you position:Home > aphria us stock > aphria us stock

US Gov Stock Market Graph: A Comprehensive Analysis

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the ever-evolving landscape of financial markets, the US government stock market graph has become a crucial tool for investors and analysts alike. This graph not only showcases the performance of government securities but also provides valuable insights into the broader economic climate. In this article, we will delve into the intricacies of the US government stock market graph, exploring its significance, key components, and the factors that influence its movement.

Understanding the US Government Stock Market Graph

The US government stock market graph primarily focuses on the performance of government securities, such as Treasury bills, notes, and bonds. These securities are issued by the US government to finance its operations and are considered one of the safest investments in the world. The graph displays the price and yield of these securities over a specific period, allowing investors to gauge their performance and make informed decisions.

Key Components of the US Government Stock Market Graph

Price: The price of a government security represents the current market value of the bond. It is typically expressed as a percentage of the bond's face value. As the price of a bond increases, its yield decreases, and vice versa.

Yield: The yield of a government security is the effective interest rate earned by the investor. It is calculated by dividing the annual interest payment by the bond's current market price. The yield is a critical indicator of the bond's attractiveness to investors.

Maturity: The maturity of a government security refers to the time remaining until the bond matures and the principal amount is repaid. Generally, longer-term bonds have higher yields than shorter-term bonds.

Interest Rate: The interest rate is a key factor that influences the yield of government securities. When interest rates rise, the prices of existing bonds fall, and vice versa.

Factors Influencing the US Government Stock Market Graph

Several factors can impact the US government stock market graph:

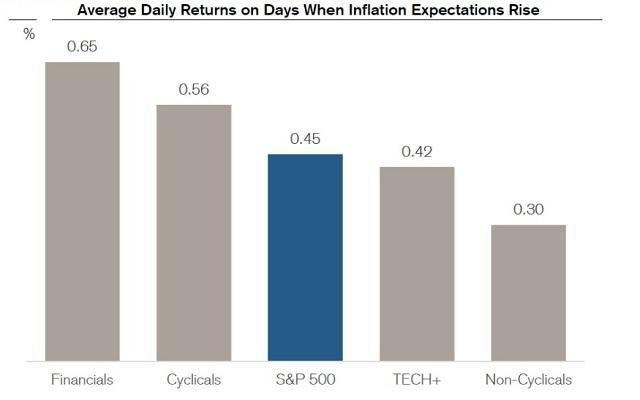

Economic Indicators: Economic indicators, such as GDP growth, unemployment rates, and inflation, play a significant role in shaping the graph. For instance, higher inflation can lead to increased interest rates, causing bond prices to fall.

Monetary Policy: The Federal Reserve's monetary policy decisions, such as interest rate adjustments, can significantly impact the graph. For example, a rate hike can lead to higher yields and lower bond prices.

Political Events: Political events, such as elections or policy changes, can also influence the graph. For instance, a new administration might implement policies that could affect the economy and, consequently, the graph.

Case Studies

To illustrate the impact of these factors, let's consider two case studies:

2019 Economic Growth: In 2019, the US economy experienced strong growth, leading to lower unemployment rates and higher inflation. As a result, the US government stock market graph showed a slight upward trend in yields, reflecting the increased demand for government securities.

2020 COVID-19 Pandemic: The COVID-19 pandemic led to a sharp decline in economic activity, resulting in lower interest rates and higher bond prices. The US government stock market graph displayed a significant upward trend in yields during this period.

In conclusion, the US government stock market graph is a vital tool for understanding the performance of government securities and the broader economic climate. By analyzing its key components and the factors that influence its movement, investors and analysts can make informed decisions and navigate the complex world of financial markets.

so cool! ()

last:US Stock Futures React to Tariffs: A Comprehensive Analysis

next:nothing

like

- US Stock Futures React to Tariffs: A Comprehensive Analysis

- Today's Top Momentum Stocks in the US Markets

- Title: US Stock Hedging Strategies Backfire During Market Rout

- US Petroleum Stock Piles: The Cornerstone of Energy Security

- Battery Stocks US: A Comprehensive Guide to Investing in the Battery Industry

- Title: Us Expat Stock Trader Accounts: A Comprehensive Guide

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol veri.

- Can Marijuana Companies Move from Canadian Stock Exchange to US?

- Stock Market Lunch Break: Understanding the Dynamics of US Markets

- Stocks Yesterday Closing Chart: A Comprehensive Analysis

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol msft.

- Top Gaining US Stocks This Week: Momentum Analysis

recommend

US Gov Stock Market Graph: A Comprehensive Ana

US Gov Stock Market Graph: A Comprehensive Ana

Undervalued US Stocks 2023: Uncovering Hidden

Investing in Canadian Stocks from the US: Navi

Embossed Gold US Eagle Business Card Stock: Th

Pharmaceutical Stocks in US: A Guide to Invest

Understanding the US Penny Stock Exchange: A C

Title: US Dollar to Yen Stock Symbol: Understa

Current CAPE Ratio in the US Stock Market: A C

Tencent Stock Price in US Dollars: A Comprehen

US Stock Exchange Open Hours: A Comprehensive

SNES Classic Stock Checker: Toys "R&a

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Lithium Ion Stocks in the US: A Comprehensive "

- military stocks"

- Understanding the US Smokeless Tobacco Stock S"

- US 10Y Stock: A Comprehensive Guide to Underst"

- Trade US Stocks in Canada: A Comprehensive Gui"

- Lin Stock US: The Ultimate Guide to Understand"

- silver stocks"

- US Oil Stocks: A Comprehensive Guide to API an"

- stock chart patterns"

- Title: US Overseas Stock Fund: A Strategic Inv"