you position:Home > new york stock exchange > new york stock exchange

Should I Invest in US Stocks If USD Is Weakening?

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

In recent times, the US dollar has been experiencing a significant weakening. This has led many investors to question whether it's still a good idea to invest in US stocks. In this article, we'll delve into the implications of a weakening USD on the US stock market and help you make an informed decision.

Understanding the Weakening USD

A weakening USD means that the value of the dollar is decreasing compared to other currencies. This can be due to various factors such as economic instability, political uncertainty, or high inflation. When the USD weakens, it can have both positive and negative impacts on the stock market.

Positive Impacts of a Weakening USD

Increased Demand for US Goods and Services: A weaker USD makes US goods and services cheaper for foreign buyers. This can lead to an increase in exports, which can positively impact the earnings of US companies.

Boost to Multinational Companies: Many US companies have significant operations outside the country. A weaker USD can increase the value of their foreign earnings when converted back to USD, boosting their overall profits.

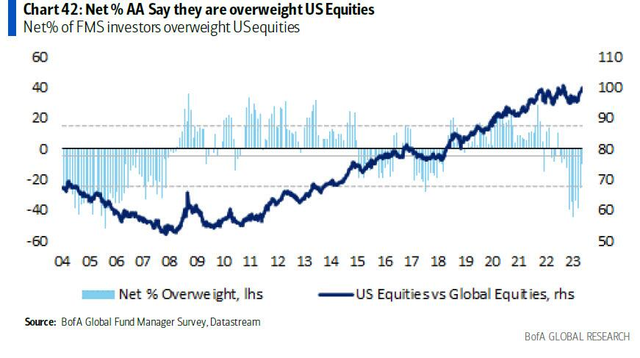

Attractiveness to Foreign Investors: A weaker USD can make US stocks more attractive to foreign investors. This can lead to increased demand for US stocks, potentially driving up their prices.

Negative Impacts of a Weakening USD

Increased Costs for US Consumers: A weaker USD can lead to higher prices for imported goods, as they become more expensive in USD terms. This can put pressure on consumer spending and potentially lead to lower corporate earnings.

Higher Interest Rates: In response to a weakening USD, the Federal Reserve may raise interest rates to stabilize the currency. Higher interest rates can make borrowing more expensive for companies, potentially reducing their profitability.

Investing in US Stocks During a Weakening USD

Given the potential benefits and risks associated with a weakening USD, here are some key considerations for investors:

Diversification: Diversifying your portfolio can help mitigate the risks associated with a weakening USD. Consider investing in stocks from various sectors and geographical regions.

Focus on Companies with Strong International Presence: Companies with a significant international presence may benefit more from a weaker USD. Look for companies that generate a substantial portion of their revenue from overseas operations.

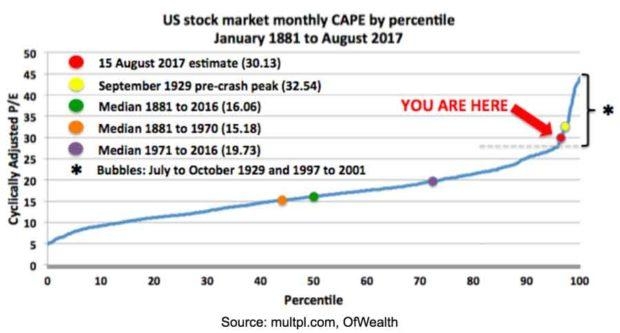

Evaluate Valuations: A weaker USD can drive up the prices of US stocks. It's important to evaluate the valuations of the stocks you're considering to ensure they are not overvalued.

Monitor Economic Indicators: Keep an eye on economic indicators such as inflation, GDP growth, and employment data. These indicators can provide insights into the future direction of the USD and the stock market.

Case Study: Apple Inc.

Consider Apple Inc., a company with a significant international presence. In 2020, when the USD weakened, Apple's revenue from overseas operations increased when converted back to USD. This helped boost the company's overall profits, leading to a rise in its stock price.

In conclusion, while a weakening USD presents both opportunities and risks, it's important to conduct thorough research and consider your investment strategy carefully. By diversifying your portfolio and focusing on companies with strong international presence, you can potentially benefit from the positive impacts of a weaker USD while mitigating the risks.

so cool! ()

like

- Can a Non-US Citizen Own Stock in the United States? A Comprehensive Guide

- US Protest Stock Market: Understanding the Impact and Reactions

- The US Stock Market Depends on Its Product: A Deep Dive into the Dynamics

- Us Fertilizer Stocks: A Comprehensive Guide to Investing in the Agriculture Secto

- Current CAPE Ratio and Shiller PE: A Deep Dive into the US Stock Market

- How Will the US Election Impact Stocks?

- How Stocks Trade in US Exchanges: A Comprehensive Guide

- Understanding the Names of US Stock Exchanges

- US Military Green Screen Stock: Submarine Torpedo Demystified

- Maximize Your Investment Portfolio with the US Gold Stock ETF

- Unlocking the Benefits of the US Foods Employee Stock Purchase Plan

- Orsted Stock US: A Comprehensive Guide to Investing in Denmark's Renewable E

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Should I Invest in US Stocks If USD Is Weakeni

Should I Invest in US Stocks If USD Is Weakeni

"Car Us Stock": Unlocking th

Current US Stock Market Themes for 2025: A Dee

Ablus Stock: Unveiling the Potential of This E

Unlocking the Potential of Hemlock US Stock: A

BGL US Stock: Top Opportunities & Inve

Dow Today News: Latest Updates and Market Anal

How to Buy Stocks in the US: A Comprehensive G

Understanding ETFs in the US Stock Market

Title: Best US Stocks to Buy Now for Long-Term

Title: Total US Stock Market Capitalization Au

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Title: Stock Market to GDP Ratio in the U.S.: "

- Title: 2018 US Stock Market Holidays: A Compre"

- How to Buy Nintendo Stock in the US: A Step-by"

- Best US Stocks to Buy for Long-Term Investment"

- US Stock Index Historical Data: A Comprehensiv"

- Best Performing US Stock Market Sectors in 202"

- UK Stock Tax: How It Helps Your US Company Tax"

- Morgan Stanley Advises Taking Profits on Price"

- Invest in Us Stock Market vs. India: A Compara"

- Stock News Today: Key Updates from the US Mark"