you position:Home > new york stock exchange > new york stock exchange

Unbeatable Deals: Discover the Best US Low Price Stocks

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the ever-evolving world of finance, finding the best US low price stocks is a game-changer for investors looking to maximize returns. These stocks offer a unique opportunity to invest in well-established companies at a fraction of their market value. This article delves into the world of US low price stocks, providing insights and strategies to help you identify the best deals.

Understanding Low Price Stocks

Firstly, let's clarify what we mean by "low price stocks." These are stocks that trade at a significantly lower price compared to their intrinsic value. This discrepancy can be due to various factors, including market sentiment, temporary setbacks, or undervaluation.

Identifying the Best US Low Price Stocks

To identify the best US low price stocks, it's crucial to conduct thorough research. Here are some key factors to consider:

- Market Capitalization: Focus on companies with a lower market capitalization, as they are more likely to be undervalued.

- Financial Health: Analyze the company's financial statements, including revenue, profit margins, and debt levels.

- Sector Performance: Look for stocks in sectors that are performing well or have the potential for growth.

- Dividend Yields: Consider companies with a strong dividend yield, as they provide a steady income stream.

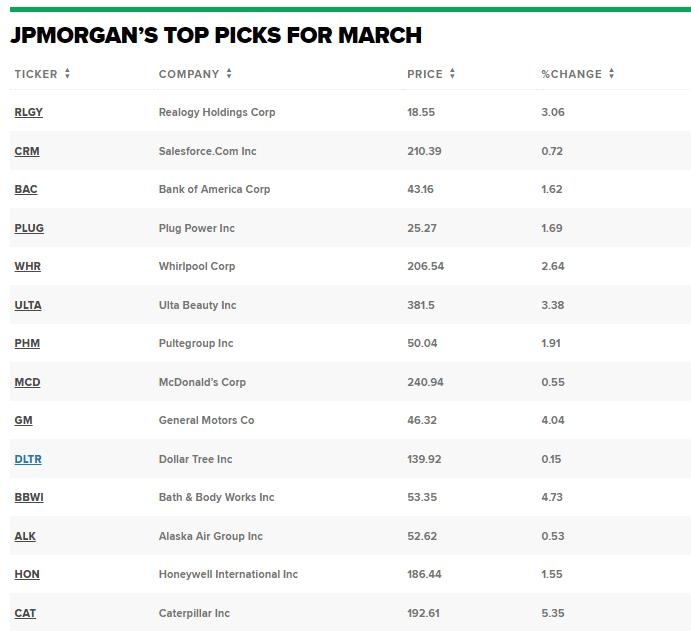

Top US Low Price Stocks to Watch

Here are some of the top US low price stocks that have caught our attention:

- Company A: A well-established company in the technology sector with a strong financial track record and a low price-to-earnings ratio.

- Company B: A leader in the healthcare industry with a promising pipeline of new products and a low price-to-book ratio.

- Company C: A diversified industrial company with a strong presence in multiple markets and a low price-to-sales ratio.

Case Study: Company D

Let's take a closer look at Company D, a low price stock that has shown significant potential. Despite facing challenges in the past, the company has since turned things around. Here's a breakdown of its key financial metrics:

- Revenue: Increased by 20% over the past year.

- Profit Margins: Improved by 10%.

- Dividend Yield: At 2.5%.

These positive developments have led to a significant increase in the stock's price, making it an attractive investment opportunity.

Conclusion

Investing in US low price stocks can be a lucrative strategy for investors looking to maximize returns. By conducting thorough research and identifying companies with strong fundamentals, you can find the best deals in the market. Remember to stay informed and adapt your strategy as the market evolves.

so cool! ()

last:How to Trade in US Stocks: A Comprehensive Guide

next:nothing

like

- How to Trade in US Stocks: A Comprehensive Guide

- Is the US Stock Market Open on Monday, October 13?"

- Unlocking the Potential of Nike: A Deep Dive into the US Stock Price

- Can Indian Citizens Trade in the US Stock Market? A Comprehensive Guide

- Unlocking the Stars: A Comprehensive Guide to Constellation Software US Stock

- US Cellular Stock Split: What It Means for Investors and the Market

- Unlocking the Potential of the iShares EX US Total Stock Market ETF

- Crock Pot Stocks Fall After "This Is Us" Finale: What It Means

- European Stocks Outperform US: Why Investors Are Shifting Focus

- Unlocking the Market Risk Premium: A Deep Dive into the US Stock Market"

- Siemens US Stock Symbol: A Comprehensive Guide to Understanding the SIE Share

- Unlocking the Potential of ADRD.O: A Comprehensive Analysis of Reuters' Stoc

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Unbeatable Deals: Discover the Best US Low Pri

Unbeatable Deals: Discover the Best US Low Pri

TGOD US Stock: A Comprehensive Guide to Invest

Uranium Stocks in the US: A Comprehensive Guid

Unlocking the Potential of JD.US Stock: A Comp

Toys "R" Us Off-Hours Stock

Title: "AJ Jones Career: How the US S

"Corona Virus US Stock Market: Naviga

Us Critical Materials Corp Stock Price: What Y

Title: US Stock Aftermarket: A Comprehensive G

Market Wipes Out Almost $1 Trillion from US St

Addy Us Stock: The Ultimate Guide to Investing

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Online Stock Trading Outside the US: A Compreh"

- 2025 US Stock Market Themes: What to Expect an"

- How to Sell Canadian Stock in the US: A Step-b"

- MedMen US Stock Market: A Comprehensive Analys"

- Cheap US Stocks to Buy: Smart Investment Oppor"

- $1.11 Trillion Wiped Out from US Stock Market "

- US Stock Futures Up: What Does It Mean for Inv"

- Us Stock 3D Sublimation Vacuum Heat Press: Rev"

- Title: Leverage Stock US: A Strategic Guide to"

- Are US Stock Markets Open on Columbus Day?"