you position:Home > us energy stock > us energy stock

Stocks That Benefit from US Interest Rate Cuts

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the volatile world of financial markets, few events send ripples of excitement through the trading floors quite like the prospect of interest rate cuts by the Federal Reserve. For investors, understanding which stocks stand to benefit from these monetary policy adjustments can be the difference between a profitable portfolio and a mere collection of equities. This article delves into the types of stocks that typically thrive during periods of US interest rate cuts.

Banks and Financial Institutions

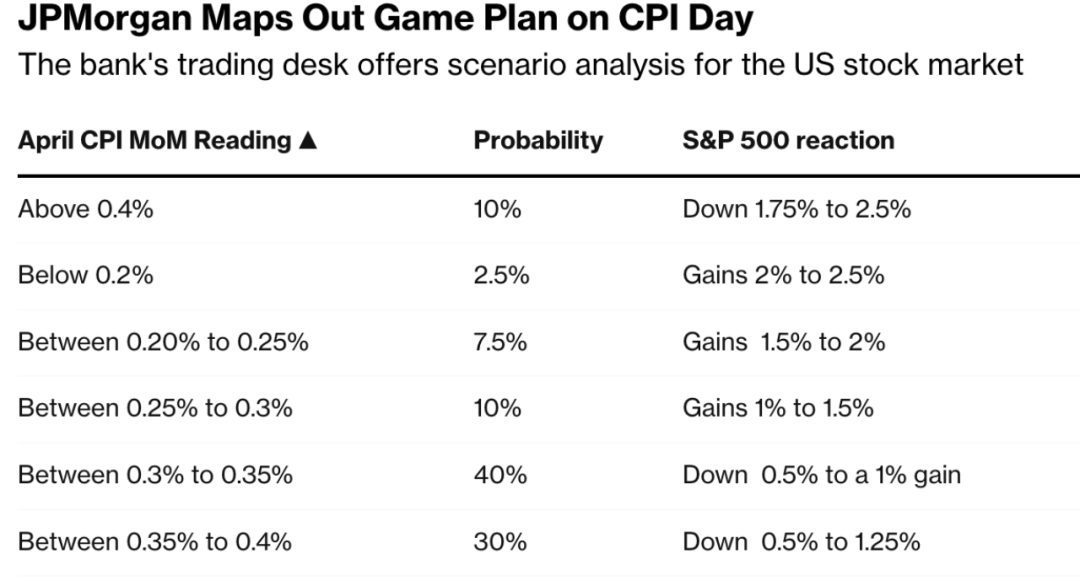

One of the most direct beneficiaries of interest rate cuts are banks and financial institutions. When the Federal Reserve reduces interest rates, the cost of borrowing money decreases. This means that banks can lend money at lower rates, potentially increasing their loan volumes and profits. Institutional investors like JPMorgan Chase, Bank of America, and Wells Fargo often see a boost in their stock prices as the prospect of higher loan income becomes more promising.

Real Estate and Home Construction Stocks

Lower interest rates also make mortgages and other real estate loans more affordable. This often leads to a surge in demand for real estate, driving up the prices of home construction and real estate stocks. Companies like Home Depot, Lowe's, and PulteGroup can experience a significant uptick in sales as potential homeowners take advantage of the lower borrowing costs to purchase homes.

Technology Stocks

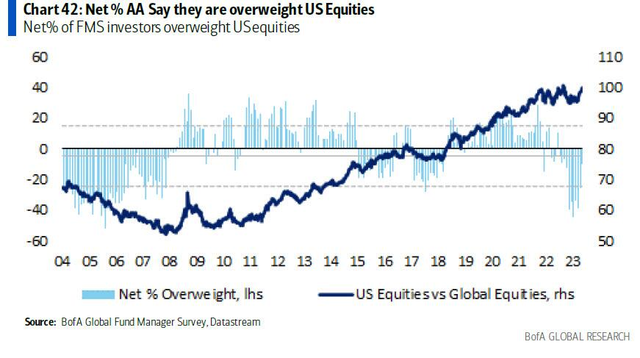

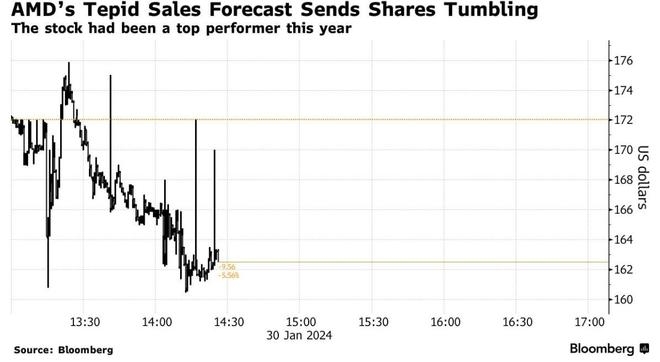

The technology sector, known for its ability to innovate and adapt to market changes, can also benefit significantly from interest rate cuts. With lower interest rates, companies have easier access to capital, which can be used for expansion, investment, and even mergers and acquisitions. Firms like Apple, Microsoft, and Amazon often see their stock prices rise as a result of the improved borrowing conditions.

Retail and Consumer Discretionary Stocks

Consumer discretionary stocks tend to do well during periods of lower interest rates because consumers have more disposable income. When the cost of borrowing is lower, consumers are more likely to take out loans for big-ticket purchases like cars, appliances, or vacations. Retail giants like Walmart, Target, and Costco often see increased sales during these times, leading to a rise in their stock prices.

Energy Stocks

Lower interest rates can also benefit the energy sector, particularly oil and gas companies. With lower borrowing costs, these companies can invest more heavily in exploration and production activities. As a result, companies like ExxonMobil and Chevron may see an increase in their stock prices as they take advantage of the favorable financial conditions.

Case Study: Amazon's Stock Performance

A prime example of how interest rate cuts can impact stock prices is Amazon. During the 2019 Federal Reserve's series of interest rate cuts, Amazon's stock price surged. The lower interest rates made it easier for Amazon to access capital for its vast expansion plans, from cloud computing to online grocery delivery. This accessibility to capital, coupled with the company's robust growth prospects, made investors optimistic about the future of Amazon's stock, leading to significant gains.

In conclusion, understanding which stocks benefit from US interest rate cuts is crucial for investors looking to capitalize on monetary policy shifts. By focusing on sectors like banking, real estate, technology, retail, and energy, investors can position their portfolios to potentially capitalize on the opportunities presented by lower interest rates.

so cool! ()

last:Equinix US Real Estate Stocks: A Strategic Investment for the Future

next:nothing

like

- Equinix US Real Estate Stocks: A Strategic Investment for the Future

- Understanding the Impact of US Stock Prices on Chinese Companies

- The Best Way to Buy US Stocks in Australia

- Top Lithium Stocks in the US: A Comprehensive Guide

- Small Cap US Tech Stocks: A Lucrative Investment Opportunity

- US Companies Listed on Shanghai Stock Exchange: Opportunities and Challenges

- The Stock and Flow of US Firearms: Understanding the Dynamics of Gun Ownership

- Understanding the iShares Total U.S. Stock Market Index NAV

- FLST US Stock Exchange: A Comprehensive Guide to Understanding and Investing

- AMC Stock Invest US: Understanding the Potential of AMC Theatres Stock

- Russian Companies Listed on US Stock Exchange: A Comprehensive Guide

- Penny Stocks to Invest In: A Guide for Aspiring Investors

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Stocks That Benefit from US Interest Rate Cuts

Stocks That Benefit from US Interest Rate Cuts

Indian Banks Listed in US Stock Exchange: A Co

Micron US Stock: A Comprehensive Guide to Inve

CS Stock Price: What You Need to Know

Small Cap US Tech Stocks: A Lucrative Investme

The Best US Cannabis Stock: A Comprehensive Gu

Alb.us Stock: Unveiling the Potential of This

Title: Fundamental Analysis of the US Stock Ma

How Much of the US Stock Is Owned by China?

Nintendo Switch Back in Stock in US: The Ultim

Analyst Upgrades US Stocks: Recent News and Im

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Tech Stocks to Buy: Top Picks for 2023"

- Healthcare ETF: A Comprehensive Guide to Inves"

- NVDA Price Target: What You Need to Know"

- Tech Stocks: The Future of Investment"

- Real Estate ETFs: A Strategic Investment for D"

- Mckesson US Pharma Stocks: A Comprehensive Gui"

- Is US Steel on the Stock Market? A Comprehensi"

- Title: Best US Penny Stocks to Buy Right Now"

- Insurance Stocks: A Sound Investment for the F"

- US Fabric Stock: Your Ultimate Guide to the Be"