you position:Home > us energy stock > us energy stock

US Economy Stock 2018: A Comprehensive Review

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

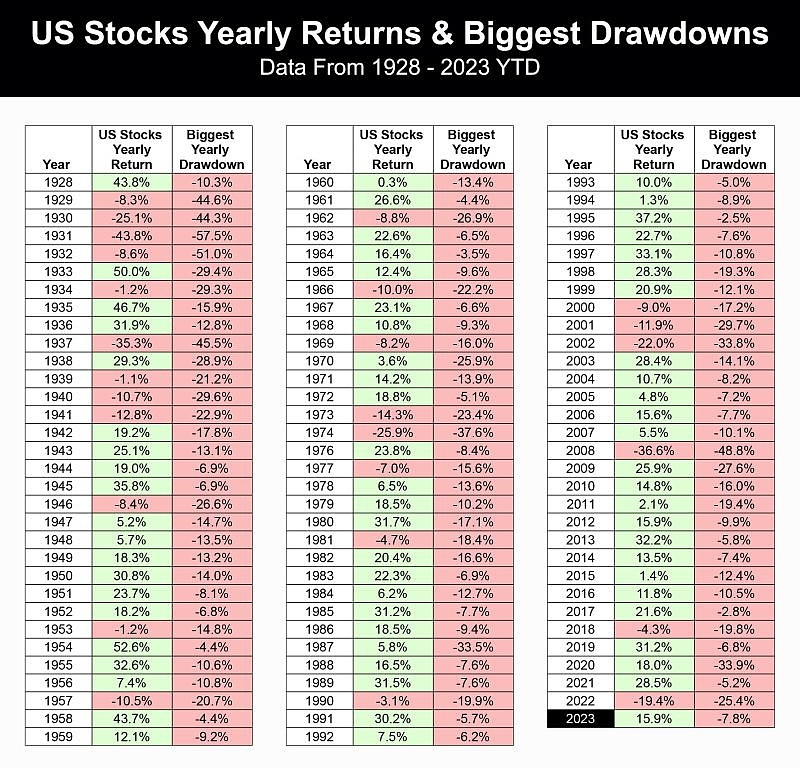

The year 2018 was a pivotal moment for the US economy, with stocks playing a significant role in reflecting the overall market trends. This article delves into the key developments and factors that influenced the stock market in 2018, providing valuable insights for investors and analysts.

Stock Market Performance in 2018

In 2018, the US stock market experienced a mix of ups and downs. The year started with a strong rally, driven by expectations of continued economic growth and favorable corporate earnings. However, as the year progressed, several factors, including trade tensions, political uncertainty, and rising interest rates, began to weigh on investor sentiment.

Rising Interest Rates and their Impact on Stocks

One of the most significant factors influencing the stock market in 2018 was the rise in interest rates. The Federal Reserve increased the federal funds rate four times during the year, signaling its commitment to a gradual tightening of monetary policy. This rise in interest rates led to a slowdown in stock market gains, particularly in sectors sensitive to borrowing costs, such as real estate and utilities.

Trade Tensions and their Impact on Stocks

Trade tensions between the US and China were another major factor affecting the stock market in 2018. The ongoing trade war resulted in increased tariffs on goods and services, causing disruptions in global supply chains and raising concerns about economic growth. As a result, stocks of companies exposed to international trade, such as technology and consumer discretionary sectors, experienced significant volatility.

Political Uncertainty and its Impact on Stocks

Political uncertainty, particularly surrounding the midterm elections and the upcoming presidential election in 2020, also played a role in the stock market's performance in 2018. Investors were concerned about potential policy changes that could impact the economy and corporate profits, leading to increased volatility in the market.

Key Sectors and their Performance in 2018

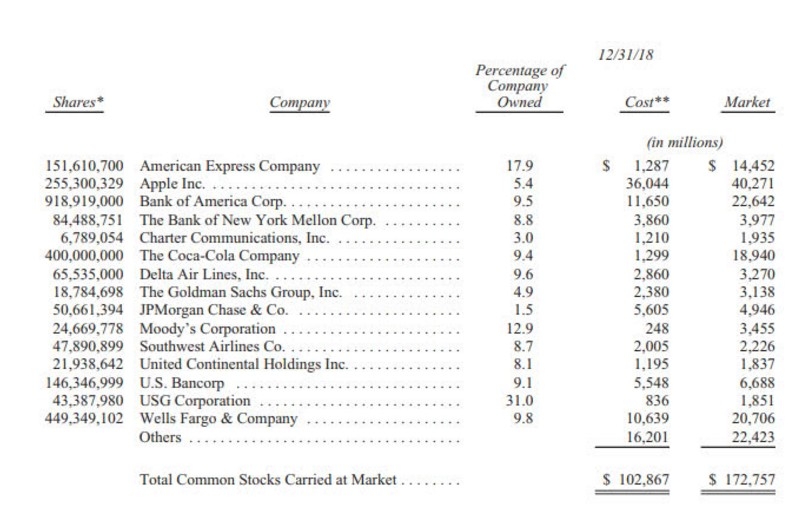

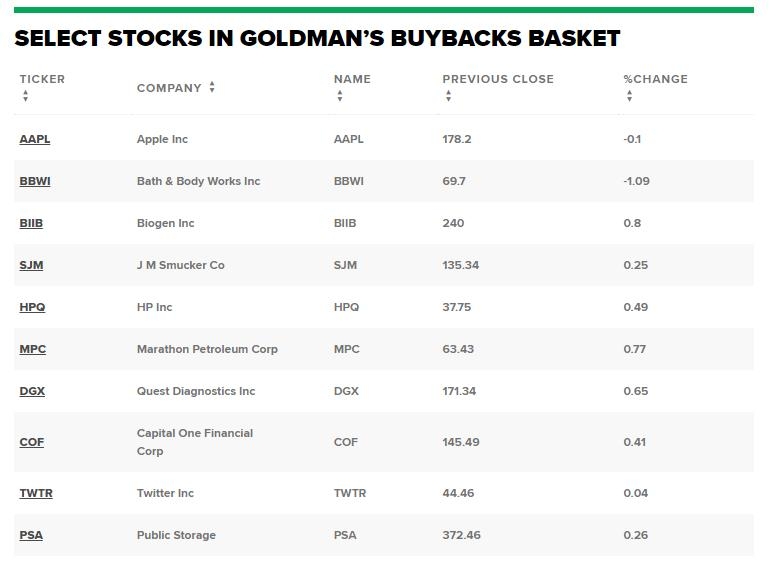

Several sectors experienced notable performance in 2018, with some outperforming others. The technology sector, led by giants like Apple and Microsoft, saw strong gains throughout the year, driven by robust earnings and growing demand for consumer electronics and software services. On the other hand, the energy sector faced challenges due to falling oil prices and increased regulatory scrutiny.

Case Studies: Apple and Facebook

Two notable case studies in 2018 were Apple and Facebook. Apple's stock experienced a strong rally during the year, driven by its strong earnings and growing product lineup. The company's decision to invest heavily in services, such as Apple Music and Apple TV, also contributed to its strong performance. Facebook, on the other hand, faced scrutiny due to privacy concerns and regulatory challenges, leading to a decline in its stock price.

Conclusion

The US stock market in 2018 was shaped by a combination of factors, including rising interest rates, trade tensions, and political uncertainty. While some sectors and companies performed well, others faced significant challenges. Understanding these factors is crucial for investors and analysts looking to navigate the stock market in the years ahead.

so cool! ()

last:Title: Quantitative Easing and Its Impact on the US Stock Market

next:nothing

like

- Title: Quantitative Easing and Its Impact on the US Stock Market

- Title: "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&

- Title: List of Stocks in the US: Your Ultimate Guide to Investment Opportunities

- Nintendo US Stock on NASDAQ: An In-Depth Analysis

- Is the US Stock Market in Trouble?

- Are the US Stock Markets Open on Presidents Day?

- The 25 Biggest Pharmaceutical Stocks Trading in the US

- RSI Analysis of US Stocks in July 2025: Predictions and Insights

- Understanding US Stock Exchange Market Hours in EST

- Best Brokerage for US Stocks in Singapore: Your Ultimate Guide

- Trading US Stocks from Dubai: A Comprehensive Guide

- PlayStation 5 Console in Stock US: Your Ultimate Guide to Availability and Purcha

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

US Economy Stock 2018: A Comprehensive Review

US Economy Stock 2018: A Comprehensive Review

Title: Toyo Solar Stock in South Carolina: A S

How Much of the US Stock Is Owned by China?

US Government Stocks List: A Comprehensive Gui

Title: Best Performing US Stocks: 5 Days Momen

Momo US Stock Price: What You Need to Know

Is the US Stock Market Trading Today?

Title: Does Ubq Israeli Company Trade on US St

Agrimonia Pilosa Powder Extract US Stock Avail

Title: US Digital Currency Stock: The Future o

Multibagger Stocks: How US Paid Services Can H

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Water Stocks: A Smart Investment in a Thirsty "

- Options Strategies: Mastering the Art of Tradi"

- Impact of Exchange Rate Fluctuations on US Sto"

- US Stock Futures Fall: What It Means for Inves"

- Green Energy Stocks: The Future of Investment"

- Top US Stock Companies: A Deep Dive into the F"

- Momentum Trading: A Strategic Approach to Capi"

- Title: "Isrg Us Stock Price: A Compre"

- Nintendo Switch Back in Stock in US: The Ultim"

- Agrimonia Pilosa Powder Extract US Stock Avail"