you position:Home > us energy stock > us energy stock

Are Stock and Bonds Regulated by the US Securities Exchange?

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

Introduction: Investing in stocks and bonds is a crucial part of financial planning for many individuals and institutions. However, understanding the regulatory framework surrounding these investments is equally important. In this article, we delve into the question: Are stock and bonds regulated by the US Securities and Exchange Commission (SEC)? We will explore the role of the SEC, the regulations that govern stocks and bonds, and the implications for investors.

Understanding the Role of the US Securities and Exchange Commission (SEC)

The US Securities and Exchange Commission (SEC) is a government agency established in 1934 to protect investors, maintain fair and efficient markets, and facilitate capital formation. The SEC plays a crucial role in regulating the securities industry, including stocks and bonds.

Regulations Governing Stocks

Stocks are shares of ownership in a company. The SEC regulates stocks to ensure that investors receive accurate and complete information about the company's financial health and operations. Key regulations include:

Initial Public Offering (IPO): Before a company can go public and sell its stock to the public, it must register with the SEC. This registration process requires the company to provide detailed information about its business, financials, and management.

Continuous Disclosure: Public companies must file regular reports with the SEC, including quarterly and annual reports. These reports provide updates on the company's financial performance and business activities.

Market Manipulation: The SEC enforces laws against fraudulent activities, insider trading, and market manipulation. These laws protect investors from unfair practices and promote fair and transparent markets.

Regulations Governing Bonds

Bonds are debt instruments issued by companies or governments to raise capital. The SEC regulates bonds to ensure that investors have access to accurate information about the bond issuer's creditworthiness and the terms of the bond.

Bond Issuance: Similar to stocks, bond issuers must register their securities with the SEC. This registration process requires the issuer to provide detailed information about the bond, including its interest rate, maturity date, and terms.

Continuous Disclosure: Bond issuers must file periodic reports with the SEC, providing updates on their financial condition and any changes to the bond terms.

Credit Rating: The SEC does not regulate credit ratings agencies, but it does oversee the bond market to ensure that issuers provide accurate and transparent information about their creditworthiness.

Case Study: Enron and WorldCom

Two notable cases illustrate the importance of SEC regulations in the stock and bond markets. Enron, a major energy company, collapsed in 2001 after hiding massive debts and using accounting fraud to inflate its profits. The SEC investigation revealed that Enron violated several securities laws, including disclosure requirements and insider trading. Similarly, WorldCom, a telecommunications company, engaged in accounting fraud that led to its bankruptcy in 2002. The SEC played a critical role in uncovering the fraud and bringing the companies to justice.

Conclusion:

In conclusion, both stocks and bonds are regulated by the US Securities and Exchange Commission (SEC). The SEC's role is to protect investors, maintain fair and efficient markets, and facilitate capital formation. By ensuring that investors have access to accurate and complete information, the SEC helps to build trust in the financial markets and promote economic growth.

so cool! ()

like

- Understanding the Impact of US Stock Exchange Stocks: A Closer Look at JBLU

- List of Large Cap Stocks in US: Top Investments for 2023

- "Is It a US or Canada Stock?" – How to Identify and Invest in

- Us Stock Blacklist: What It Means for Investors and Companies

- Reuter's US Stock Market: A Comprehensive Overview

- Unlocking Potential: The Rise of US Hemp Company Stocks

- Stock Market US Buying Assets: A Comprehensive Guide

- Mint Mobile Stock: Everything You Need to Know About US's Hottest Carrier

- Us News Best Stocks: Top Picks for Investors in 2023

- Unveiling the Power of US Stock Codes: Your Ultimate Guide

- TG Therapeutics: A Rising Star in US Biotech Stocks

- Unlocking Dividends: Exploring US Energy Initiatives Stock

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Are Stock and Bonds Regulated by the US Securi

Are Stock and Bonds Regulated by the US Securi

Charlotte's Web US Stock: A Comprehensive

Top Cybersecurity Stocks as Recommended by US

Maximize Your Retirement Savings with Canadian

June 25, 2025 US Stock Market Summary: Key Dev

Understanding US GAAP Tax Deductibility of RSU

US Stock Future Live: The Ultimate Guide to Un

Penny Stocks to Invest In: Top 5 Picks for 202

Stock Market US Buying Assets: A Comprehensive

Computershare Sale of Stock by Executor of Est

CNN News: The Latest Updates on US Stocks

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Title: Understanding Debt to Equity: A Key Fin"

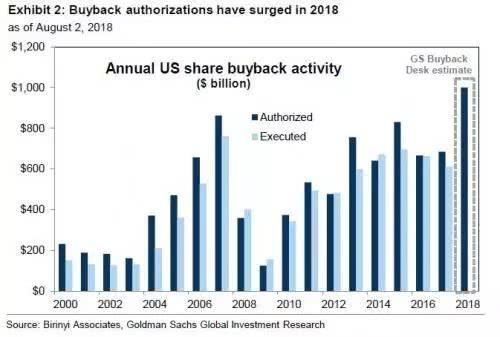

- Stock Buybacks: A Strategic Move for Investors"

- How Many Times Has the US Stock Market Crash?"

- Stock Market US Coronavirus: Impact and Recove"

- Stream for Us TV Subscription Out of Stock: Wh"

- Title: Leveraged ETFs: Your Gateway to High-Yi"

- All Weather Portfolio: Building Resilient Inve"

- How Many US Cups is a Quart for Stock? A Compr"

- US Steel Stock Live: Real-Time Analysis and In"

- Ev Stocks: The Future of Transportation and En"