you position:Home > new york stock exchange > new york stock exchange

Title: US Mid Cap Stock Index: A Comprehensive Guide

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

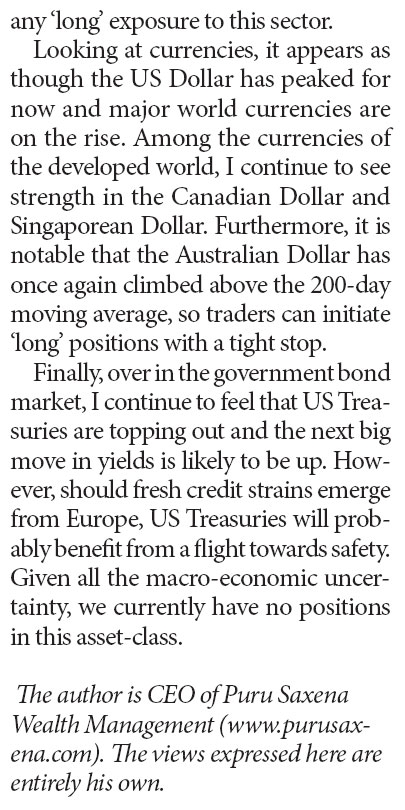

Introduction: In the vast world of stock markets, the US Mid Cap Stock Index holds a significant position. As the middle ground between small and large-cap stocks, mid-cap companies offer investors a balance of growth potential and stability. This article aims to provide a comprehensive guide to the US Mid Cap Stock Index, including its composition, performance, and investment opportunities.

Understanding the US Mid Cap Stock Index

The US Mid Cap Stock Index, also known as the S&P MidCap 400, is a benchmark index that tracks the performance of mid-sized companies listed on US exchanges. It consists of 400 companies with a market capitalization ranging from

Composition of the US Mid Cap Stock Index The companies included in the US Mid Cap Stock Index are selected based on their market capitalization, liquidity, and financial stability. These companies operate across various sectors, including technology, healthcare, consumer goods, and finance. This diversity ensures that the index reflects the broader economic trends and market conditions.

Performance of the US Mid Cap Stock Index The US Mid Cap Stock Index has shown strong performance over the years. Historically, it has outperformed both the S&P 500 and the Russell 2000 indices. This indicates that mid-cap companies have the potential to offer higher returns compared to small or large-cap stocks. However, it is important to note that mid-cap stocks also carry higher risk due to their smaller size and market exposure.

Investment Opportunities in the US Mid Cap Stock Index Investing in the US Mid Cap Stock Index offers several advantages. Firstly, mid-cap companies have the potential for significant growth, as they are often in the expansion phase of their business cycles. Secondly, these companies are less vulnerable to economic downturns compared to small-cap stocks, making them a stable investment option. Lastly, mid-cap stocks offer a balance between growth and stability, making them suitable for a wide range of investors.

Case Studies To illustrate the potential of the US Mid Cap Stock Index, let's consider a few case studies:

Apple Inc.: Once a mid-cap company, Apple has grown to become one of the largest companies in the world. Its inclusion in the S&P MidCap 400 index showcases the growth potential of mid-cap stocks.

Microsoft Corporation: Similarly, Microsoft's journey from a mid-cap company to a global technology giant demonstrates the potential for significant returns in the mid-cap segment.

Amazon.com, Inc.: Amazon's rise from a small online bookstore to a dominant e-commerce platform is another example of the growth potential in the mid-cap segment.

Conclusion: The US Mid Cap Stock Index offers investors a unique opportunity to invest in a diverse range of mid-sized companies. With the potential for significant growth and stability, the mid-cap segment is an attractive option for investors seeking a balance between risk and return. By understanding the composition, performance, and investment opportunities of the US Mid Cap Stock Index, investors can make informed decisions and capitalize on the potential of mid-cap companies.

so cool! ()

like

- CGC Stock US: A Comprehensive Guide to Investing in China Global Commodity Group

- PEP US Stock: The Ultimate Guide to Understanding and Investing in Private Equity

- Understanding the STNG US Stock Price: A Comprehensive Guide

- US Stock Market: Top 5 Must-Know Factors for Maximum Returns

- US Companies with Stock Value Up to $6 Each: A Comprehensive Guide

- US Space Force Stock: A New Era of Investment Opportunities

- US MJ Stock: The Future of Legal Cannabis in the Market

- Overnight US Stock Market: Insights and Analysis

- How to Buy US Stocks for Non-Residents Internationally

- How Will the US Elections Affect the Stock Market?

- Rare Earth Stocks: The US-Australia Deal Revolutionizing Global Supply Chains

- Should I Invest in US Stocks?

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Title: US Mid Cap Stock Index: A Comprehensive

Title: US Mid Cap Stock Index: A Comprehensive

How to Buy US Stocks for Non-Residents Interna

Title: "US Election Effect on the Ind

Iraq Agrees to Establish a Strategic Stock Exc

Title: Buying Stocks in Taiwan Stock Exchange:

Title: Offshore Stock Brokers: The Ultimate Gu

Fuel Stocks US: Powering Your Investment Portf

Ignite Us Stock: Unleashing the Power of Growt

Title: Best US Stock to Buy Right Now

US Bank Stock Outlook: What to Expect in 2023

Renewable Energy Companies: A Boon for the US

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Invest in Us Oil Stocks: A Smart Move for Your"

- Title: Discover the Real-Life Beauty of Lightw"

- Online Stock Trading Outside the US: A Compreh"

- Analyst Upgrades US Stocks Premarket: A Promis"

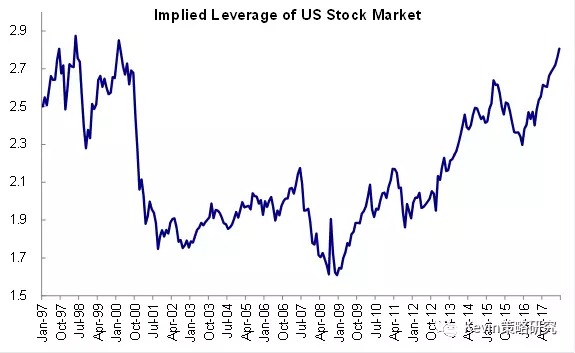

- Title: Leverage Stock US: A Strategic Guide to"

- Understanding the Power of US Compounding Stoc"

- How Can I Buy US Stocks?"

- Best Cannabis Stock: How to Invest in the Grow"

- Largest Stock Exchanges in the US: A Comprehen"

- Best US Value Stocks: Unveiling the Hidden Gem"