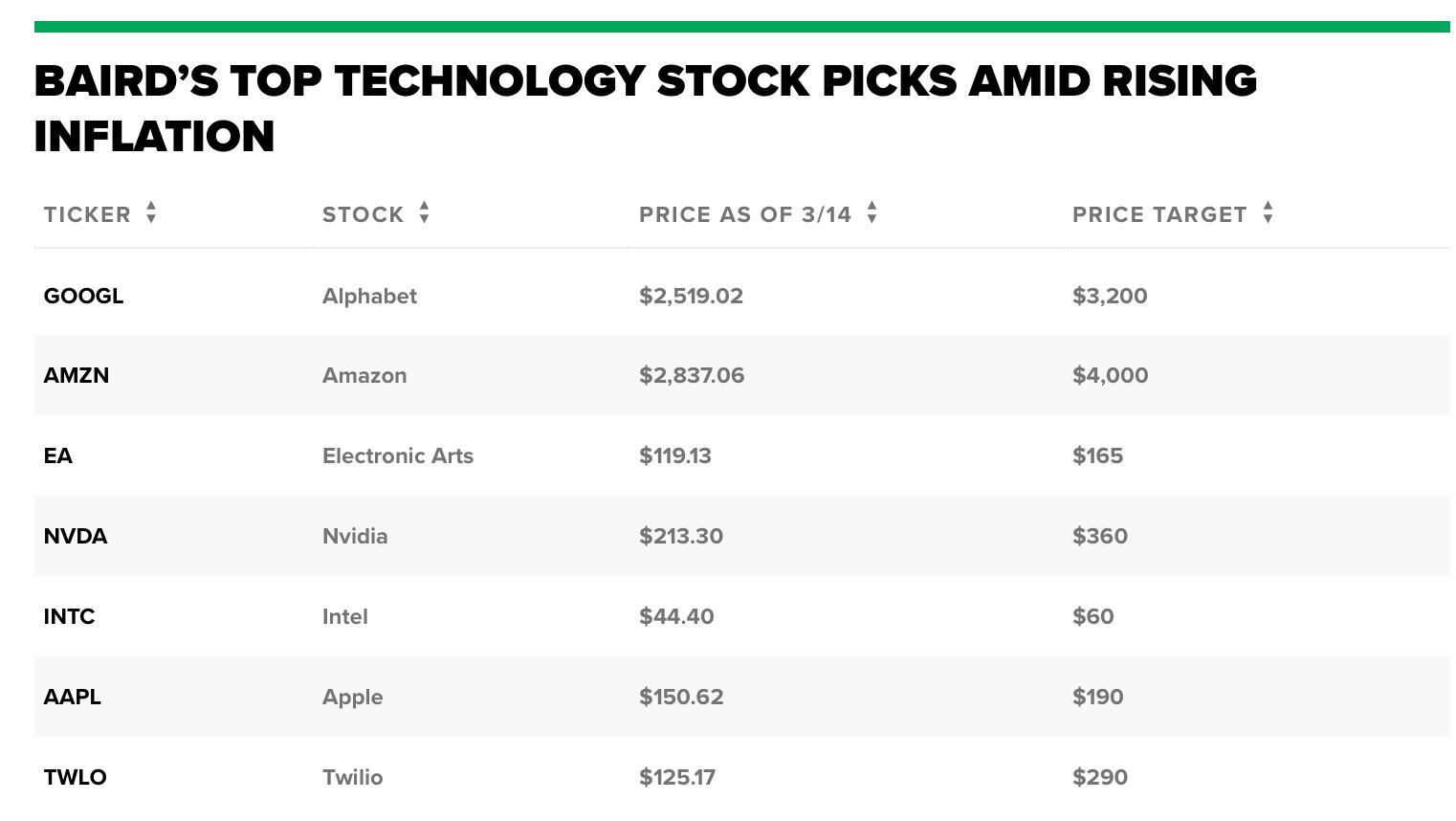

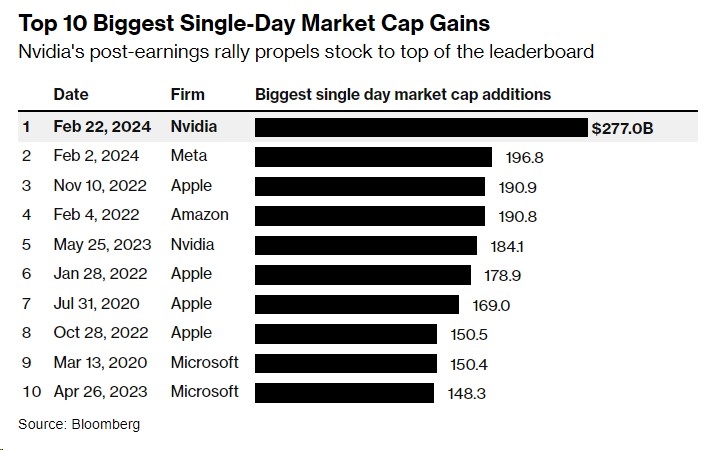

Tech Stocks Boom: In the past few years, the rise of tech stocks, particularly those listed on the NASDAQ, has significantly impacted the US stock market average daily trading volume. Companies like Apple, Microsoft, and Amazon have seen a surge in trading activity, contributing to the overall increase in market volume.

Factors Influencing the US Stock Market Average Daily Trading Volume

Several factors can influence the trading volume, including:

- Economic Data: Economic reports and data, such as unemployment rates and GDP growth, can impact investor sentiment and trading volume.

- Political Events: Political events, such as elections or policy changes, can create uncertainty and volatility in the market.

- Market Sentiment: Investor sentiment, influenced by news, rumors, and market trends, can drive trading volume.

Conclusion

The US stock market average daily trading volume is a vital metric for understanding market activity, liquidity, and investor sentiment. By analyzing this figure, investors and traders can gain valuable insights into potential market trends and make informed decisions. As the financial landscape continues to evolve, keeping an eye on the average daily trading volume will remain crucial for anyone involved in the stock market.

so cool! ()

last:Title: List of All Stocks Traded in the US: A Comprehensive Guide

next:nothing

like

- Title: List of All Stocks Traded in the US: A Comprehensive Guide

- How Indian Investors Can Buy US Stocks: A Comprehensive Guide

- Gift Tax for Non-US Citizens Owning Stock of a US Company

- US Rare Earth Company Stock: The Future of Advanced Technology

- How Malaysians Buy US Stock: A Comprehensive Guide

- US Lumber Stock Symbol: Understanding the Investment Opportunity

- US Stock Gainers and Losers: Understanding Market Trends

- Ocado Stock US: A Closer Look at the Future of Online Grocery Shopping

- US 4th Qtr 2018 Stock Market: A Comprehensive Analysis

- US Stock Market April 30, 2025 Closing: A Comprehensive Review

- Medtronic US Stocks: A Comprehensive Guide to Investing in the Healthcare Giant

- US Mail Stock Price: What You Need to Know

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Understanding the US Stock Market Average Dail

Understanding the US Stock Market Average Dail

Best Performing US Stocks Last 5 Days: Momentu

Best US Rare Earth Stocks: A Guide to Investme

Title: Is Stocks More Powerful Than the US Dol

Intel US Stocks: A Comprehensive Guide to Inve

Best US Stocks Under $10: A Smart Investment S

Innovative Strategies for Enhancing Your US St

Title: The Number of Stocks Listed on US Excha

Bud Stock Price US: The Current Status and Fut

Title: Natural Gas Companies Stock Us: The Gro

Title: RSX US Stock Price: Understanding the M

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Understanding Russell 2000 Stocks: A Comprehen"

- Title: Convertible Bond: Understanding the Ver"

- ADRs: Unlocking the Potential of U.S. Stocks f"

- Strong US Stocks: A Guide to Investment Opport"

- US Lumber Stock Symbol: Understanding the Inve"

- Can Non-US Citizens Invest in Stocks?"

- Nintendo US Stock on NASDAQ: An In-Depth Analy"

- Barclays Strategists Believe US Stocks Are Ove"

- Airbnb Stock Forecast: What to Expect in the N"

- Sustainable Investing: A Path to Profit and a "