you position:Home > aphria us stock > aphria us stock

Understanding US Bank Preferred Stock: A Comprehensive Guide"

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info: Preferred(11)Bank(58)S(88)

In today's financial landscape, preferred stocks have become a popular investment choice for many investors. Among these, US Bank preferred stock stands out as a lucrative option. This article delves into the details of US Bank preferred stock, providing a comprehensive guide to help you understand its features, benefits, and risks.

What is US Bank Preferred Stock?

US Bank preferred stock is a type of investment security issued by the U.S. Bank, one of the largest financial institutions in the United States. It represents a claim on the bank's assets and earnings, giving shareholders a higher priority in receiving dividends and liquidation proceeds compared to common stockholders.

Key Features of US Bank Preferred Stock

Dividends: US Bank preferred stockholders are entitled to receive fixed dividends before common stockholders. These dividends are typically higher than those of common stocks, making preferred stocks an attractive option for income-seeking investors.

Liquidity: US Bank preferred stock is traded on major exchanges, providing liquidity to investors. This means you can buy or sell your preferred stock without much difficulty.

Priority: As mentioned earlier, preferred stockholders have a higher priority in receiving dividends and liquidation proceeds compared to common stockholders. This makes preferred stocks a safer investment option during economic downturns.

Callable: Some US Bank preferred stocks are callable, which means the bank can redeem the shares at a predetermined price before their maturity date. This feature can affect the stock's price and dividend yield.

Benefits of Investing in US Bank Preferred Stock

Income Generation: The fixed dividends provided by US Bank preferred stock can generate a steady stream of income for investors.

Dividend Safety: The priority in receiving dividends makes US Bank preferred stock a safer investment option compared to common stocks, especially during economic uncertainties.

Liquidity: The ability to trade US Bank preferred stock on major exchanges ensures liquidity, allowing investors to enter or exit their positions with ease.

Risks Associated with US Bank Preferred Stock

Market Risk: The value of preferred stocks can fluctuate based on market conditions, potentially leading to capital losses.

Callable Risk: Callable preferred stocks may face the risk of being redeemed by the issuing company, which can affect the investor's dividend income.

Interest Rate Risk: As interest rates rise, the value of fixed-income investments, including preferred stocks, may decline.

Case Study: Investing in US Bank Preferred Stock

Consider an investor who purchases US Bank preferred stock at

During this period, the investor may also benefit from capital gains if the stock's price increases. However, they should also be aware of the risks associated with investing in preferred stocks, such as market risk and callable risk.

In conclusion, US Bank preferred stock is a valuable investment option for income-seeking investors. By understanding its features, benefits, and risks, you can make informed decisions when considering an investment in US Bank preferred stock.

so cool! ()

like

- Toys R Us Seasonal Stock Crew Salary: Understanding the Pay for Temporary Workers

- Title: All Us Stock ETF: A Comprehensive Guide to Understanding and Investing

- Understanding Tax Implications for US Investors in Canadian Dividend Stocks&q

- Understanding the Dynamics of Listed Stocks in the US Stock Market

- Understanding the Daily Dollar Value of Traded Stock Volume in the US

- Royal Bank of Canada (RY) US Stock Price: What You Need to Know

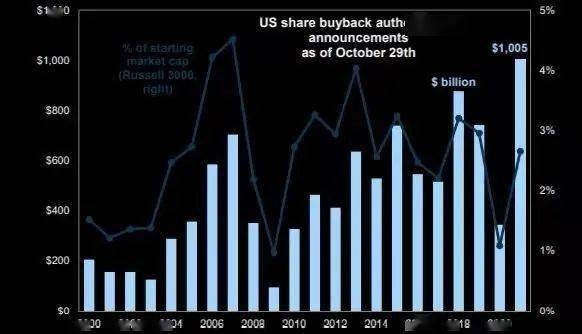

- Understanding the US Stock Buyback Blackout Period: What You Need to Know&quo

- Understanding ETF Stocks: A Comprehensive Guide to US Investment Opportunities

- Understanding the US Oil Sands Inc Stock Price: What You Need to Know

- Swiss Banks Sell US Stocks: A Lucrative Investment Opportunity

- Understanding the P/E Ratio: A Key Indicator in the US Stock Market

- US Bank Preferred Stock Series P Prospectus: A Comprehensive Guide

recommend

Barron's US Marijuana Stocks: A Comprehen

Barron's US Marijuana Stocks: A Comprehen

Russia and US Stock Market: A Comprehensive An

US Silica Stock Forecast: A Comprehensive Anal

Does the U.S. Stock Market Open Today? Underst

Understanding the PTC US Stock Price: A Compre

Unlocking the Potential of the Monat US Stock

Title: Nestle US Stock Symbol: A Comprehensive

Real Estate vs. Stocks in the US: Which Invest

Sono Stock Price: A Comprehensive Guide to Son

Title: US Overseas Stock Fund: A Strategic Inv

Best Dividend US Stock: How to Identify the Be

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- disney dividend"

- US Rail Stock: The Vital Role of Railroad Shar"

- Mexican Stocks Trading in the US: A Comprehens"

- Maximizing Returns: Top Oil Companies in the U"

- US Large Cap Stocks: Market Cap Over $10 Billi"

- Best US Robotics Stocks: Top Picks for 2023"

- Average Return of the US Stock Market from 200"

- The NASDAQ Stock Market: A Hub of Innovation a"

- Tomorrow: US Stock Market Drop – What You Ne"

- Barron's US Marijuana Stocks: A Comprehen"