you position:Home > aphria us stock > aphria us stock

Title: Is the US Stock Market Currently Overvalued?

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Introduction: The US stock market has been a beacon of economic stability and growth for decades. However, with the recent surge in stock prices, many investors and financial experts are left questioning whether the market is currently overvalued. In this article, we delve into the factors that contribute to market valuations and explore the potential implications of an overvalued stock market.

Understanding Market Valuation:

Market valuation is a critical metric used to determine whether a stock or the overall market is overpriced or undervalued. It involves comparing the current market price of a stock or the market as a whole to its intrinsic value. The intrinsic value is often estimated by analyzing financial metrics such as earnings, dividends, and growth prospects.

Current Market Conditions:

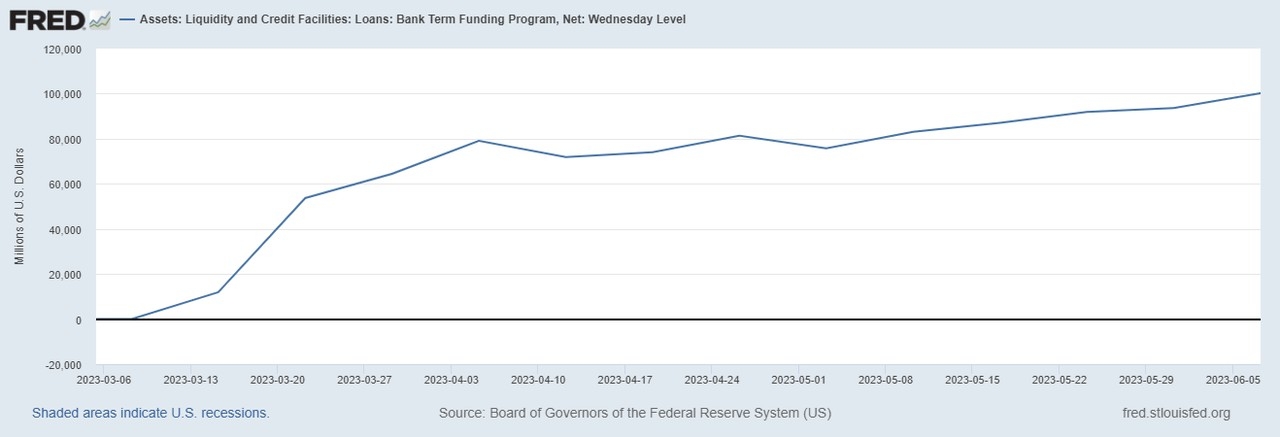

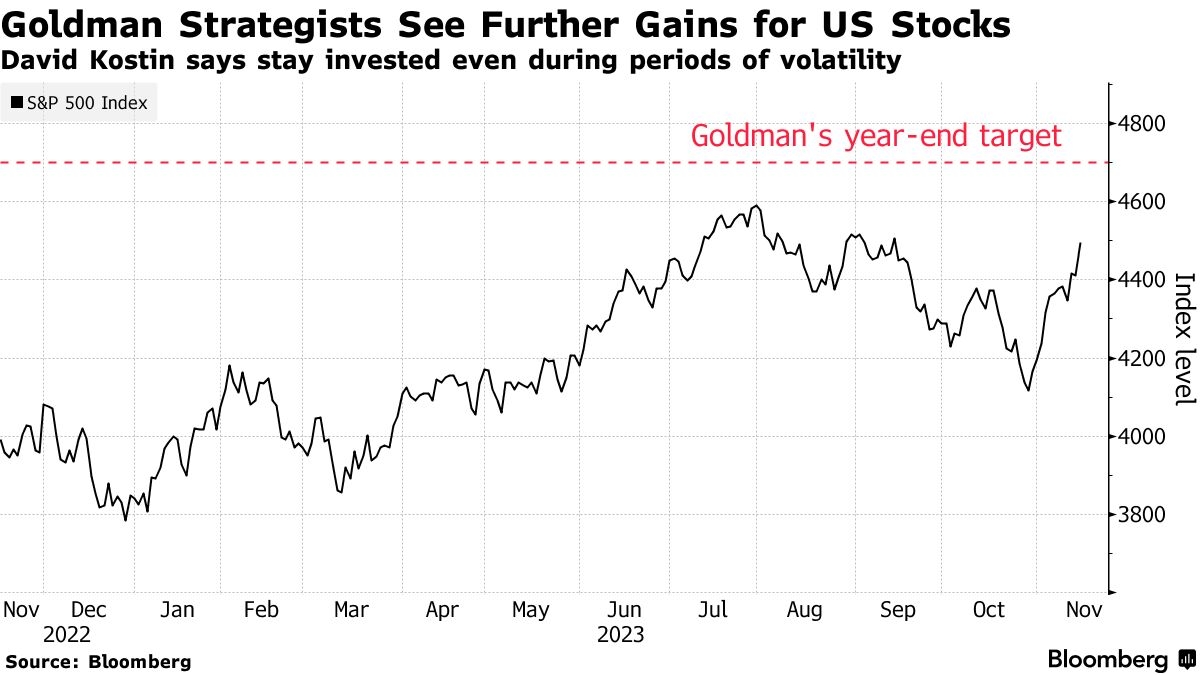

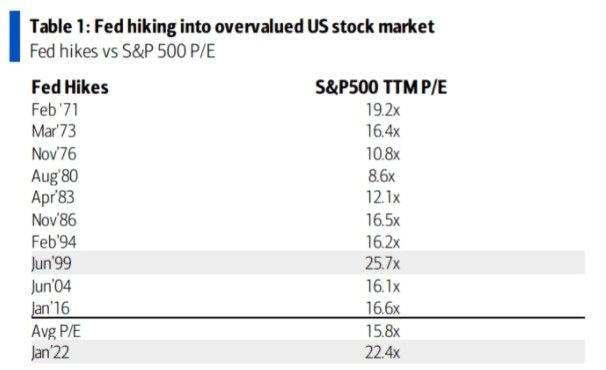

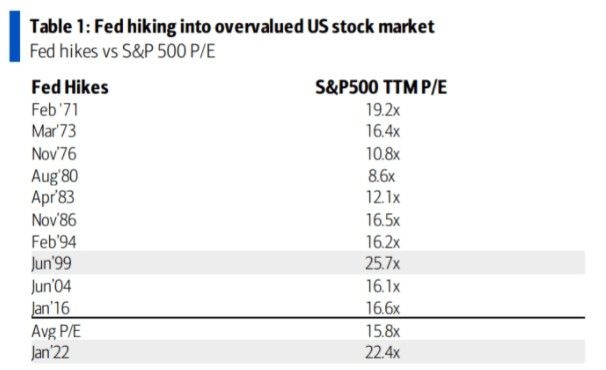

Several factors indicate that the US stock market might be overvalued at present. One of the primary factors is the low-interest-rate environment. Historically, low-interest rates have been associated with higher stock prices, as investors seek higher returns on their investments. However, with the Federal Reserve's recent hikes in interest rates, the market may be facing a reversal of this trend.

Another factor is the record-high valuations of certain sectors, such as technology and healthcare. These sectors have seen significant growth over the past few years, but their current valuations may be unsustainable in the long term.

Sector Analysis:

Technology Sector: The technology sector has been a major driver of the stock market's growth in recent years. However, some analysts argue that the sector's valuations are reaching unsustainable levels. For instance, tech giants like Apple and Amazon have seen their stock prices soar, but their growth rates may not be able to sustain these valuations.

Healthcare Sector: The healthcare sector has also seen significant growth, driven by factors such as an aging population and technological advancements. However, some healthcare companies may be overvalued, particularly those involved in biotechnology and pharmaceuticals.

Historical Context:

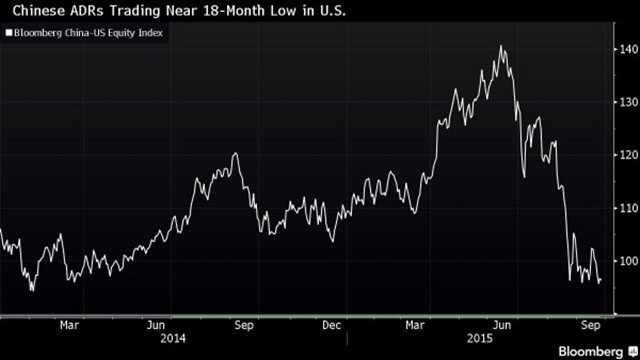

To better understand the current market situation, it's essential to look at historical data. The dot-com bubble of the late 1990s serves as a cautionary tale. During that period, many tech stocks were overvalued, leading to a significant market crash. While today's market is not in a bubble phase, it's important to remain vigilant and cautious.

Case Studies:

Facebook's IPO: In 2012, Facebook's initial public offering (IPO) was one of the most highly anticipated in history. However, the stock's price plummeted shortly after the IPO, illustrating the potential risks of overvalued stocks.

Tesla's Stock Price: Tesla's stock has seen significant volatility, with its price soaring and crashing multiple times. While the company has seen impressive growth, some analysts argue that its stock price is currently overvalued.

Conclusion: The question of whether the US stock market is currently overvalued is complex and multifaceted. While several factors suggest that the market may be overvalued, it's essential to conduct thorough research and consider historical data before drawing any conclusions. As always, investors should exercise caution and consult with a financial advisor before making any investment decisions.

so cool! ()

last:Best US Telecom Stocks: Top Investments for 2023

next:nothing

like

- Best US Telecom Stocks: Top Investments for 2023

- Today's Top Momentum Stocks: A Dive into the US Markets

- US Shorted Stocks: Understanding the Risks and Opportunities

- Confidence Flight Indicators: How to Navigate the Stock Market with Precision in

- Title: 2020 Philine Isabelle Barolo Preda In Stock US

- Title: The Biggest Market Cap Stocks in the US: A Comprehensive Guide

- T110 Stock Recovery: A Comprehensive Guide for US Investors

- Oil Refinery Stocks: A Lucrative Investment Opportunity in the US Energy Sector

- Stock Image Electrical Symbols: A Comprehensive Guide for US Engineers and Design

- How to Trade on the London Stock Exchange from the US

- Title: US Stock Market Averages Today

- Title: Direction of the U.S. Stock Market: What Investors Need to Know

recommend

Title: Is the US Stock Market Currently Overva

Title: Is the US Stock Market Currently Overva

Fidelity US Focus Stock: A Strategic Investmen

US Stell Stock Price: A Comprehensive Analysis

All Us Stocks List with History: A Comprehensi

US Stock Broker for Non-Resident: Unlocking In

Stock of Government Debt Held by US Investors:

US Stock Listed Companies: A Comprehensive Gui

US Stock Buybacks Total Volume: The Impact on

Title: Total Assets in US Stock Market: An In-

Top 10 in US Stocks Market Review

The Effect of U.S. Elections on the Stock Mark

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Should I Buy US Oil Fund Stock?"

- How Are US Stocks Doing? A Comprehensive Analy"

- How to Buy US Stock from India: A Comprehensiv"

- Title: Schedule of 2018 Reports That Affect Us"

- Telegram Channel for US Stock Market: Your Ult"

- US Nickel Stock Price: A Comprehensive Guide t"

- Stock Market Lunch Break: Understanding the Dy"

- CSL Behring Stock US: A Comprehensive Analysis"

- Title: 2020 Philine Isabelle Barolo Preda In S"

- disney stock forecast"