you position:Home > us energy stock > us energy stock

Stock Market US Buying Assets: A Comprehensive Guide

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

The stock market in the United States has been witnessing a surge in buying assets, reflecting a strong economic outlook and investor confidence. This article delves into the reasons behind this trend, the types of assets being bought, and the potential impact on the market.

Rising Stock Market

The U.S. stock market has been on a bullish run, with the S&P 500 and the Dow Jones Industrial Average hitting new record highs. This uptrend is attributed to several factors, including strong corporate earnings, low interest rates, and favorable economic indicators.

Reasons for Buying Assets

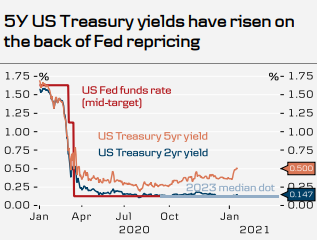

- Low Interest Rates: The Federal Reserve has been maintaining low interest rates, making borrowing cheaper for companies and encouraging them to invest in assets.

- Corporate Earnings: Many companies are reporting strong earnings, providing a solid foundation for the stock market's growth.

- Global Economic Recovery: The global economy is showing signs of recovery, which is boosting investor confidence and driving demand for assets.

Types of Assets Being Bought

- Equities: Investors are increasingly buying stocks, attracted by the potential for high returns.

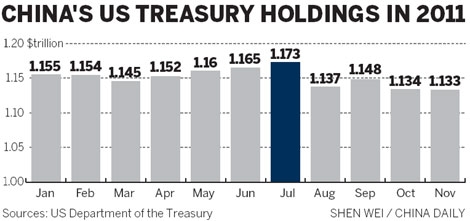

- Bonds: Despite the low-interest-rate environment, bonds are still a popular investment due to their relatively low risk.

- Real Estate: The real estate market is also seeing increased activity, with investors seeking stable returns.

- Commodities: Commodities like gold and oil are being bought as a hedge against inflation and economic uncertainty.

Impact on the Market

- Increased Liquidity: The buying of assets is increasing liquidity in the market, which can lead to higher stock prices.

- Sector Rotation: Investors are shifting their focus from one sector to another, creating opportunities for growth.

- Market Volatility: While the overall trend is bullish, the market may experience periods of volatility as investors react to changing economic conditions.

Case Studies

- Apple: Apple has been a major buyer of assets, including stocks and bonds. The company's strong financial position has allowed it to make significant investments, which have contributed to its growth.

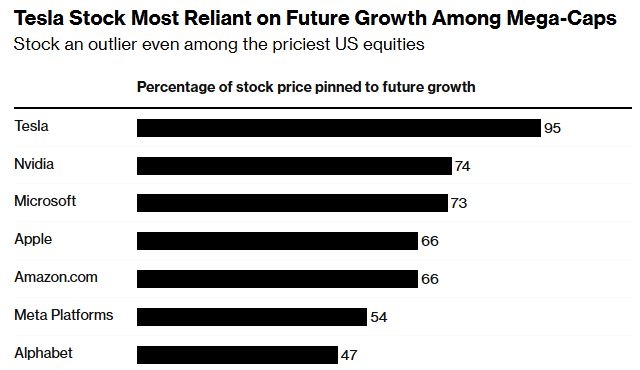

- Tesla: Tesla has been actively buying assets, including acquiring other companies and expanding its production capacity. These investments have helped the company establish itself as a leader in the electric vehicle market.

Conclusion

The stock market in the United States is witnessing a surge in buying assets, driven by factors like low interest rates, strong corporate earnings, and a global economic recovery. Investors are increasingly looking at various asset classes to diversify their portfolios and capitalize on the market's growth potential. However, it's important to stay informed about market trends and make informed investment decisions.

so cool! ()

like

- Mint Mobile Stock: Everything You Need to Know About US's Hottest Carrier

- Us News Best Stocks: Top Picks for Investors in 2023

- Unveiling the Power of US Stock Codes: Your Ultimate Guide

- TG Therapeutics: A Rising Star in US Biotech Stocks

- Unlocking Dividends: Exploring US Energy Initiatives Stock

- April 8, 2025: US Stock Market Summary

- Dow Jones US Completion Total Stock Market Index Chart: A Comprehensive Guide

- The Cheapest Stock in the US: A Golden Opportunity for Investors?

- New US Stock: A Guide to Investing in Emerging Opportunities

- How to Buy US Stocks from Overseas: A Step-by-Step Guide

- US Stock Extended Morning Time: A Comprehensive Analysis

- "Free Stock Photos: Contact Us for Top-Quality Imagery"

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Stock Market US Buying Assets: A Comprehensive

Stock Market US Buying Assets: A Comprehensive

Non-US Citizens and the US Stock Market: A Com

US Stock After Hours Movers: Understanding the

How Major US Stock Indexes Fared Wednesday

Glaxosmithkline Stock Price US: A Comprehensiv

Title: "Tough Stance Heightens Us Sto

Are Foreign Stocks Better Than US Stocks Right

Southern Hemisphere Mining Ltd: An Overview of

Maximizing Returns: A Deep Dive into US Farm S

US Small Cap Stocks News Today: Key Updates an

NTIOF Stock: Understanding OTC Markets in the

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- How to Trade Australian Stocks in the US: A Co"

- US Listed South American Stocks: A 2019 Review"

- US Defense Stocks Outlook: Future Prospects an"

- Is It a Qualified Dividend If It's a US S"

- Title: Fundamental Analysis of the US Stock Ma"

- Stock Speculation Definition and Its Impact on"

- Soros Continues Betting Against US Stock: What"

- How to Trade on the London Stock Exchange from"

- Defensive Stocks: A Shield Against Market Vola"

- Top US Penny Stocks Today: Opportunities and R"