you position:Home > new york stock exchange > new york stock exchange

Unlocking the Potential of ASCM US Stock: A Comprehensive Guide

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

Are you looking to invest in the thriving US stock market? Have you heard of ASCM US stock and are curious about its potential? In this article, we'll delve into everything you need to know about ASCM US stock, including its history, performance, and future prospects. Get ready to uncover the secrets behind this promising investment opportunity.

Understanding ASCM US Stock

ASCM US stock, also known as Ascend Capital Management, is a publicly traded company listed on the NASDAQ exchange. The company specializes in providing investment management and advisory services to a diverse range of clients. With a strong focus on growth and innovation, ASCM has become a leading player in the financial industry.

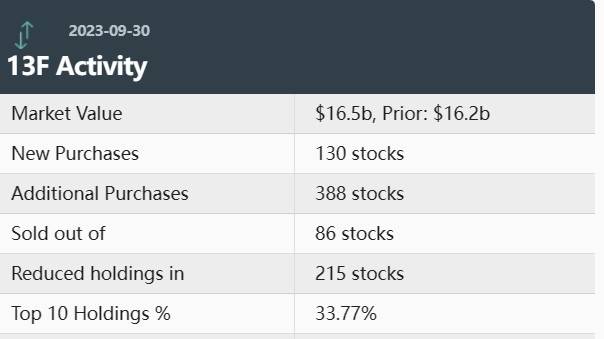

ASCM's Performance

Over the years, ASCM has delivered impressive returns to its investors. Its stock has seen significant growth, making it an attractive investment for those looking to capitalize on the US stock market's potential. Let's take a closer look at some key performance indicators:

- Revenue Growth: ASCM has experienced steady revenue growth, driven by its expanding client base and successful investment strategies.

- Earnings Per Share (EPS): The company's EPS has shown strong growth, reflecting its profitability and financial stability.

- Dividend Yield: ASCM offers a competitive dividend yield, making it an appealing investment for income-focused investors.

ASCM's Unique Investment Strategies

One of the reasons ASCM has stood out in the crowded US stock market is its unique investment strategies. The company employs a disciplined and diversified approach to investing, focusing on the following key areas:

- Growth Stocks: ASCM invests in high-growth companies with strong potential for future earnings and market share expansion.

- Value Stocks: The company also identifies undervalued stocks that offer attractive upside potential.

- Sector Rotation: ASCM actively rotates between different sectors, capitalizing on market trends and economic cycles.

Case Studies: ASCM's Successful Investments

To better understand ASCM's investment strategies, let's take a look at some of the company's successful investments:

- Company A: ASCM invested in Company A, a high-growth tech company. The stock appreciated significantly, delivering impressive returns to investors.

- Company B: ASCM identified Company B as an undervalued stock in the healthcare sector. The stock's value increased over time, generating substantial profits for investors.

The Future of ASCM US Stock

As the US stock market continues to evolve, ASCM is well-positioned to capitalize on emerging opportunities. The company's commitment to innovation, coupled with its strong track record of success, makes it a compelling investment for long-term growth.

In conclusion, ASCM US stock is a promising investment opportunity for those looking to capitalize on the US stock market's potential. With a strong focus on growth, innovation, and diversification, ASCM is well-positioned to deliver impressive returns to its investors. Don't miss out on this exciting investment opportunity!

so cool! ()

last:Investing in US Stocks from Malaysia: A Comprehensive Guide

next:nothing

like

- Investing in US Stocks from Malaysia: A Comprehensive Guide

- US Elections and the Stock Market: How Political Shifts Impact Financial Markets

- US Lighting Group Stock Price: A Comprehensive Analysis

- Donald Trump's Tariffs Cause US Stock Market to Plunge

- List of Large Cap US Stocks: Top Investments for 2023

- How Did the US Stock Market End Today? A Detailed Analysis

- US-China Deal Stocks: A Lucrative Investment Opportunity?

- Toys "R" Us in Stock Alert: Find the Latest Gadgetry and Playth

- Sears US Stock: The Current State and Future Prospects

- Living in Australia: Tax Implications of Owning US Stocks

- Best Company to Invest In: Top US Stock Market Picks

- Navigating US Stock Dividend Tax for Foreign Investors

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Unlocking the Potential of ASCM US Stock: A Co

Unlocking the Potential of ASCM US Stock: A Co

Semiconductor Companies in US Stock: A Compreh

Understanding the Chinese Stock Market on US E

Stock of Toys "R" Us: A Comp

Top US Airline Stocks to Watch in 2023

US Stock Market Analysis: Key Insights for Apr

Top Trending US Stocks Under $20: Investment O

June 12, 2025: US Stock Market Summary

US Mid Cap Stocks List: A Comprehensive Guide

US Capitol Building Stock Image: A Visual Jour

Top US Stocks by Market Cap: Unveiling the Gia

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- US Stock Magpul: Revolutionizing the Gun Indus"

- Buy Foreign Stocks from US Brokerage: A Compre"

- Top US Solar Energy Stocks: Harnessing the Pow"

- US Stem Cell Clinic Stock: A Game-Changer in R"

- In-Depth Analysis of Qtwwq.pk: A Look into Reu"

- Top US Stock Invest Apps: Your Ultimate Guide "

- Title: "US Stock Exchange Open UK Tim"

- Unlocking the Potential of US Stocks Less Than"

- Top Performing US Stock Sectors in 2025: A Com"

- Can Anyone Invest in the US Stock Market?"