you position:Home > aphria us stock > aphria us stock

How Are US Stocks Doing? A Comprehensive Analysis

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the ever-evolving world of finance, keeping a pulse on the performance of US stocks is crucial for investors and traders. The stock market is a reflection of the economic health of a country, and the US stock market, in particular, is one of the most influential in the world. In this article, we will delve into the current state of US stocks, examining key trends, market indicators, and potential opportunities.

Market Performance

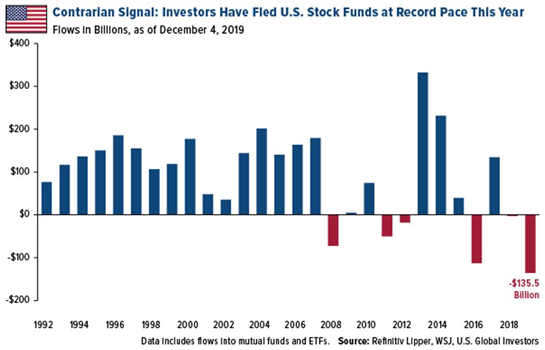

As of the latest data, the US stock market has been experiencing a mixed bag of performance. The S&P 500, a widely followed index that tracks the performance of 500 large companies, has seen a significant increase in recent years. This growth can be attributed to a number of factors, including strong corporate earnings, low interest rates, and a robust economic recovery post-pandemic.

However, it's important to note that the market is not without its challenges. Volatility has been a persistent issue, with significant ups and downs in stock prices. This volatility can be attributed to a variety of factors, including geopolitical tensions, inflation concerns, and shifting investor sentiment.

Sector Performance

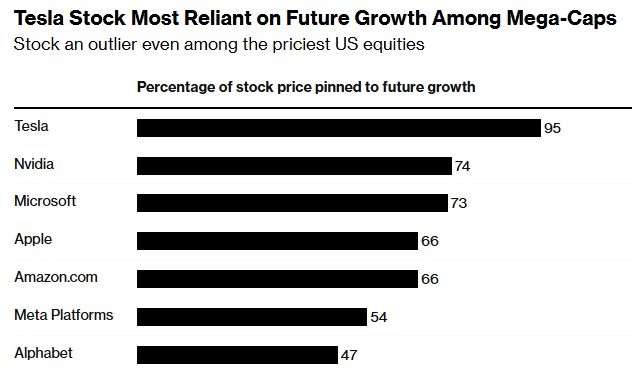

When looking at the performance of different sectors within the US stock market, some have stood out more than others. Technology, for example, has been a major driver of growth, with companies like Apple, Microsoft, and Amazon leading the way. The technology sector has seen significant innovation and expansion, which has contributed to its strong performance.

On the other hand, sectors like energy and financials have struggled in recent years. The energy sector has been impacted by falling oil prices and a shift towards renewable energy sources, while the financial sector has faced regulatory challenges and increased competition.

Market Indicators

Several key market indicators provide insights into the overall health of the US stock market. One of the most important indicators is the unemployment rate, which has been steadily declining in recent years. A lower unemployment rate suggests a stronger economy and, by extension, better performance for stocks.

Another crucial indicator is the Consumer Price Index (CPI), which measures inflation. While low inflation is generally seen as a positive sign, high inflation can be detrimental to stock prices. As of now, inflation remains relatively low, which is a positive sign for the market.

Case Studies

To better understand the performance of US stocks, let's look at a couple of case studies. Amazon, a leader in the technology sector, has seen its stock price soar in recent years, driven by its strong financial performance and innovative business model. On the other hand, BP, an energy company, has seen its stock price decline due to falling oil prices and increased competition in the renewable energy sector.

Conclusion

In conclusion, the US stock market has been performing well, with the S&P 500 leading the way. However, it's important to be aware of the challenges and potential risks that come with investing in the stock market. By staying informed and monitoring key indicators, investors can make more informed decisions and potentially capitalize on opportunities in the US stock market.

so cool! ()

last:US Stock Market Bubble Debate 2025: A Closer Look at Today’s Economy

next:nothing

like

- US Stock Market Bubble Debate 2025: A Closer Look at Today’s Economy

- How to Trade HK Stocks in the US: A Comprehensive Guide

- US Stock Exchange Symbols Ending with X: A Comprehensive Guide

- Best US Penny Stocks for 2021: Your Guide to High-Potential Investments

- Predictions for the Stock Market with Trump as the New President

- Pharmaceutical Stocks in US: A Guide to Investment Opportunities

- US Stock APA Yahoo: A Comprehensive Guide to Understanding Stock Market Data

- Top US Pot Stocks 2021: A Comprehensive Guide

- Site Co.frio.tx.us Live Stock: Your Ultimate Resource for Texas Stock Market Upda

- Title: US GDP vs Stock Market Chart: A Comprehensive Analysis

- Understanding the US Robotics Stock Symbol: A Comprehensive Guide

- Average Annual Stock Market Return in the US: A Comprehensive Analysis

recommend

How Are US Stocks Doing? A Comprehensive Analy

How Are US Stocks Doing? A Comprehensive Analy

Undervalued US Stocks 2023: Uncovering Hidden

Lowes Stock US: A Comprehensive Analysis

US Stock Market 2007-2017: A Decade of Fluctua

US Stock Exchange Symbols Ending with X: A Com

Title: US Olive Oil Stocks: A Deep Dive into t

Understanding the Fair Value of US Stock Futur

Top US Steel Companies Stocks: A Comprehensive

Haleon US Stock Price: What You Need to Know

Title: US Based Pot Stock: A Growing Industry

Title: Path Us Stock: A Comprehensive Guide to

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Dash Stock US: A Comprehensive Guide to Invest"

- options trading for beginners"

- high yield stocks"

- fibonacci retracement"

- best growth stocks"

- Best Dividend US Stock: How to Identify the Be"

- penny stocks to buy"

- Average Annual Stock Market Return in the US: "

- Hot Momentum Stocks US: The Top Picks for 2023"

- Top 10 US Stocks to Watch in 2023"