you position:Home > new york stock exchange > new york stock exchange

US GD Stock Expectation: 2023 Outlook and Investment Insights

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Understanding the US GD Stock Market

In the ever-evolving landscape of global finance, the US General Dividend (GD) stock market has long been a beacon for investors seeking stable and consistent returns. As we delve into the year 2023, it's crucial to understand the expectations surrounding these stocks and how they can impact your investment strategy. This article aims to provide a comprehensive outlook on the US GD stock market, highlighting key trends, potential risks, and investment opportunities.

The State of the US GD Stock Market

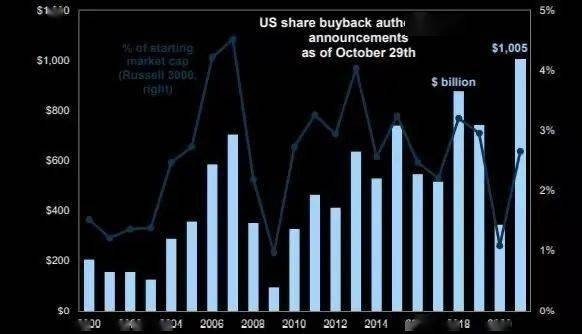

The US GD stock market has been a significant component of the broader equity market, offering investors a blend of stability and growth potential. These stocks are typically characterized by their consistent dividend payments, making them an attractive option for income investors and those seeking capital preservation.

Trends to Watch in 2023

Dividend Yield Trends: The dividend yield of US GD stocks has been fluctuating over the years. As of early 2023, the yield stands at around 2.5%, slightly higher than the long-term average. This indicates a favorable environment for income investors.

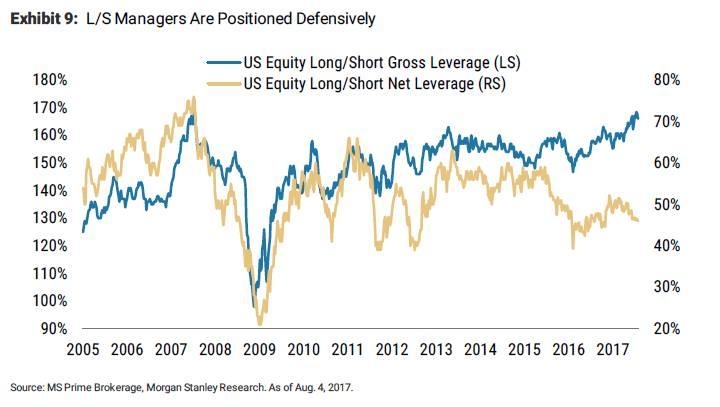

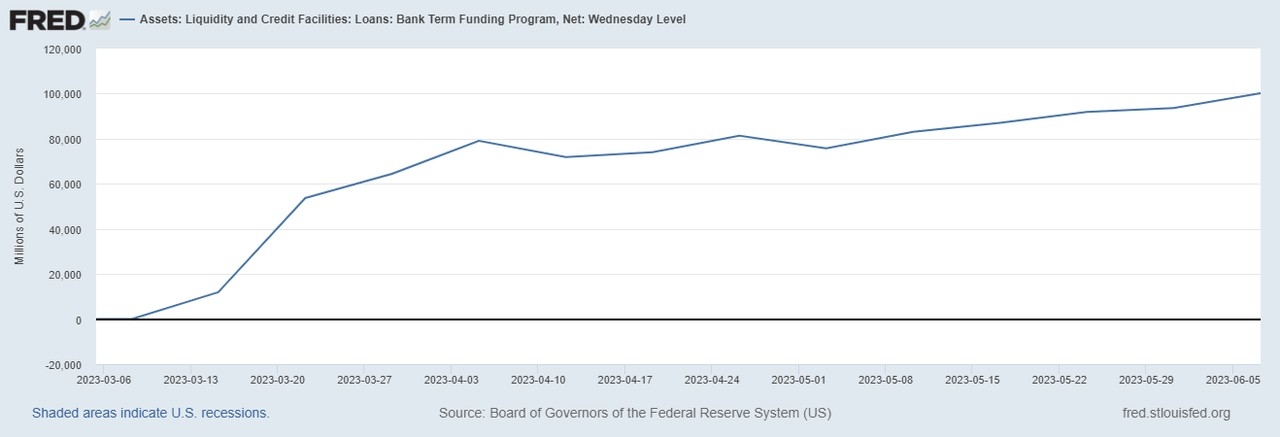

Economic Factors: The US economy's performance is a critical factor influencing the GD stock market. With the Federal Reserve's interest rate hikes and inflation concerns, the market is expected to remain volatile. However, strong economic growth and corporate earnings could support the GD stocks.

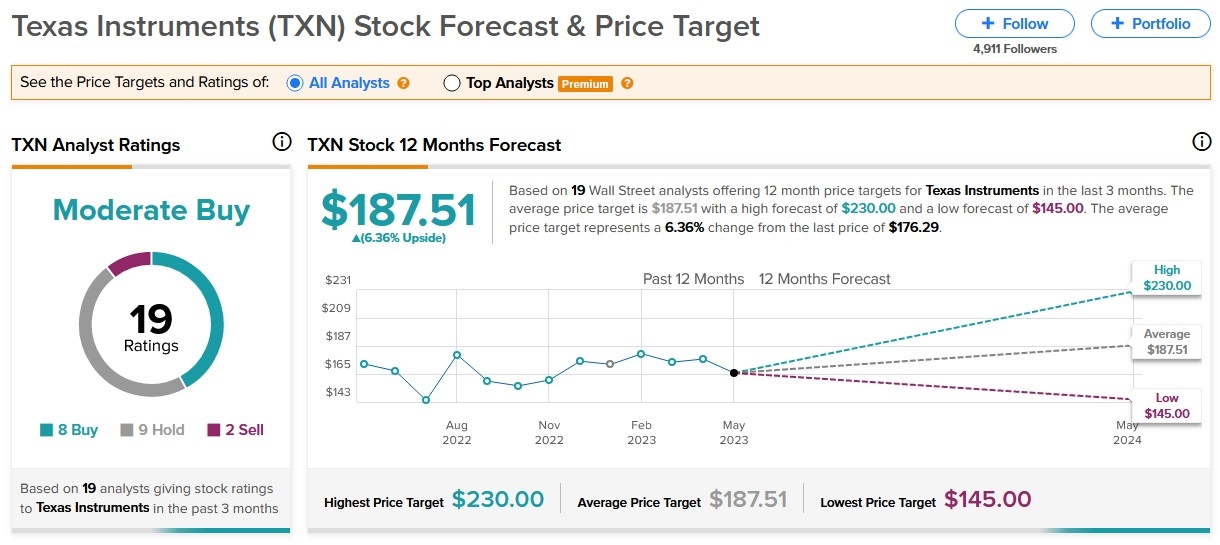

Sector Performance: Different sectors within the US GD stock market have shown varying performance. Technology, healthcare, and consumer staples have been prominent performers, offering stability and growth potential.

Key Investment Opportunities

Technology Stocks: The technology sector has been a significant driver of the US GD stock market. Companies like Apple, Microsoft, and Visa offer stable dividends and growth potential.

Healthcare Stocks: The healthcare sector has been a haven for investors seeking stability and growth. Companies like Johnson & Johnson and Pfizer offer consistent dividends and exposure to a growing healthcare market.

Consumer Staples Stocks: The consumer staples sector has been a reliable performer, offering stable dividends and growth potential. Companies like Procter & Gamble and Coca-Cola are prominent players in this sector.

Case Study: Johnson & Johnson

Johnson & Johnson (JNJ) is a prime example of a US GD stock that has delivered consistent performance over the years. With a dividend yield of around 3.5%, JNJ offers investors a stable income stream. The company's diversified product portfolio and strong brand presence have contributed to its resilience in various market conditions.

Conclusion

The US GD stock market presents a compelling opportunity for investors seeking stability and consistent returns. As we navigate the year 2023, it's crucial to stay informed about market trends, economic factors, and investment opportunities. By focusing on sectors like technology, healthcare, and consumer staples, investors can position themselves for long-term success in the US GD stock market.

so cool! ()

last:NYSE for: Unveiling the Power of the New York Stock Exchange

next:nothing

like

- NYSE for: Unveiling the Power of the New York Stock Exchange

- Alphabet Stock Price Today: A Comprehensive Analysis

- Unlocking the Potential of Aftermarket Stock Prices

- Stock Market Good or Bad Today: A Comprehensive Analysis

- Exploring the Heart of American Finance: The New York Wall Street Stock Exchange

- Lithium Battery Stocks: The US Market's Bright Future

- Stock Market Predictions: How the US Election Impacts Your Investments

- Unlocking the Potential of AI-Related Stocks in the US Market

- Premarket Marketwatch: Your Ultimate Guide to Understanding the Pre-Market Tradin

- US Stock Mag 7: The Ultimate Guide to the Top 7 Must-Have Stocks

- US Filter Stock Price: What You Need to Know

- Why Are Stocks Down Today? Understanding the Market's Decline

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

US GD Stock Expectation: 2023 Outlook and Inve

US GD Stock Expectation: 2023 Outlook and Inve

US Stock Mag 7: The Ultimate Guide to the Top

Chinese Stocks on U.S. Markets: A Comprehensiv

Latest News for US Stock Market: Key Developme

Title: Best US Stocks to Buy Now for Long-Term

US Cellular Stock Price Performance: A Compreh

Title: Stock Price in US Recession 2001: A Com

List of US Stock Market Holidays in 2019

"St. Simon Stock Pray for Us: A Devot

Title: US Airways Stock Certificate: A Guide t

Top US Stocks to Buy Now for Long-Term Investo

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Understanding the Implications of US Stock Deb"

- Lowest Fees Broker for US Stocks: Your Ultimat"

- Understanding US Capital Stock Quarterly Data:"

- Total US Stock Market Capitalization in 2018: "

- Title: "US Steel Stock Value: Current"

- Toys "R" Us Off-Hours Stock "

- Best US Stock Warrants of 2018: Top Picks and "

- Space Stocks: The Future of Investment in the "

- Is the US Stock Market Open on June 20, 2022?"

- Toys "R" Us Seasonal Overnig"