you position:Home > us energy stock > us energy stock

The Best Way to Buy US Stocks in Australia

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

Are you an Australian investor looking to diversify your portfolio with US stocks? If so, you've come to the right place. Investing in US stocks from Australia can be a smart move, as it allows you to tap into the world's largest and most dynamic stock market. In this article, we'll explore the best ways to buy US stocks in Australia, ensuring you make informed decisions and maximize your investment potential.

Understanding the US Stock Market

Before diving into the details of how to buy US stocks from Australia, it's essential to understand the US stock market. The US market is home to numerous large-cap companies, including tech giants like Apple, Microsoft, and Google, as well as established players in various sectors. Investing in US stocks can offer several advantages, such as potential for higher returns, exposure to a diverse range of industries, and the opportunity to benefit from the dollar's strength.

Best Ways to Buy US Stocks in Australia

Brokers with US Stock Trading Platforms The most straightforward way to buy US stocks from Australia is through a broker with a platform that allows you to trade on US exchanges. Many Australian brokers offer this service, including CommSec, Bell Direct, and Mellon Financial. These brokers provide access to a wide range of US stocks, as well as valuable research tools and resources to help you make informed investment decisions.

Global Trading Platforms Another option is to use global trading platforms like Interactive Brokers or E*TRADE. These platforms offer access to both US and Australian stock exchanges, allowing you to trade in both markets. They often provide competitive fees and a user-friendly interface, making them an excellent choice for experienced investors.

Direct Investment through a US Brokerage Account If you prefer a more hands-on approach, you can open a brokerage account with a US-based broker, such as Fidelity or Charles Schwab. This method requires you to have a US bank account and may involve additional paperwork, but it offers the most control over your investments.

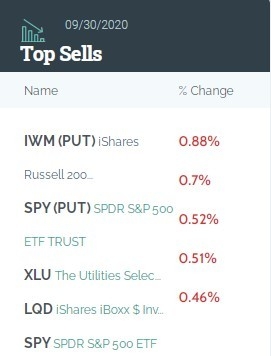

ETFs and Mutual Funds For those who prefer a more passive approach, investing in US ETFs (Exchange-Traded Funds) or mutual funds can be an excellent option. These funds provide exposure to a basket of US stocks, allowing you to diversify your portfolio without the need to buy individual stocks. Australian brokers like CommSec and Bell Direct offer a range of US ETFs and mutual funds.

Considerations When Buying US Stocks from Australia

When buying US stocks from Australia, there are several factors to consider:

- Exchange Rates: The value of the Australian dollar relative to the US dollar can impact your investment returns. Keep an eye on exchange rate fluctuations and consider using a forward contract to lock in a favorable rate.

- Fees and Commissions: Different brokers and platforms charge varying fees and commissions. Be sure to compare the costs and choose a broker that offers competitive pricing.

- Tax Implications: Australian investors must pay tax on their investment earnings, including dividends and capital gains. Consult with a tax professional to understand the tax implications of investing in US stocks.

Case Study: Investing in US Tech Stocks

Let's consider an example of investing in US tech stocks through an Australian broker. Suppose you decide to invest

By diversifying your portfolio with US stocks, you can potentially increase your investment returns and benefit from the growth of leading US companies.

In conclusion, buying US stocks from Australia is a viable and exciting investment opportunity. By choosing the right broker, understanding the US stock market, and considering the various factors involved, you can make informed decisions and maximize your investment potential. Happy investing!

so cool! ()

last:Top Lithium Stocks in the US: A Comprehensive Guide

next:nothing

like

- Top Lithium Stocks in the US: A Comprehensive Guide

- Small Cap US Tech Stocks: A Lucrative Investment Opportunity

- US Companies Listed on Shanghai Stock Exchange: Opportunities and Challenges

- The Stock and Flow of US Firearms: Understanding the Dynamics of Gun Ownership

- Understanding the iShares Total U.S. Stock Market Index NAV

- FLST US Stock Exchange: A Comprehensive Guide to Understanding and Investing

- AMC Stock Invest US: Understanding the Potential of AMC Theatres Stock

- Russian Companies Listed on US Stock Exchange: A Comprehensive Guide

- Penny Stocks to Invest In: A Guide for Aspiring Investors

- Bud Stock Price US: The Current Status and Future Prospects

- Are Bump Stocks Illegal in the US?

- Air US Stock: Exploring the World of American Airline Stocks

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

The Best Way to Buy US Stocks in Australia

The Best Way to Buy US Stocks in Australia

Should I Sell US Steel Stock?

Title: TD US Stock Price: A Comprehensive Anal

Title: Japan Stock Banks in US Markets: Opport

Title: Best US Penny Stocks to Buy Right Now

Title: US Stock Market Indices Today: A Compre

AMC Stock Invest US: Understanding the Potenti

Holidays and the US Stock Market in 2021: A Co

DNK.US Stock: A Deep Dive into the Emerging Bi

US Steel Stock Target Price: What Investors Ne

All Stock Symbols for US and Canada: A Compreh

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Speculative Fervor in US Stocks: A Thriving Ma"

- Momo US Stock Price: What You Need to Know"

- Coffee Stocks: A Booming Industry with Endless"

- Walmart Dividend: A Comprehensive Guide to Und"

- Impact of US Tariffs on Global Stock Markets"

- Panasonic Canada Stock Price in US Dollars: A "

- Indian Banks Listed in US Stock Exchange: A Co"

- Title: Stock Taxation in the United States: Un"

- Best ETFs to Buy Now: Your Ultimate Guide to D"

- Revenue Growth: Strategies to Skyrocket Your B"