you position:Home > new york stock exchange > new york stock exchange

Unlocking the Potential of Promising Penny Stocks in the US

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

In the world of investing, the allure of high-potential, low-cost stocks is undeniable. Penny stocks, often trading for less than $5 per share, have long been a favorite among risk-takers and value hunters. This article delves into the realm of promising penny stocks in the US, offering insights into how investors can identify and capitalize on these opportunities.

Understanding Penny Stocks

First, it's crucial to understand what penny stocks are. They are shares of publicly traded companies that trade at very low prices. While this makes them accessible to individual investors, it also comes with significant risks. Penny stocks are often less regulated and have lower liquidity compared to larger, more established companies.

Identifying Promising Penny Stocks

So, how does one identify a promising penny stock? Here are some key factors to consider:

1. Industry Trends: Look for penny stocks in industries that are experiencing growth or are poised for future expansion. For instance, sectors like technology, biotech, and renewable energy are currently thriving.

2. Company Fundamentals: Analyze the financial health of the company. Look for signs of profitability, strong revenue growth, and a solid balance sheet.

3. Management Team: A competent and experienced management team can make a significant difference in the success of a company. Research the backgrounds and track records of the key individuals involved.

4. News and Updates: Stay informed about the latest news and updates from the company. Positive developments, such as new product launches or partnerships, can drive up the stock price.

Case Study: BioNTech (BNTX)

One notable example of a penny stock that turned into a significant success is BioNTech (BNTX). This biotech company gained global recognition for its role in developing the COVID-19 vaccine, mRNA-1273. As a result, its stock price skyrocketed, offering substantial returns to early investors.

Risks and Considerations

While penny stocks offer the potential for high returns, they also come with significant risks. Here are a few things to keep in mind:

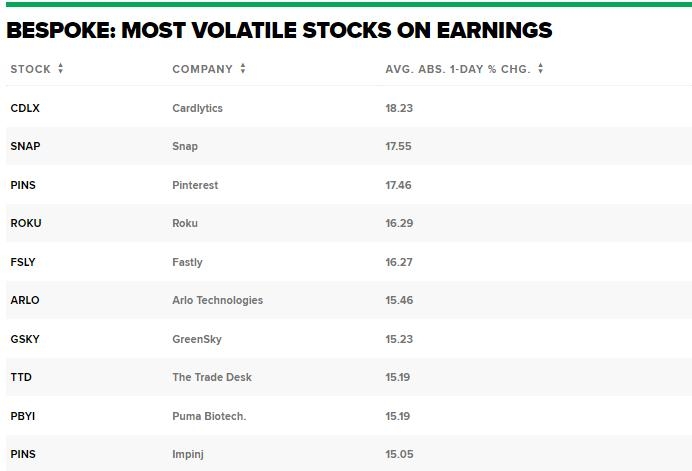

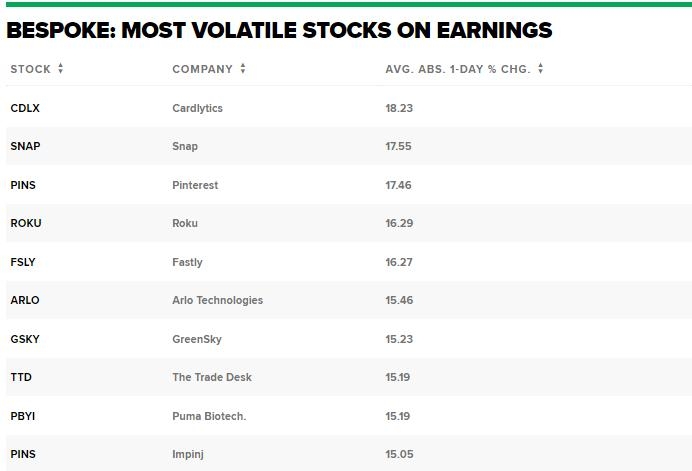

1. High Volatility: Penny stocks can be highly volatile, with stock prices fluctuating rapidly. This can make them challenging to trade and potentially lead to significant losses.

2. Regulatory Risks: As mentioned earlier, penny stocks are often less regulated, which can expose investors to higher risks of fraud and manipulation.

3. Limited Information: Due to their smaller size, penny stocks may not have the same level of transparency and reporting requirements as larger companies.

Conclusion

Investing in promising penny stocks in the US can be a lucrative venture, but it requires careful research and due diligence. By focusing on industry trends, company fundamentals, and staying informed about the latest news, investors can identify and capitalize on these opportunities. However, it's crucial to weigh the risks and only invest what you can afford to lose.

so cool! ()

like

- How to Trade on the Canadian Stock Market: A Comprehensive Guide for U.S. Investo

- Biggest US Stock Losers: The Market's Deadliest Declines Unveiled

- February 2020 IPO List: Top US Stock Market Companies to Watch

- Russia-Ukraine War: How It's Impacting the US Stock Market

- Top Performing US Stock Sectors in 2025: A Comprehensive Insight

- Tokenized US Stocks: Revolutionizing the Financial Landscape

- Stock Screeners: Uncover US Stocks with Options for Free Download

- Understanding the US Cobalt Stock Symbol: What You Need to Know

- Buying US Stocks in Hong Kong: A Comprehensive Guide

- Buy Foreign Stocks from US Broker: Your Ultimate Guide to Global Investing

- Stock Holidays: A Comprehensive Guide to US Market Closures

- Understanding the Chinese Stock Market on US Exchanges

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Unlocking the Potential of Promising Penny Sto

Unlocking the Potential of Promising Penny Sto

Understanding the Implications of US Stock Deb

Nonresident Alien US Stock Capital Gains Tax:

Title: Good US Bank Stocks: Top Picks for Inve

Title: "US Education Stock: A Compreh

IPOs March 2020: A Deep Dive into the US Stock

Top US Airline Stocks to Watch in 2023

Title: Top Rare Earth Stocks US: Unveiling the

US Durable Goods Stock: A Comprehensive Guide

US Fed Rate Hike Impact on Indian Stock Market

US House Votes to Boost Chinese Stocks: What Y

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Unlocking the Potential of High Growth US Stoc"

- Dow Jones Industrial Average: The pulse of the"

- Understanding RRSP US Stock Withholding Tax"

- Us Apple Stock: The Ultimate Guide to Investin"

- Accessing Option Trading US Stocks from Austra"

- Can UK Citizens Invest in US Stocks? A Compreh"

- Allianz US Stock: A Comprehensive Guide to Inv"

- Stock Price for US Bank: A Comprehensive Guide"

- How Many People in the US Own Stocks: The Risi"

- Sibanye Stillwater Stock US: A Comprehensive A"