you position:Home > new york stock exchange > new york stock exchange

US Cobalt Stock in Frankfurt: A Comprehensive Guide

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In today's rapidly evolving global market, the demand for cobalt has surged, particularly in the technology sector. As a key component in the production of lithium-ion batteries, cobalt is becoming increasingly valuable. If you're looking to invest in cobalt stocks, Frankfurt, Germany, is a hub of activity for this crucial commodity. This article delves into the US cobalt stock landscape in Frankfurt, offering insights into the market and potential investment opportunities.

Understanding Cobalt's Importance

Cobalt is a critical element used in various industries, including the automotive, aerospace, and electronics sectors. However, its significance in the technology industry cannot be overstated. Cobalt batteries are the backbone of today's portable electronic devices, electric vehicles (EVs), and renewable energy storage systems.

The US Cobalt Stock Market in Frankfurt

Frankfurt, as the financial center of Europe, hosts numerous investment opportunities, including the US cobalt stock market. Here's a closer look at what you need to know:

1. Market Dynamics

The cobalt market is subject to various factors, including global supply and demand dynamics, geopolitical tensions, and technological advancements. As a result, US cobalt stocks in Frankfurt can experience significant price fluctuations.

2. Key Players

Several US-based companies are actively involved in the cobalt industry, and their stocks are traded in Frankfurt. These include:

- Glencore Plc: A global diversified natural resource company with a significant presence in the cobalt market.

- Freeport-McMoRan Inc.: A major miner and producer of cobalt, among other metals.

- Cooper Cobalt Inc.: A Canadian-based junior mining company with a focus on cobalt exploration and development.

3. Investment Strategies

Investing in US cobalt stocks in Frankfurt requires careful consideration of various factors, including:

- Company fundamentals: Assess the financial health, operational efficiency, and growth prospects of the companies you're considering.

- Market trends: Stay updated on the latest cobalt market trends, including supply and demand dynamics, technological advancements, and regulatory changes.

- Risk management: Diversify your investment portfolio to mitigate potential risks associated with cobalt stocks.

Case Study: Glencore Plc

Glencore Plc, one of the world's leading producers of cobalt, offers a compelling case study for investors. The company has a strong presence in the cobalt market, with operations across the globe. In recent years, Glencore has expanded its cobalt production capacity and diversified its revenue streams, contributing to its impressive performance.

Conclusion

Investing in US cobalt stocks in Frankfurt can be a lucrative opportunity, but it requires thorough research and analysis. By understanding the market dynamics, key players, and investment strategies, you can make informed decisions and potentially reap significant returns. Keep in mind the importance of risk management and stay updated on the latest market trends to maximize your investment potential.

so cool! ()

last:Cheap US Stocks to Buy: Smart Investment Opportunities

next:nothing

like

- Cheap US Stocks to Buy: Smart Investment Opportunities

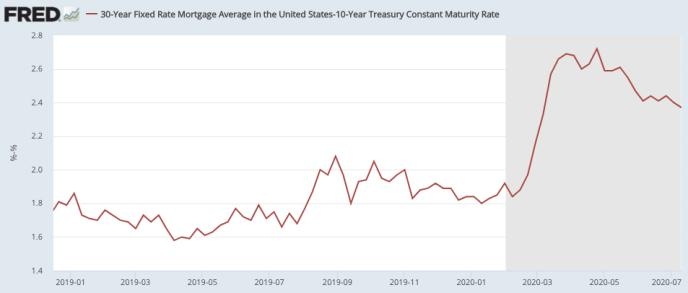

- US 30-Year Mortgage Rate Chart: A Stock Comparison Analysis

- Unleashing the Power of US AI Penny Stocks: A Game-Changing Investment Opportunit

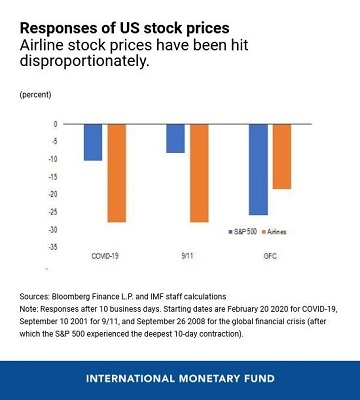

- Historical US Stock Market Crashes: Lessons from the Past

- Brcc US Stock: A Comprehensive Guide to Investing in BRCC Corporation

- LG Uplus Corp US Stock: A Comprehensive Guide to Investing

- Maximizing Returns with US Large Company Stock Funds: A Comprehensive Guide

- Understanding the Salary of a Toys "R" Us Stock Clerk

- Title: Maximize Your US Dollar Stock Buying Power - Strategies for 2023

- Leading Us-Traded China Stocks: Your Guide to Investment Opportunities"

- US Bond Market vs Stock Market: Understanding the Key Differences

- Title: Top US Stock Market Brokers in the Philippines: Your Gateway to Global Inv

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

US Cobalt Stock in Frankfurt: A Comprehensive

US Cobalt Stock in Frankfurt: A Comprehensive

Stock Quotes US: The Ultimate Guide to Underst

Understanding US Capital Gains Tax on Stock Op

Number of Listed Stocks in the US 2017: A Deep

Us Foods Holdings Stock: A Comprehensive Analy

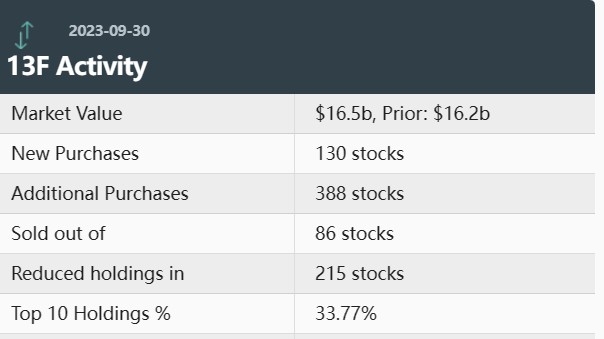

Airline US Stocks: A Comprehensive Guide to In

How Foreigners Buy U.S. Stocks: A Comprehensiv

International Stocks Outperforming US Stocks i

Artificial Intelligence: A Game-Changer for US

Kirkland Signature Chicken and Rice Cat Food 2

Best AI Stocks in the US: Top Picks for 2023

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- Title: "http stocks.us.reuters.com st"

- Is the US Stock Market Open on December 24? Th"

- US Penny Stocks to Watch Today: Unveiling the "

- Bump Stock Ban: A Federal Decision That Shaped"

- Hot Stocks to Watch in the US and Canada: Top "

- US Cellular Stock Price Performance: A Compreh"

- Heat Map US Stock: A Visual Guide to Understan"

- Stock US Robotics: Unicom Global's Innova"

- Best Stock for Options Trading: Unlock Your Po"

- Robot Stocks in the US: Revolutionizing the In"