you position:Home > aphria us stock > aphria us stock

Why Stocks Dropping Today: Key Factors and Implications

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The stock market can be unpredictable, and today's drop in stocks has left many investors scratching their heads. In this article, we'll delve into the key factors contributing to today's stock market decline and explore the potential implications for investors.

Economic Indicators and Data

One of the primary reasons for today's stock market drop is the release of economic indicators and data. Negative news regarding the economy, such as lower-than-expected GDP growth or rising unemployment rates, can lead to a sell-off in the stock market. Additionally, companies' earnings reports that miss analysts' estimates can also contribute to a downward trend.

For example, if a major company in a key sector reports lower-than-expected earnings, it can trigger a ripple effect throughout the industry, causing investors to sell off their stocks in fear of further declines.

Political and Geopolitical Factors

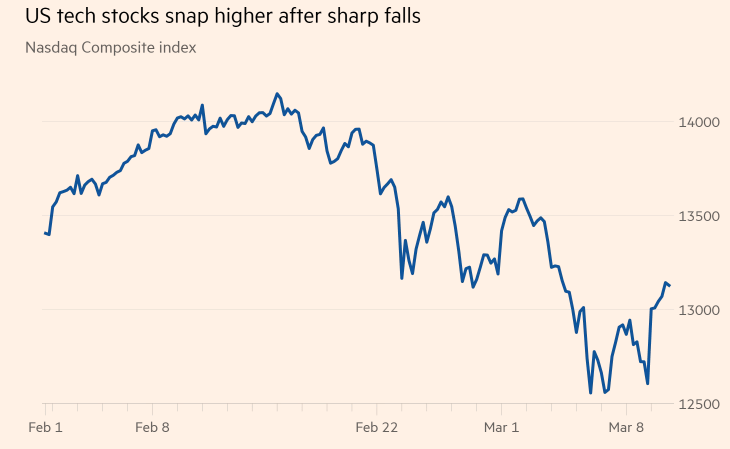

Political and geopolitical events can also significantly impact the stock market. Issues such as trade wars, political instability, or international conflicts can cause investors to become nervous and sell off their stocks. In today's market, tensions between the United States and China have been a major concern, as the two countries engage in a trade war that has caused uncertainty and volatility.

Market Sentiment and Speculation

Market sentiment and speculation can also play a role in today's stock market drop. When investors become overly optimistic or pessimistic, it can lead to rapid price movements. For instance, if a large number of investors believe that the market is overvalued, they may start selling off their stocks, causing prices to fall.

Moreover, speculative trading, such as the use of leverage or margin trading, can exacerbate market volatility. When traders use borrowed money to invest in stocks, they can amplify their gains or losses, which can contribute to sudden market movements.

Technological Advances and Disruptions

Technological advances and disruptions can also influence the stock market. For instance, if a new technology emerges that threatens the profitability of existing companies, it can lead to a sell-off in those companies' stocks. Similarly, if a major tech company faces a major scandal or regulatory issues, it can have a widespread impact on the market.

Impact on Investors

Today's stock market drop has several implications for investors. First, it's important to remain calm and not panic sell. Historically, panic selling has led to even greater losses. Instead, investors should take a long-term perspective and focus on their investment strategy.

Second, diversification is key. By investing in a variety of assets, investors can reduce their exposure to market volatility. This can help mitigate the impact of today's stock market drop on their portfolios.

In conclusion, today's stock market drop can be attributed to a combination of economic indicators, political and geopolitical factors, market sentiment, and technological disruptions. As investors, it's crucial to remain informed and focused on our investment strategies, rather than reacting impulsively to market movements.

so cool! ()

last:Unlock the Secrets of the Newest Stock Market Trends

next:nothing

like

- Unlock the Secrets of the Newest Stock Market Trends

- S&P 500 Index Year to Date Performance: A Comprehensive Analysis

- US Stock Futures: A Comprehensive Wiki Guide"

- Strong Buy Stocks US: Top Picks for 2023

- Unlocking Potential with US Large Cap Stock Funds: A Comprehensive Guide

- Marketplace Wall Street: The Intersection of E-Commerce and Financial Markets

- US Stock Extended Hours: Maximizing Your Trading Opportunities

- US Good Stocks to Buy: Top 5 Investments for 2023

- NASDAQ Historical Graph: Unveiling Decades of Stock Market Trends

- US Market Close: A Comprehensive Guide to Understanding Today's Financial La

- When Will the Market Drop Again? A Comprehensive Analysis

- What Does NYSE Do: The Comprehensive Guide to the New York Stock Exchange

recommend

Why Stocks Dropping Today: Key Factors and Imp

Why Stocks Dropping Today: Key Factors and Imp

APE US Stock: A Comprehensive Guide to Underst

Samsung Note 5 US Cellular Stock ROM: The Ulti

Is the US Stock Market Open on December 31st?

Jordan 1 High Mocha Size US 8 Stock X: A Compr

Best US Robotics Stocks: Top Picks for 2023

What's the Highest Stock: Unveiling the P

Is the US Stock Market Open Today July 12, 202

Stock Options at Novartis: A Comprehensive Gui

Best Stock to Buy in the US Market Now: Top Pi

Title: "http stocks.us.reuters.com st

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Renaissance Oil Corp US Stock Symbol: Your Gui"

- Safe US Stocks: Your Guide to Secure Investmen"

- US Silica Stock Forecast: A Comprehensive Anal"

- market correction"

- sofi invest"

- Luxury Brands Stocks: The Ultimate Investment "

- Investing in Canadian Stocks from the US: Navi"

- The Biggest Companies in the US Stock Market: "

- Latest News on US Stock Market Crash: What You"

- Current US Stock Market Outlook: July 2025 Ana"