you position:Home > aphria us stock > aphria us stock

When Will the Market Drop Again? A Comprehensive Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The stock market is a dynamic entity, constantly evolving and influenced by a myriad of factors. Investors often find themselves pondering the inevitable question: "When will the market drop again?" This article delves into the factors that can trigger market downturns, the historical patterns, and the strategies investors can employ to navigate through such volatile periods.

Understanding Market Downturns

Market downturns, also known as bear markets, are characterized by a significant decline in the value of stocks over a period of time. These downturns can be caused by various factors, including economic recessions, geopolitical tensions, and unexpected events.

Economic Indicators

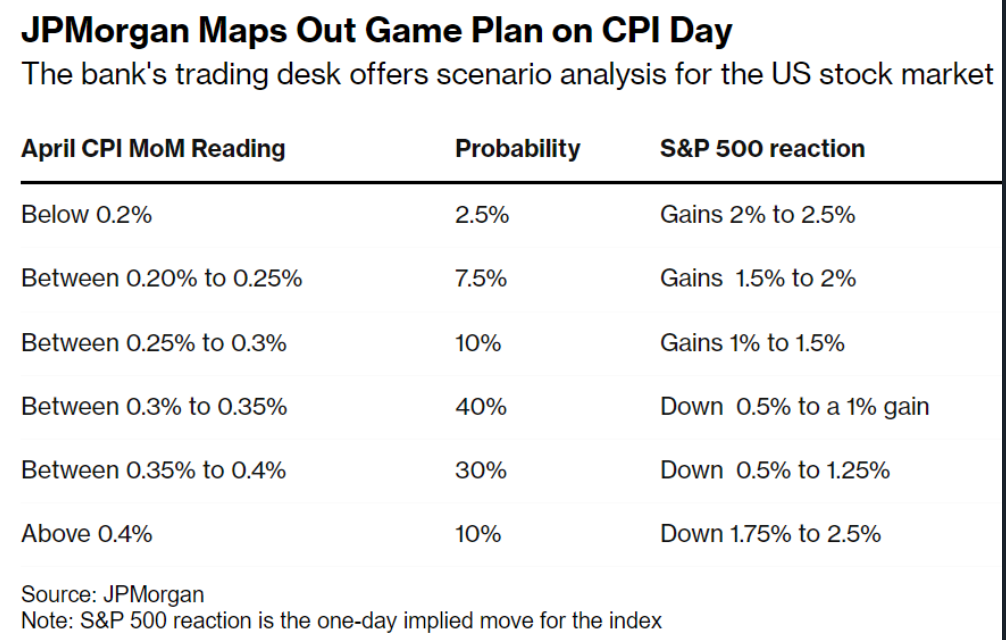

One of the primary factors that can lead to a market downturn is economic indicators. These indicators, such as GDP growth, unemployment rates, and inflation, provide insights into the overall health of the economy. For instance, if the unemployment rate starts to rise significantly, it could indicate a potential economic downturn, leading to a drop in the stock market.

Geopolitical Tensions

Geopolitical tensions can also cause market downturns. Events such as trade wars, political instability, and conflicts can disrupt global trade and investment, leading to a decline in stock prices.

Unexpected Events

Unexpected events, such as natural disasters or health crises, can also trigger market downturns. These events can cause widespread panic and uncertainty, leading to a sell-off in the stock market.

Historical Patterns

Historically, the stock market has experienced periodic downturns. For instance, the dot-com bubble burst in 2000, and the financial crisis of 2008 were significant market downturns. These events serve as a reminder that market downturns are a natural part of the investment cycle.

Strategies for Navigating Market Downturns

Investors can employ various strategies to navigate through market downturns:

1. Diversification

Diversification is a key strategy to mitigate the risk of market downturns. By investing in a variety of assets, including stocks, bonds, and real estate, investors can reduce their exposure to any single market.

2. Long-Term Perspective

Investors should maintain a long-term perspective when investing in the stock market. Short-term market fluctuations are common, but long-term investment can provide significant returns.

3. Risk Management

Risk management is crucial in navigating market downturns. Investors should assess their risk tolerance and invest accordingly. This includes setting stop-loss orders and diversifying their portfolio.

Case Studies

One notable case study is the 2008 financial crisis. The crisis was triggered by the collapse of the housing market in the United States, leading to a global financial meltdown. Investors who had diversified their portfolios and maintained a long-term perspective were better equipped to navigate through the downturn.

Conclusion

The question of when the market will drop again is a challenging one. However, by understanding the factors that can trigger market downturns, investors can better prepare themselves for such volatile periods. Diversification, a long-term perspective, and risk management are key strategies for navigating market downturns.

so cool! ()

like

- What Does NYSE Do: The Comprehensive Guide to the New York Stock Exchange

- Lode Yahoo: Revolutionizing the Online Experience

- Nasdaq 100 Close Today: The Latest Market Insights

- Streamline Your Financial Management: A Comprehensive Guide to Yahoo Finance Logi

- US Alibaba Stock: A Comprehensive Guide to Investing in Alibaba's American M

- Top Stock Picks for August 2025 in the US Market

- Yahoo Stocks: Your Ultimate Guide to Stock Market Success"

- Stock Market Crash & US Election: A Tangled Web of Impact

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol vaw:

- National Stock Exchange Chart: Unveiling the Dynamics of the Market"

- What is Stock Market Down: Understanding the Decline and Its Implications

- US News Stocks to Buy: Top Picks for 2023

recommend

When Will the Market Drop Again? A Comprehensi

When Will the Market Drop Again? A Comprehensi

Hikvision US Stock: A Comprehensive Analysis o

Buying U.S. Stocks with a Weak Canadian Dollar

April 2025 US Stock Market Crash: What You Nee

How to Hedge Your US Stocks: Strategies for Ri

Title: Top US Stocks to Watch in 2022: A Compr

Moto G5 Plus US Retail Stock ROM: The Ultimate

Microsoft Stock US: A Comprehensive Analysis o

Title: Domestic Stocks Outperform Foreign-Faci

Dividend Stocks Traded in the US: A Comprehens

http stocks.us.reuters.com stocks fulldescript

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Best US Marijuana Penny Stocks: Your Guide to "

- Title: US International Stock Index: A Compreh"

- US Stock Market 2025: Predictions and Performa"

- Reddit's Influence on the US Stock Market"

- Small US Stocks to Buy: Top Picks for 2023"

- Beigene US Biotech Stocks: A Lucrative Investm"

- The US Stock Market Futures: Key Insights and "

- NVIDIA Announces $50 Billion Stock Buyback: Wh"

- US Stock Market 2020: A Comprehensive Chart An"

- Title: List of US Penny Stocks Under $1: A Gui"