you position:Home > new york stock exchange > new york stock exchange

Buying US Stock in Australia: A Comprehensive Guide

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

Are you looking to invest in US stocks but reside in Australia? If so, you're not alone. Many Australians are interested in diversifying their investment portfolios by investing in US stocks. In this article, we'll explore the process of buying US stocks in Australia, including the best platforms, fees, and tips for success.

Understanding the Basics

Before diving into the details, it's important to understand the basics of buying US stocks from Australia. Unlike local stocks, US stocks are traded on different exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. This means that you'll need a brokerage account that allows you to trade on these exchanges.

Choosing the Right Brokerage

The first step in buying US stocks in Australia is to choose a reputable brokerage. There are several options available, each with its own set of fees, services, and features. Some popular brokerage platforms for Australian investors include:

- Interactive Brokers: Known for its low fees and advanced trading tools, Interactive Brokers is a popular choice for active traders.

- E*TRADE: Offering a user-friendly platform and a range of investment options, E*TRADE is a great choice for beginners and experienced investors alike.

- Fidelity: Fidelity offers a comprehensive platform with a variety of investment options, including mutual funds, ETFs, and individual stocks.

When choosing a brokerage, consider factors such as fees, platform features, customer service, and the ability to trade on US exchanges.

Understanding Fees and Taxes

Buying US stocks from Australia comes with its own set of fees and taxes. Here are some key points to keep in mind:

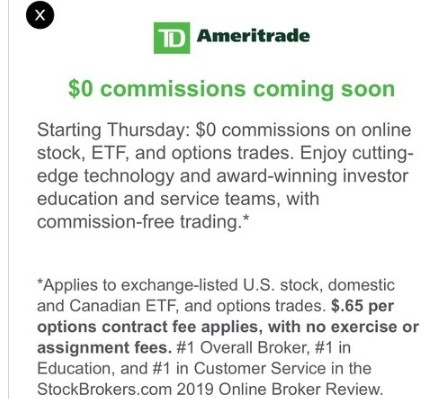

- Brokerage Fees: Most brokers charge a commission for each trade. Fees can vary depending on the broker and the type of trade (market, limit, or stop).

- Exchange Fees: Some exchanges charge a fee for trading on their platform. This fee is typically passed on to the investor.

- Foreign Tax: US stocks are subject to a 30% withholding tax on dividends. However, many Australians are eligible for a tax credit to offset this tax.

- Withholding Tax: If you sell a US stock, you may be subject to a 10% withholding tax on the capital gains.

It's important to understand these fees and taxes to ensure that you're making an informed investment decision.

Tips for Success

To maximize your returns when buying US stocks from Australia, consider the following tips:

- Diversify Your Portfolio: Diversifying your portfolio can help reduce risk and increase returns. Consider investing in a mix of stocks, bonds, and ETFs.

- Research Thoroughly: Before investing in a particular stock, do your homework. Research the company's financials, industry trends, and management team.

- Stay Informed: Keep up with market news and economic indicators to stay informed about potential investment opportunities.

- Use Stop-Loss Orders: A stop-loss order can help protect your investment by automatically selling a stock if it falls below a certain price.

Conclusion

Buying US stocks from Australia can be a great way to diversify your investment portfolio. By choosing the right brokerage, understanding fees and taxes, and following these tips, you can make informed investment decisions and potentially increase your returns. Remember to do your research and stay informed to maximize your success.

so cool! ()

like

- FIFA Coin Stock US: A Comprehensive Guide to Investing in the FIFA Coin Market

- US Midterm Elections 2018: How Did They Impact the Stock Market?

- The Future of the US Stock Market: What Investors Need to Know

- Top Drone Stocks in the US: Your Guide to Investing in the Future

- US Market Stock List: Comprehensive Guide to Top Investments

- Understanding the Canadian Tax Implications for US Citizens Selling ULCC Stock&am

- High Stock Value in US Economy 2019: Fidelity's Perspective

- US Large Cap Stocks: Unveiling the Highest Returns Past Week and Analyzing Moment

- Earnings Calendar: Key US Stocks to Watch on October 20, 2025

- Total Value of the US Stock Market in 2018: A Comprehensive Analysis

- Russia Stock in US: A Comprehensive Guide to Investing in Russian Stocks"

- Title: Top US Cannabis Stocks to Watch in 2023

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Buying US Stock in Australia: A Comprehensive

Buying US Stock in Australia: A Comprehensive

Can U.S. Citizens Invest in the Indian Stock M

Title: "US Steel Stock Value: Current

RSM US LLP Stock: Understanding the Financial

Top Drone Stocks in the US: Your Guide to Inve

Title: "US Election Effect on the Ind

Trade US Stocks from the Philippines: A Compre

Current US Stock Market Sentiment: A Look into

Heliogen US Company Stock Exchange: A Promisin

Title: Best US Stock to Buy Right Now

Earnings Calendar Next Week: US Stocks to Watc

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- Understanding the Stock Market's Behavior"

- Title: US Oil Companies Stocks: A Comprehensiv"

- US Stock Earnings Announcements: The Key to In"

- Holidays and the US Stock Market: What You Nee"

- Is China Buying US Stocks Now? A Deep Dive int"

- Buzz Us Stocks on the Move: Unveiling the Most"

- Title: US Stock Market on November 25, 2016: A"

- Trade US Stocks from the Philippines: A Compre"

- Toys "R" Us Off-Hours Stock "

- AMC Stock US: A Comprehensive Guide to Underst"