you position:Home > aphria us stock > aphria us stock

US Stock Futures React to Tariffs: A Comprehensive Analysis

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

Introduction

The US stock market, often considered the barometer of the global economy, has always been sensitive to geopolitical and economic developments. One such development that has consistently impacted the market is the imposition of tariffs. This article delves into how US stock futures have reacted to tariffs, analyzing the trends and providing insights into the future implications.

Understanding Tariffs

Tariffs are taxes imposed on imported goods. They are used by governments to protect domestic industries, generate revenue, or as a retaliatory measure against other countries' trade policies. The United States has been imposing tariffs on various goods, including steel, aluminum, and electronic products, leading to significant reactions in the stock market.

Impact on Stock Futures

The impact of tariffs on US stock futures can be observed through various metrics, including trading volumes, price movements, and volatility. Here's a closer look at how tariffs have affected the market:

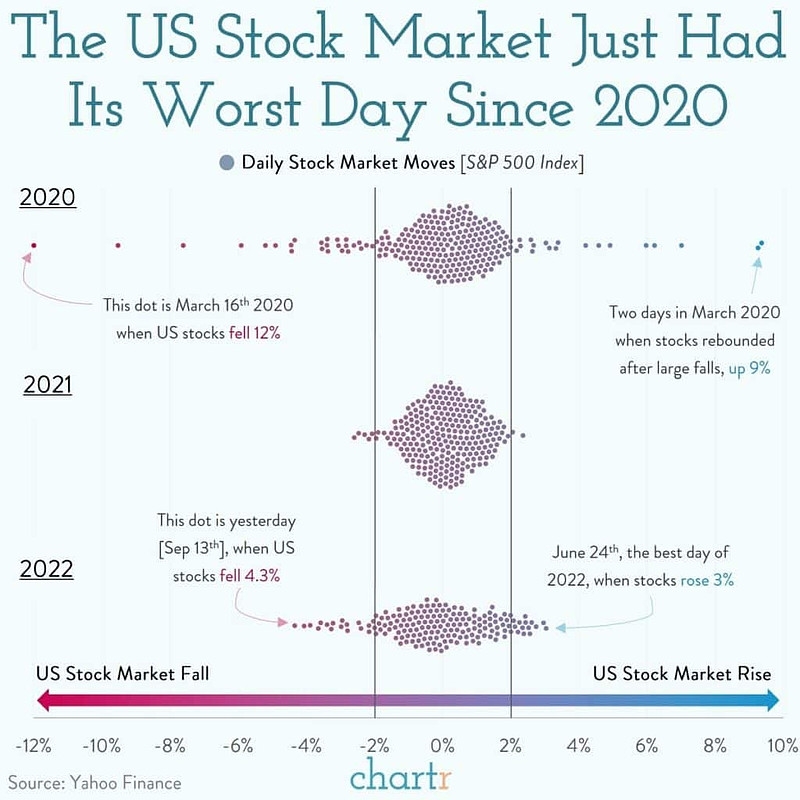

- Volatility: Tariffs have been a significant source of volatility in the stock market. When news of new tariffs is announced, stock futures often experience sharp movements, both up and down.

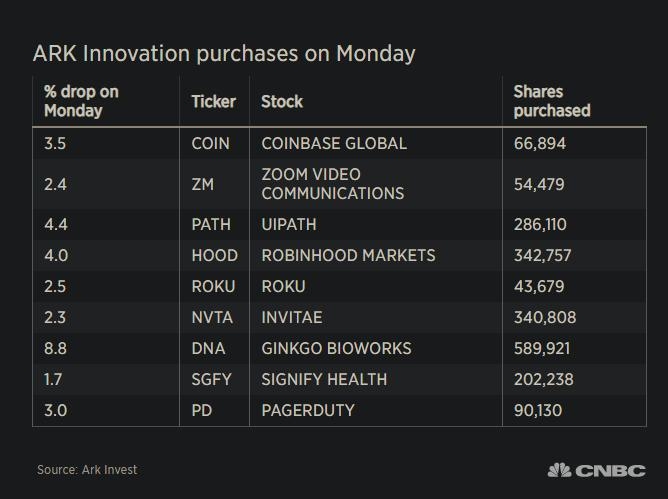

- Trading Volumes: The trading volumes in stock futures tend to increase during periods of tariff announcements and negotiations. This is because investors are reacting to the potential impact on their investments.

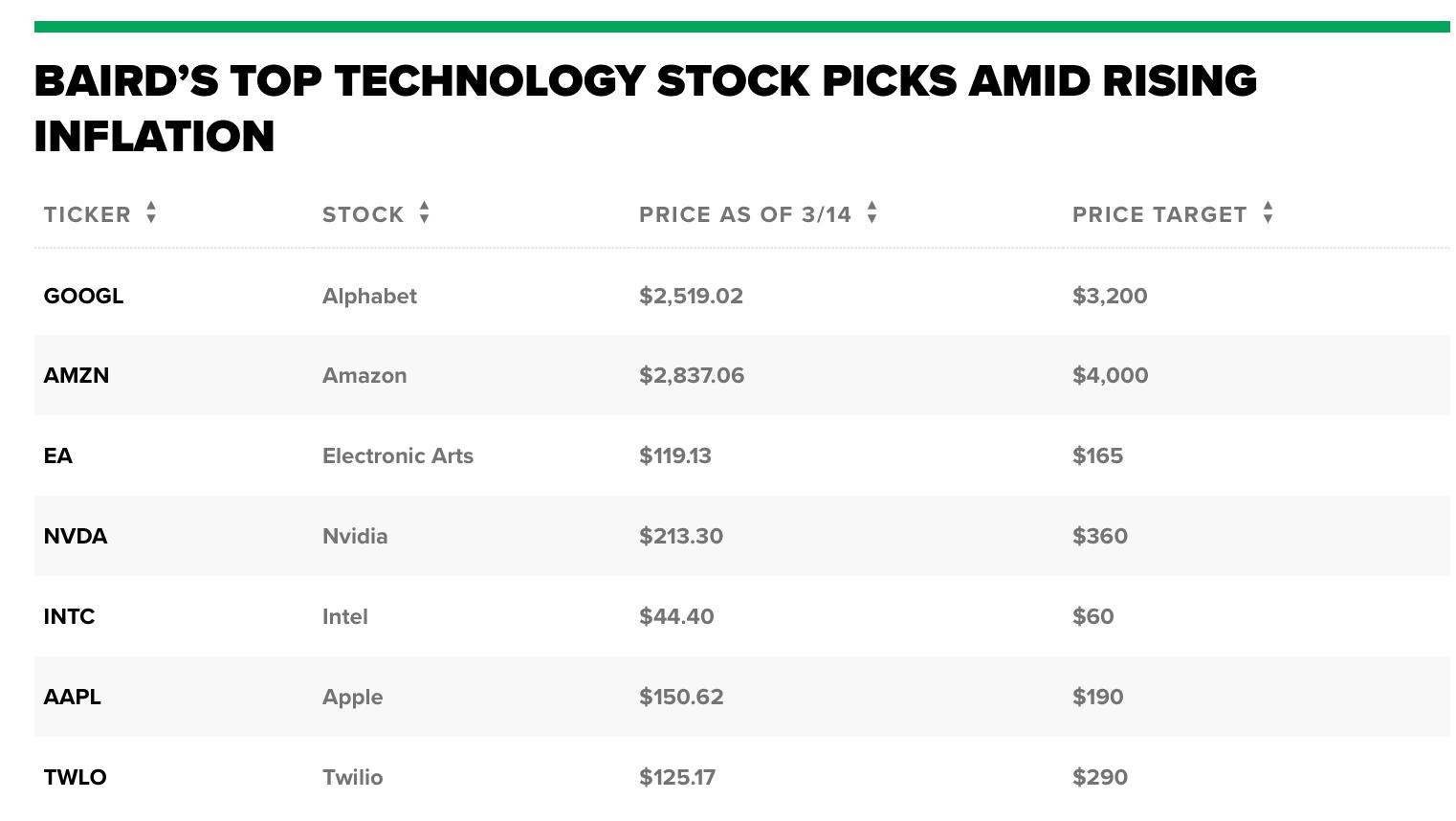

- Price Movements: The reaction of stock futures to tariffs can vary. In some cases, the market may react negatively, leading to a decline in prices. In other cases, the market may react positively, expecting long-term benefits from the tariffs.

Case Studies

To understand the impact of tariffs on stock futures better, let's look at a few case studies:

- Steel Tariffs: In 2018, the Trump administration imposed tariffs on steel imports. The S&P 500 futures initially fell, indicating a negative reaction. However, over time, the market recovered, suggesting that the long-term impact of the tariffs was not as severe as initially feared.

- China Trade War: The ongoing trade war between the United States and China has been a significant source of volatility in the stock market. The S&P 500 futures have experienced sharp movements in both directions, reflecting the uncertainty surrounding the trade negotiations.

Conclusion

The reaction of US stock futures to tariffs is a complex and multifaceted issue. While tariffs can lead to short-term volatility and uncertainty, they can also have long-term benefits for certain industries. As investors, it is crucial to stay informed about the latest developments and understand the potential impact of tariffs on their investments.

so cool! ()

last:Today's Top Momentum Stocks in the US Markets

next:nothing

like

- Today's Top Momentum Stocks in the US Markets

- Title: US Stock Hedging Strategies Backfire During Market Rout

- US Petroleum Stock Piles: The Cornerstone of Energy Security

- Battery Stocks US: A Comprehensive Guide to Investing in the Battery Industry

- Title: Us Expat Stock Trader Accounts: A Comprehensive Guide

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol veri.

- Can Marijuana Companies Move from Canadian Stock Exchange to US?

- Stock Market Lunch Break: Understanding the Dynamics of US Markets

- Stocks Yesterday Closing Chart: A Comprehensive Analysis

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol msft.

- Top Gaining US Stocks This Week: Momentum Analysis

- Title: Stock Invest Us.com - Your Ultimate Guide to Stock Investment in the USA

recommend

US Stock Futures React to Tariffs: A Comprehen

US Stock Futures React to Tariffs: A Comprehen

Citi Says Buyers Plow $21 Billion into US Stoc

The Cheapest Way to Buy US Stocks in the UK

US Stock Listed Companies: A Comprehensive Gui

The Effect of U.S. Elections on the Stock Mark

How to Buy US Stock from Hang Seng Bank

All-Time High US Stocks: A Deep Dive into the

Is the US Stock Market Open on December 31?

Understanding the US Bank Sector Stocks: A Com

Investing in Canadian Stocks from the US: Navi

Reddit US Stock Later 2019 Prediction

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- how to make money in stocks"

- US Stock Futures React to Tariffs: A Comprehen"

- US Cannabis Stock Catalyst: The Future of Lega"

- Lowes Stock US: A Comprehensive Analysis"

- market manipulation"

- best tech stocks"

- usa ka share market"

- dividend etf"

- Title: Purchasing Heritage Cannabis US Stock: "

- silver etf"