you position:Home > us energy stock > us energy stock

How Many Times Has the US Stock Market Crash?

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

The U.S. stock market has seen its fair share of crashes throughout history. From the legendary 1929 Wall Street Crash to more recent events, these downturns have left a lasting impact on investors and the economy. But how many times has the U.S. stock market actually crashed?

The Great Depression and the 1929 Crash

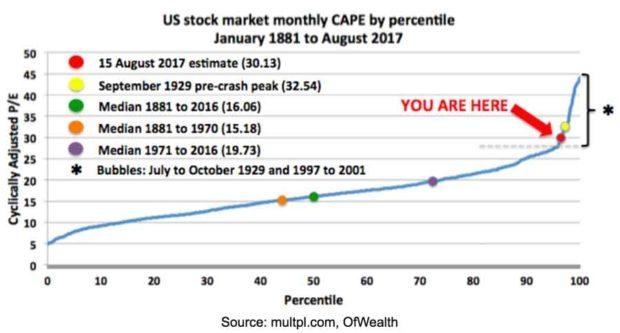

The most famous stock market crash in history, the 1929 Wall Street Crash, is often referred to as the event that sparked the Great Depression. This crash was a result of excessive speculation and the bursting of the stock market bubble. It led to a massive loss of wealth, bank failures, and widespread unemployment.

The Dot-Com Bubble and 2000 Crash

Another significant crash occurred in 2000 when the tech-heavy Nasdaq Composite Index experienced a dramatic fall. This crash was caused by the bursting of the dot-com bubble, which was fueled by excessive optimism about the potential of the internet. Many investors lost a significant amount of money, and the tech industry took years to recover.

The 2008 Financial Crisis

The 2008 financial crisis is considered one of the most severe economic downturns since the Great Depression. It was caused by a variety of factors, including the subprime mortgage crisis, excessive risk-taking by financial institutions, and a lack of regulation. The crash led to the failure of several major financial institutions, a sharp decline in stock market values, and a global economic recession.

Lesser Known Crashes

Besides these major crashes, the U.S. stock market has seen several other significant downturns. Here are a few examples:

- The Panic of 1873: One of the earliest stock market crashes, it was caused by speculative bubbles in railroads and banking.

- The Black Tuesday of 1937: This crash was a brief but severe downturn in the stock market that was part of the Great Depression.

- The October 1987 Crash: Often referred to as "Black Monday," this crash was characterized by a massive, one-day loss of nearly 23% in the Dow Jones Industrial Average.

Understanding Stock Market Crashes

Stock market crashes are often a result of a combination of factors, including economic uncertainty, excessive speculation, and inadequate regulation. While these crashes can be devastating, they also present opportunities for long-term investors. The key to surviving and thriving during a stock market crash is to maintain a well-diversified portfolio and to stay disciplined in your investment strategy.

Case Studies

One of the most notable examples of a successful long-term investment during a stock market crash is Warren Buffett's purchase of Berkshire Hathaway stock in the 1960s. At the time, the stock was selling for less than $7 per share, and Buffett saw it as an opportunity to invest in a company with strong fundamentals. Over the years, Berkshire Hathaway has grown significantly, and Buffett has become one of the most successful investors in history.

In conclusion, the U.S. stock market has experienced several major crashes throughout history. While these downturns can be devastating, they also present opportunities for long-term investors. By understanding the causes and consequences of stock market crashes, investors can make informed decisions and potentially benefit from these opportunities.

so cool! ()

last:"2025 May 6 US Stock Market Summary: Key Moves and Analysis"

next:nothing

like

- "2025 May 6 US Stock Market Summary: Key Moves and Analysis"

- Mic US Stock Price: Current Trends and Future Prospects

- Does Aldi Stock Tradd in the US? A Comprehensive Guide

- Namibia Stock Listed in US: A Comprehensive Guide

- Intuitive Surgical: A Leading Player in US Healthcare Stocks

- Top US Cannabis Stocks: Your Guide to Investment Opportunities

- Ajaib Us Stock: Unveiling the Mysteries of the Stock Market

- Current Stock Market Outlook 2025: A Glimpse into the Future of US Equities

- Maximizing Returns with iShares Trust S&P US Preferred Stock Index Fund

- Reasons to Own Us Bancorp Stock: Top 5 Advantages

- Understanding the Tata Motors US Stock Market: An In-Depth Look

- Understanding the US Stock Exchanges Market Share

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

How Many Times Has the US Stock Market Crash?

How Many Times Has the US Stock Market Crash?

Unlocking the Potential of NVDA: A Comprehensi

US Stock Market Performance on April 7, 2025:

Stocks of CRSP US Large Cap Growth Index Holdi

Number of Companies Listed in US Stock Market:

Holiday US Stock Market 2025: What to Expect a

Best Non-US Stocks to Buy: A Global Investment

Is the US Stock Market a Bubble? A Closer Look

3 Categories of Companies in the US Stock Mark

Loc Don Tomaso at Stocker Los Angeles CA US: A

Should I Invest in US Stocks When the Dollar I

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Momentum Stocks: Unveiling the 5-Day Performan"

- Understanding the US Bancorp Preferred Stock C"

- Prison Stocks: The Hidden Investment Opportuni"

- Understanding the Value ETF: A Comprehensive G"

- Unlocking Potential: A Deep Dive into Growth E"

- US Graphene Companies Stock: A Comprehensive O"

- NVDA Stock US: A Comprehensive Analysis of NVI"

- Unlock the Full Potential of Your US Cellular "

- How Did the US Stock Market Perform in May 201"

- Barron's Market Data: Your Ultimate Guide"