you position:Home > new york stock exchange > new york stock exchange

How Can I Invest in US Stocks from Australia?

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Investing in US stocks from Australia can be an exciting opportunity for Australian investors to diversify their portfolio and take advantage of the strong and dynamic US market. If you're looking to invest in US stocks, but aren't sure how to get started, this guide will walk you through the process, highlighting key steps and considerations.

Understanding the US Stock Market

Before diving into US stocks, it's crucial to understand the market. The US stock market is one of the largest and most diverse in the world, with numerous exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ. Companies listed on these exchanges range from large-cap giants to small-cap startups.

Steps to Invest in US Stocks from Australia

Choose a Brokerage Platform: To invest in US stocks from Australia, you need a brokerage platform that supports international investors. Popular options include E*TRADE, Charles Schwab, and TD Ameritrade. These platforms typically offer user-friendly interfaces, low fees, and access to a wide range of US stocks.

Open an Account: Once you've chosen a brokerage platform, you'll need to open an account. This process involves providing personal information, proof of identity, and funding your account. Many brokers offer online applications that can be completed in just a few minutes.

Familiarize Yourself with the Platform: Before making any investments, take the time to familiarize yourself with your brokerage platform. This includes understanding how to navigate the platform, how to place orders, and how to track your investments.

Research and Select Stocks: Research companies you're interested in investing in. Consider factors such as the company's financial health, market position, and growth prospects. You can use financial websites like Yahoo Finance and Seeking Alpha for research.

Place Your Order: Once you've selected a stock, you can place your order through your brokerage platform. You'll need to decide whether you want to buy shares or sell short. Ensure you understand the implications of your decision.

Monitor Your Investments: After placing your order, monitor your investments regularly. Stay informed about market news, company updates, and any relevant regulatory changes that could impact your investments.

Benefits of Investing in US Stocks from Australia

Diversification: Investing in US stocks allows you to diversify your portfolio and reduce risk. The US market is often less correlated with the Australian market, making it a good hedge against domestic market fluctuations.

Access to Large-Cap Companies: The US market is home to some of the largest and most successful companies in the world. Investing in these companies can provide access to consistent dividend yields and capital appreciation.

Regulatory Environment: The US stock market is highly regulated, offering a level of transparency and protection that may not be as strong in other markets.

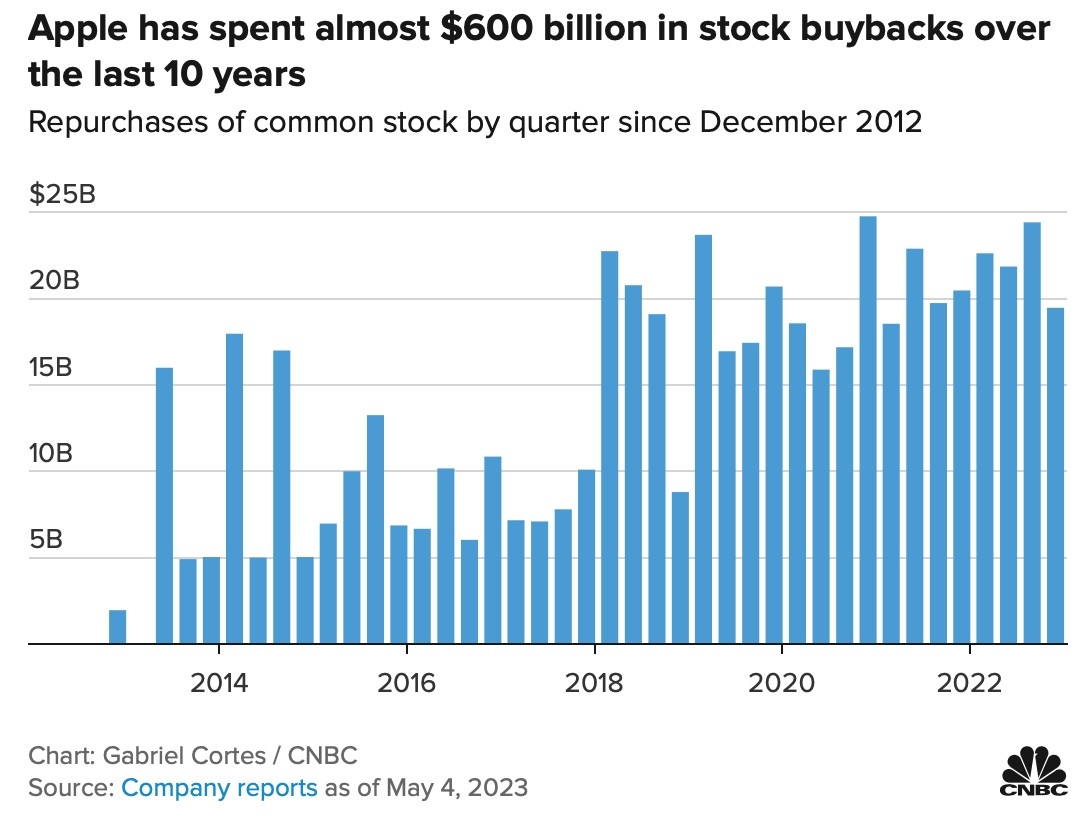

Case Study: Australian Investor Buys Apple Stock

Imagine an Australian investor who decides to invest in Apple (AAPL) stock. By opening an account with a brokerage platform like E*TRADE and conducting thorough research, the investor can buy shares of Apple and potentially benefit from the company's strong performance.

In conclusion, investing in US stocks from Australia is a viable option for diversification and potential growth. By following these steps and staying informed, Australian investors can successfully navigate the US stock market.

so cool! ()

last:Maximizing Your Stock Sale Price: Expert Tips and Strategies"

next:nothing

like

- Maximizing Your Stock Sale Price: Expert Tips and Strategies"

- Understanding the US Oil & Gas Stock Price Trends

- Top 10 Companies to Watch in the S&P 500

- Maximizing Returns with US Food Service Stocks: A Comprehensive Guide

- Stock Price: Unveiling the Secrets to Understanding Market Dynamics"

- Is It Legal to Buy Cannabis Stocks in the US? A Comprehensive Guide

- Stock Closing Prices by Date: A Comprehensive Guide to Market Analysis

- S&P 500 History Data: Decoding the Stock Market's Pulse

- Mastering Market Futures: A Comprehensive Guide for Investors

- NYSE Post: Unveiling the Power of the New York Stock Exchange

- US Pot Stocks List: Your Ultimate Guide to Investing in the Cannabis Industry

- How to Buy US Stocks with Moomoo: A Step-by-Step Guide

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

How Can I Invest in US Stocks from Australia?

How Can I Invest in US Stocks from Australia?

How to Buy US Stocks with Moomoo: A Step-by-St

US Airlines Stocks: A Comprehensive Guide to I

Best US Stocks 2020: Top Performers and What T

Unveiling the Puma Stock: A Comprehensive Anal

Highest EPS Stocks in the US: Top Performers t

US Debt and Stock Market Crash Graph: An In-De

Title: First Cobalt Corp Stock Code: US - A Co

Unlocking the Stars: A Comprehensive Guide to

HDFC Securities Charges for US Stocks: What Yo

Nem US Steel Stock: A Comprehensive Guide to I

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Best UK Broker for US Penny Stocks: Your Ultim"

- Cannabis Companies Going Public on the US Stoc"

- Chinese Buying Up US Stocks: A Shift in Global"

- Title: NSX National Stock Exchange US: Revolut"

- US Stock Decline: What It Means and How It Imp"

- Title: US Role on Japanese Stock Market Crash "

- Us Stock Exchange Market Hours: Everything You"

- Top US Mid Cap Stocks: A Guide to Investment O"

- Is the US Stock Market Heading for a Crash?"

- Upstox Buy US Stocks: Your Ultimate Guide to I"