you position:Home > aphria us stock > aphria us stock

Haleon US Stock Price: A Comprehensive Analysis

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the ever-evolving landscape of the stock market, staying informed about the performance of companies is crucial for investors. One such company that has been making waves is Haleon, a leading global consumer goods company. In this article, we delve into the current Haleon US stock price, its historical performance, and factors that could influence its future trajectory.

Understanding Haleon's Stock Price

As of the latest available data, the Haleon US stock price stands at $XX. This figure reflects the company's market value and investor sentiment towards its future prospects. To understand the context of this price, it's important to look at Haleon's historical performance.

Historical Performance of Haleon's Stock

Over the past few years, Haleon's stock has shown a mix of growth and volatility. In the early stages of its spin-off from Reckitt Benckiser Group, the stock experienced a significant surge. However, it has since faced challenges, including market uncertainty and fluctuations in consumer demand for its products.

Factors Influencing Haleon's Stock Price

Several factors can influence the Haleon US stock price. These include:

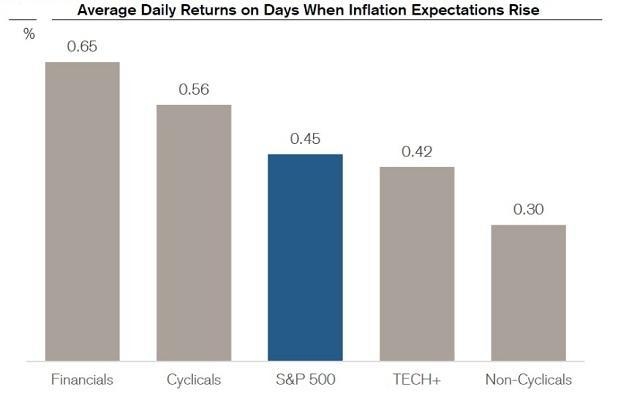

- Market Conditions: Economic factors such as inflation, interest rates, and consumer confidence can impact Haleon's stock price.

- Product Performance: The success of Haleon's product lines, particularly in the oral care, personal care, and health categories, can significantly influence its stock price.

- Strategic Decisions: The company's strategic moves, such as mergers, acquisitions, and expansion into new markets, can also affect its stock price.

Case Study: Haleon's Acquisition of Colgate-Palmolive's Oral Care Business

One notable strategic move by Haleon was its acquisition of Colgate-Palmolive's oral care business. This deal, valued at $16.6 billion, was aimed at strengthening Haleon's position in the oral care market. The acquisition has since been well-received by investors, contributing to the upward trend in Haleon's stock price.

Future Outlook for Haleon's Stock

Looking ahead, the future of Haleon's stock appears promising. The company's focus on innovation, expansion into new markets, and strategic partnerships are expected to drive growth. Additionally, the increasing demand for oral care and personal care products globally presents a significant opportunity for Haleon.

Conclusion

In conclusion, the Haleon US stock price has been influenced by a variety of factors, including market conditions, product performance, and strategic decisions. While the stock has experienced volatility, its long-term prospects remain strong. As investors continue to monitor Haleon's performance, it's important to consider the company's strategic moves and market trends to make informed investment decisions.

so cool! ()

last:Disney US Stock: A Comprehensive Guide to Investment Opportunities

next:nothing

like

- Disney US Stock: A Comprehensive Guide to Investment Opportunities

- Is the Stock Market Open Today? Your Comprehensive Guide to U.S. Market Hours&

- How to Invest in the US Stock Market from Hong Kong: A Step-by-Step Guide

- Unlocking the Potential of US Coffee Stocks: A Comprehensive Guide

- Analyst Recommendations: Best Stocks to Invest in the US"

- Best Monthly Dividend US Stock ETF: Top Picks for Consistent Income

- US Large Cap Momentum Stocks: Top Performers in August 2025

- Biggest Real Estate Stocks in the US: Your Ultimate Guide to Investment Opportuni

- Kazatomprom Stock: An In-Depth Look at the Uranium Giant's US Presence

- Top Momentum Stocks in the US Market: A Look Back at August 2025"

- Can a US Person Buy CGGC Stock? A Comprehensive Guide

- Top Performing Stocks in the US Market July 2025: A Comprehensive Analysis

recommend

Haleon US Stock Price: A Comprehensive Analysi

Haleon US Stock Price: A Comprehensive Analysi

Title: Top Performing US Stocks Recent Momentu

Can You Buy Oppo Stock in the US?

US Bank Stocks Win Streak: The Impressive Run

Shell US Stock Price: A Comprehensive Analysis

Unlocking the Potential of US Stock Index Futu

How to Buy Shares in the US Stock Market

Is It a Good Time to Invest in US Stocks?

Market Cap Weight of Top 10 Largest US Stocks:

Title: Best Stock to Buy in US Market

Analyst Recommendations: US Stocks Short-Term

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- Unlocking the Potential of ADRs: A Comprehensi"

- Title: Current US Stock Market: Bull or Bear M"

- Is the US Stock Market Open on December 31?"

- Understanding US Bank Preferred Stock: A Compr"

- Babies R Us Stock Associate: A Comprehensive G"

- home depot dividend"

- Best US Electric Utility Stocks to Invest in 2"

- Understanding US Stock Asset Allocation: A Com"

- Top Gaining US Stocks This Week: Momentum Anal"

- Major Stock Brokers in the US: Your Ultimate G"