you position:Home > new york stock exchange > new york stock exchange

Resist Buying US Stocks: Why It’s Time to Diversify

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the current volatile global market, investors are often advised to diversify their portfolios to mitigate risks. However, there's a growing sentiment among financial experts to resist buying US stocks. This article delves into the reasons behind this advice and why it's crucial to consider alternative investment options.

Economic Factors

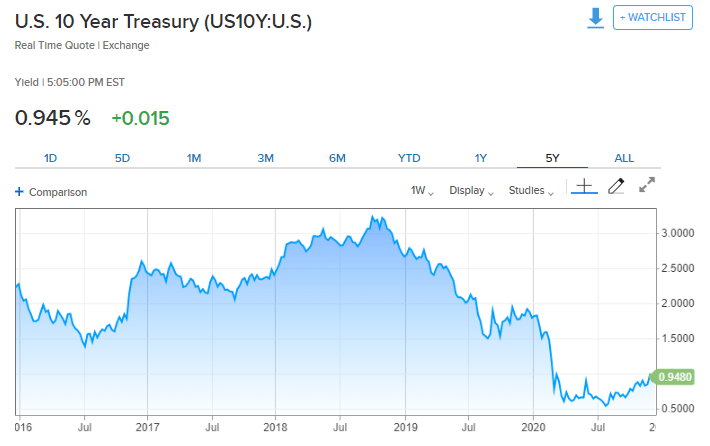

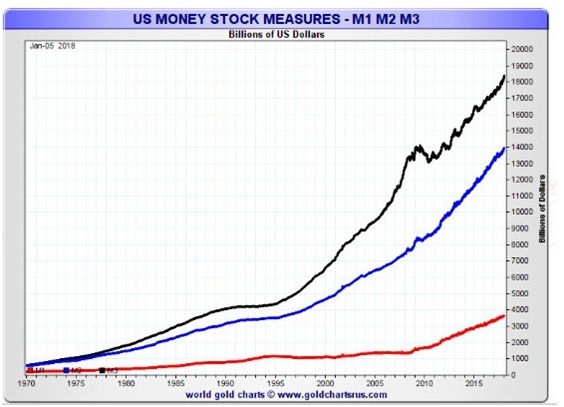

The US economy has been a powerhouse for decades, but recent trends indicate that it may not be as stable as it once was. The federal debt has reached an all-time high, and the budget deficit continues to widen. These factors raise concerns about the long-term economic health of the country.

Tech Stock Bubble

The tech industry has been a significant driver of the US stock market's growth. However, there are signs of a bubble forming in this sector. High valuations and over-reliance on a few major players have led to concerns about sustainability. Investors who are resisting buying US stocks are wise to avoid this sector and look for opportunities elsewhere.

Global Economic Shifts

The global economic landscape is changing, and the US is not immune to these shifts. Emerging markets like China and India are growing at a rapid pace, offering new opportunities for investment. Investors who resist buying US stocks and instead focus on these markets can benefit from higher growth rates and lower valuations.

Case Study: Brazil

Consider the case of Brazil, a country that has been resisting buying US stocks in recent years. Despite the economic turmoil in Brazil, the country's stock market has shown remarkable resilience. This is due to its strong emerging market status and growing middle class. Investors who resisted buying US stocks and instead invested in Brazilian equities have seen significant returns.

Currency Fluctuations

The US dollar has been a stable currency for years, but this may not be the case in the future. Currency fluctuations can have a significant impact on the returns of US stocks. Investors who resist buying US stocks and instead consider currencies like the euro or the yen may find better opportunities for diversification.

Conclusion

In conclusion, the advice to resist buying US stocks is gaining traction among financial experts. Economic factors, the tech stock bubble, global economic shifts, and currency fluctuations all point to the need for diversification. Investors who resist buying US stocks and instead explore alternative investment options can potentially achieve better returns and reduce their exposure to risk.

so cool! ()

last:Stock Market Open in US: Everything You Need to Know

next:nothing

like

- Stock Market Open in US: Everything You Need to Know

- Buy Us Stocks Malaysia: A Guide to Investing in Malaysia's Growing Market&am

- Understanding the Definition of US Small Cap Stocks

- Understanding the Foreign Corporation Sale of U.S. Stock

- How Many Stock Exchanges Exist in the US?

- Can Non-US Citizens Buy Stocks in the United States?

- India Tax on US Stocks: Everything You Need to Know"

- Best US Stock Portfolio: Your Ultimate Guide to Success

- Understanding ETFs in the US Stock Market

- Medical Stocks: A Lucrative Investment Opportunity in the US

- Top 10 US Dividend Paying Stocks to Watch in 2023

- Unlocking the Potential of US Capitol Stocks: A Comprehensive Guide

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Resist Buying US Stocks: Why It’s Time to Di

Resist Buying US Stocks: Why It’s Time to Di

The Rising Trend of US Commercial Building Sto

Is the US Stock Market Open on January 2, 2023

Title: US Cobalt Stock Price: Trends, Analysis

Highest Dividend Stocks in the US Market: A Co

US Stock Market Analysis: Key Insights for Apr

Title: TFII US Stock Price: Analysis, Trends,

Oil Companies US Stock: A Comprehensive Guide

US Stock Futures: Navigating Muted Rate Uncert

Title: Total US Stock Market Capitalization Au

US Corps of Engineers Stocking: Ensuring Prepa

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- Is the US Stock Market Closed on Columbus Day?"

- Best Small Cap Stocks in the US Market: Top Pi"

- US Currency Stock Symbol: Understanding the Si"

- Size of US Stock Market: Understanding the Mar"

- Graphene Stocks 2016 on US Exchanges: A Compre"

- Autonomous Robot US Stock Press Release: Revol"

- Title: 20 Shares of US Bank Stock: A Comprehen"

- Short Positions on US Stocks: A Strategic Appr"

- Only 10 US Stocks Really Matter: The Essential"

- Listed Russian Gold Mining Stocks: US ADRs to "