you position:Home > aphria us stock > aphria us stock

US Silica Stock Forecast: A Comprehensive Analysis

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the ever-evolving landscape of the stock market, investors are constantly seeking insights into potential investment opportunities. One such company that has caught the attention of many is US Silica Holdings Inc. With its diverse product offerings and strong market position, US Silica is a company worth keeping an eye on. In this article, we will delve into a comprehensive analysis of the US Silica stock forecast, examining its past performance, current market conditions, and future potential.

Understanding US Silica Holdings Inc.

US Silica Holdings Inc. is a leading producer and supplier of industrial minerals and materials. The company operates in various segments, including construction, consumer, and specialty products. Its products are widely used in construction, glass manufacturing, foundry, and numerous other industries. With a strong focus on innovation and sustainability, US Silica has become a key player in the industrial minerals market.

Historical Stock Performance

To gain a better understanding of the potential future of US Silica stock, it is essential to examine its historical performance. Over the past few years, the company has demonstrated a strong track record of growth and profitability. In fact, the stock has seen significant increases in value, with a notable upward trend over the past five years.

One of the key factors contributing to US Silica's success is its ability to adapt to changing market conditions. For instance, during the recession in 2008, the company managed to navigate through the tough times and emerge stronger. This resilience has been a major factor in its consistent growth and has helped to build investor confidence.

Current Market Conditions

The current market conditions play a crucial role in determining the future of US Silica stock. Several factors are currently influencing the company's performance, including:

- Economic Growth: A strong economy typically leads to increased demand for construction materials, which is US Silica's primary market.

- Commodity Prices: The prices of industrial minerals can significantly impact the company's profitability. Therefore, monitoring these prices is crucial.

- Regulatory Changes: Changes in environmental regulations can affect the cost of production and the demand for certain products.

Future Potential

Looking ahead, the future of US Silica stock appears promising. Several factors suggest that the company is well-positioned for continued growth:

- Expansion Plans: US Silica has several expansion projects in the pipeline, which are expected to increase its production capacity and enhance its market position.

- Innovation: The company is continuously investing in research and development to create new products and improve existing ones, ensuring its competitiveness in the market.

- Sustainability: With a growing focus on sustainability, US Silica is well-positioned to capitalize on the increasing demand for eco-friendly products.

Case Study: US Silica's Acquisition of Unimin Corp.

One notable example of US Silica's strategic moves is its acquisition of Unimin Corp. in 2018. This acquisition significantly expanded the company's product portfolio and market reach, further solidifying its position as a leading player in the industrial minerals industry. Since the acquisition, US Silica has seen a substantial increase in its revenue and profitability, demonstrating the positive impact of strategic investments.

Conclusion

In conclusion, the US Silica stock forecast appears positive, with several factors indicating potential for future growth. By examining the company's historical performance, current market conditions, and future potential, investors can make informed decisions about their investments. While no stock forecast can guarantee success, US Silica Holdings Inc. presents a compelling opportunity for those looking to invest in the industrial minerals sector.

so cool! ()

like

- Title: "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&

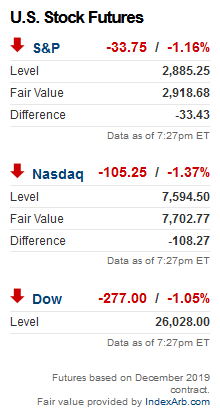

- Understanding the Fair Value of US Stock Futures

- US Nickel Stock Price: A Comprehensive Guide to Investing in Nickel Stocks

- Fox News and the US Stock Market: A Comprehensive Analysis

- July 2025 US Stock Market Holidays: A Comprehensive Guide

- Sch-r960 Stock Rom Us Cellular: The Ultimate Guide to Enhancing Your Device

- US Cellular Stock News: A Comprehensive Update on the Company's Performance

- Is the US Stock Market Open on Good Friday 2020?

- Polymer Black Stock Set NATO US: The Ultimate Solution for Modern Military Operat

- Let Us Analyze the Istanbul Stock Exchange Dataset

- How to Buy US Stock from India: A Comprehensive Guide

- Buying US Stock by Using Credit Card: A Comprehensive Guide

recommend

US Silica Stock Forecast: A Comprehensive Anal

US Silica Stock Forecast: A Comprehensive Anal

US Stock Market: A Comprehensive Guide to Unde

Man Us Stock: A Comprehensive Guide to Underst

Do Foreign Investors Pay Taxes on US Stocks?

Lin Stock US: The Ultimate Guide to Understand

American Stock Traders Outside the US: Navigat

Title: US Olive Oil Stocks: A Deep Dive into t

Title: Total Assets in US Stock Market: An In-

Is It Safe to Invest in US Stocks from India?

Include Us Stocks in Money Moneycontrol: A Com

Best Dividend US Stock: How to Identify the Be

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock