you position:Home > new york stock exchange > new york stock exchange

Major Stock Indexes in the US: A Comprehensive Guide

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

In the dynamic world of finance, understanding the major stock indexes in the US is crucial for investors and traders alike. These indexes serve as vital tools for gauging the overall health and direction of the stock market. In this article, we delve into the most prominent stock indexes, their significance, and how they can impact your investment decisions.

The S&P 500: The Gold Standard

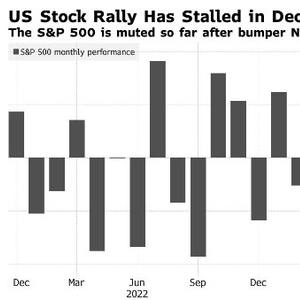

The S&P 500 is perhaps the most well-known stock index in the US. It tracks the performance of 500 large companies across various sectors. This index is often considered a benchmark for the overall US stock market. Investors often use the S&P 500 to gauge market trends and make investment decisions. For instance, if the S&P 500 is on the rise, it may indicate a strong market, while a decline might suggest a downturn.

The Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average is another key index that tracks the performance of 30 large companies. While the S&P 500 covers a broader range of industries, the DJIA is limited to just 30 companies. This index is particularly popular among retail investors due to its simplicity. It provides a quick snapshot of the stock market's overall performance.

The NASDAQ Composite

The NASDAQ Composite is the world's largest stock exchange by market capitalization. It tracks the performance of all the companies listed on the NASDAQ stock market. This index includes a wide range of companies, from tech giants like Apple and Microsoft to biotech firms and startups. The NASDAQ Composite is a good indicator of the technology sector's performance.

The Russell 3000

The Russell 3000 tracks the performance of 3000 large, mid, and small-cap companies. This index provides a comprehensive view of the US stock market, as it covers a broader range of companies than the S&P 500. Investors who are looking for exposure to smaller companies often consider the Russell 3000.

Impact on Investment Decisions

Understanding these major stock indexes can help investors make informed decisions. For example, if you're considering investing in the stock market, you might want to monitor the S&P 500 for long-term trends. Conversely, if you're interested in technology stocks, the NASDAQ Composite might be a better indicator.

Case Studies

Let's look at a few recent examples to illustrate the impact of these indexes:

S&P 500: In March 2020, the S&P 500 experienced a sharp decline due to the COVID-19 pandemic. However, it quickly recovered and reached new highs in 2021, reflecting the resilience of the US stock market.

NASDAQ Composite: In 2020, the NASDAQ Composite surged due to the strong performance of tech companies. This index has been a key driver of the stock market's overall growth over the past few years.

In conclusion, understanding the major stock indexes in the US is essential for anyone looking to invest in the stock market. These indexes provide valuable insights into market trends and can help you make informed decisions. Whether you're a seasoned investor or just starting out, familiarizing yourself with these indexes can give you a competitive edge in the market.

so cool! ()

last:Maximize Your Investment Potential with ETFs of US Stocks"

next:nothing

like

- Maximize Your Investment Potential with ETFs of US Stocks"

- Invest in Stocks in the US: A Comprehensive Guide to Navigating the Market

- Best UK Broker for US Penny Stocks: Your Ultimate Guide

- Unlocking the Potential of High Growth US Stocks Momentum

- Title: The Share of Stock of US Steel: Insights and Analysis

- Most Traded Stocks in the US: A Comprehensive Guide

- US Stock Big 7: A Comprehensive Guide to America's Most Influential Companie

- Best Performing US Large Cap Stocks August 2025: Top Picks for Investors

- US Lighting Stock: The Ultimate Guide to Buying and Selling Lights

- Stock Markets Predicting US Election: Decoding the Financial Clues

- Current US Stock Market Themes for 2025: A Deep Dive

- Top Stock in US: How to Identify and Invest in the Best Performing Companies

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Major Stock Indexes in the US: A Comprehensive

Major Stock Indexes in the US: A Comprehensive

Lowest Fees Broker for US Stocks: Your Ultimat

Understanding Major Shareholders in US Stocks:

Time to Sell Ex-US Stocks: Strategic Considera

Title: US Stock Market 2017 Chart: A Comprehen

Top Momentum Stocks: September 2025 US Large C

Title: Best US Stocks to Buy Now for Long-Term

Unlocking the Potential of Hemlock US Stock: A

How to Buy US Stocks in the UAE: A Comprehensi

US Companies with Stock Value Up to $6 Each: A

US Stock Market All-Time Graph: A Comprehensiv

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- Best US Stock Under $10: Top Picks for Investo"

- US 1 Industries Stock Quote: A Comprehensive G"

- FSB Pharma: A Deep Dive into Its US Stock Perf"

- US Stock Information: Unveiling the Key to Inv"

- ACB US Stock Listing: Everything You Need to K"

- Convert Us Air Stock Certificates: A Comprehen"

- US Cellular Stock Price Performance: A Compreh"

- Top Pharma Stocks in the US: A Comprehensive G"

- Understanding the US Cobalt Stock Price: Trend"

- How Will the US Elections Affect the Stock Mar"