you position:Home > us stock market today live cha > us stock market today live cha

US Stock Market Bull Run Outlook: A Comprehensive Analysis

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

The US stock market has been a cornerstone of global financial markets, and its performance is often a bellwether for economic trends worldwide. The term "bull run" refers to a sustained period of significant price increases in the stock market. In this article, we delve into the outlook for a potential bull run in the US stock market, examining various factors that could influence its trajectory.

Historical Performance and Trends

Firstly, it is essential to consider the historical performance of the US stock market. Over the past several decades, the S&P 500 index, a widely followed benchmark for the US stock market, has experienced numerous bull runs. For instance, the tech bubble of the late 1990s and the post-financial crisis rally of 2009-2019 are two notable examples.

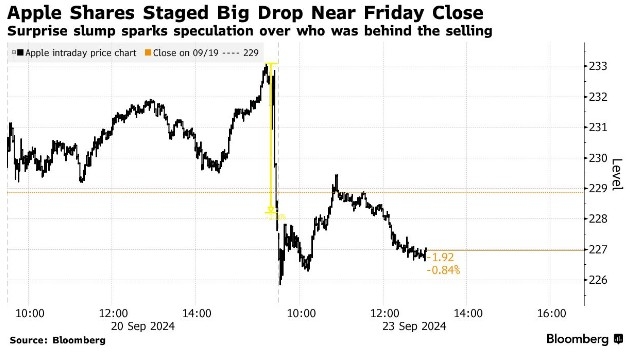

One significant trend that has shaped the US stock market is the shift towards technology and innovation. Companies like Apple, Microsoft, and Amazon have driven market performance, with their stock prices soaring over the years. This trend is expected to continue, with tech stocks playing a pivotal role in the potential bull run.

Economic Factors Influencing Bull Runs

Economic factors play a crucial role in the US stock market's bull run outlook. The Federal Reserve's monetary policy, economic growth, and corporate earnings are among the key drivers.

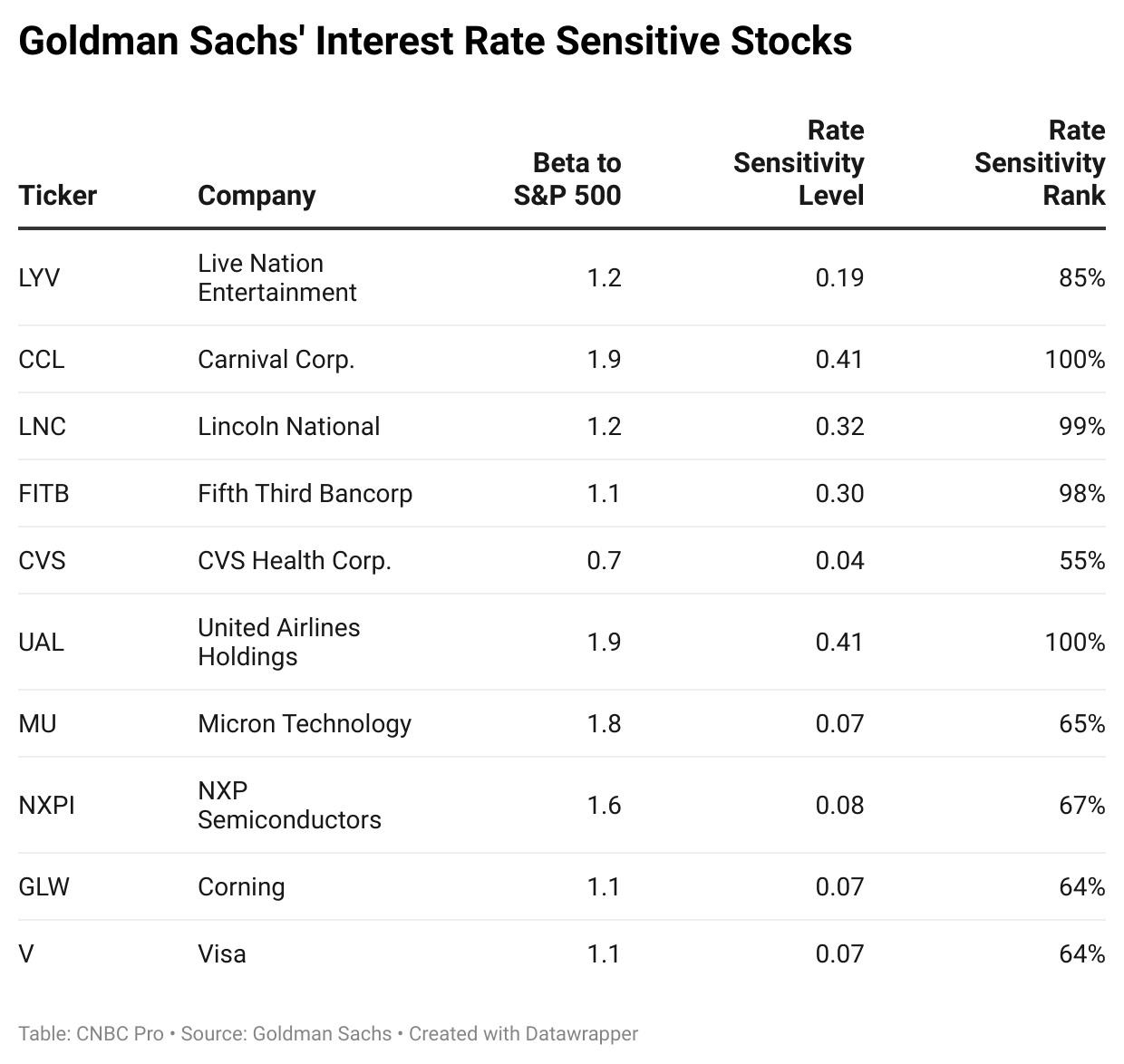

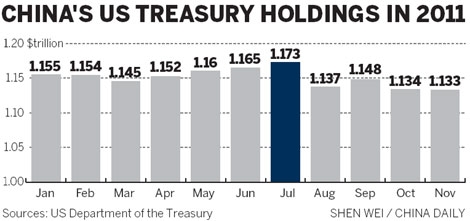

Federal Reserve Monetary Policy: The Federal Reserve's monetary policy has a significant impact on the stock market. Low-interest rates and accommodative policies can fuel market growth, as they encourage borrowing and investment. However, excessive stimulus can lead to inflation and asset bubbles. As of now, the Federal Reserve is expected to continue its gradual tightening process, which could influence the stock market's outlook.

Economic Growth: Strong economic growth, characterized by low unemployment and rising wages, can drive corporate earnings and, in turn, stock prices. The US economy has shown signs of resilience in recent years, with GDP growth hovering around 2-3%. This trend is likely to continue, providing a favorable backdrop for a bull run.

Corporate Earnings: Corporate earnings are a crucial driver of stock market performance. Companies with strong earnings growth can generate significant returns for investors. The past few years have seen an increase in earnings due to factors like tax cuts and cost-saving measures. This trend is expected to continue, supporting a bull run.

Market Valuations and Sentiment

Market valuations and investor sentiment also play a critical role in the bull run outlook. Overvalued markets are more susceptible to corrections, while optimistic sentiment can fuel further gains.

As of now, the US stock market is not considered overlyvalued, with many sectors trading at reasonable valuations. Additionally, investor sentiment remains relatively positive, driven by strong economic growth and corporate earnings.

Case Studies: Past Bull Runs

To provide a clearer picture of what a potential bull run might look like, let's examine two past bull runs:

The Dotcom Bubble (1997-2000): This bull run was driven by the explosive growth of the internet and technology sector. The NASDAQ index, which primarily tracks tech stocks, saw its value soar before crashing in 2000. This period illustrates the potential for rapid growth in a bull run, as well as the risks associated with overvalued markets.

Post-Financial Crisis Rally (2009-2019): After the 2008 financial crisis, the US stock market embarked on a bull run that lasted more than a decade. This rally was fueled by aggressive monetary policy, economic recovery, and corporate earnings growth. This case study shows the resilience of the US stock market and the potential for significant gains during a bull run.

Conclusion

In conclusion, several factors suggest a potential bull run in the US stock market. Economic growth, strong corporate earnings, and reasonable valuations provide a favorable backdrop for further market gains. However, as with any investment, there are risks to consider, including market corrections and economic downturns. Investors should monitor these factors and consider their risk tolerance when making investment decisions.

so cool! ()

last:Recent Analyst Rating Changes: A Game-Changer for US Stocks

next:nothing

like

- Recent Analyst Rating Changes: A Game-Changer for US Stocks

- Holding Dividend Stocks in a TFSA: A Strategic Move for Long-Term Wealth Accumula

- Is Toys "R" Us Stock Dead? A Comprehensive Look at the Retail G

- US Dividend Paying Stocks in TFSA: A Strategic Investment Approach

- Title: Trading US Stocks in the UAE: A Comprehensive Guide

- US-Based High Dividend Stocks: A Guide to Secure Investment Opportunities

- US Stock Market After Election: What Investors Should Know

- Aging Housing Stock: A Comprehensive Look at US Statistics 2023-2025

- Investing in US Stocks: A Comprehensive Guide

- Natural Gas US Stock: A Comprehensive Guide to Investing in the Energy Sector

- Title: Total Value of the US Stock Market in 2016: A Comprehensive Overview

- US Stock Market Analysis: August 12, 2025

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- US Stock Futures Rise Amid Government Shutdown"

- June 8, 2025: US Stock Market Summary"

- US Passport and Shell Stock Photo High Resolut"

- PS5 Stock Update: What You Need to Know in the"

- US Refineries Stocks: A Comprehensive Guide to"

- Title: Understanding the Real Return on Your I"

recommend

US Stock Market Bull Run Outlook: A Comprehens

US Stock Market Bull Run Outlook: A Comprehens

Is the US Stock Market Open on December 31? A

How Much Min Left to Us Market Start Stock: Th

S8+ Stock Firmware US Cellular ODIN: The Ultim

List of US Stock Market: Your Comprehensive Gu

Title: Charles Schwab US Stocks: Your Ultimate

Hotel Stocks in the US: A Comprehensive Guide

US Foods Stock Yards Meat Aurora IL 60502: A H

Title: 2025 US Stock Market Crash Possibility:

US Silica Stocks: A Comprehensive Guide to Inv

Show Us Your Stockings: A Stylish Guide to the

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Semiconductor Stocks Outlook 2025: A Promis"

- Title: US Stock Market Bubble 2017: What Cause"

- Title: US Oil Stock Data: A Comprehensive Guid"

- US Defense Stocks Performance Today: A Compreh"

- Best Benchmark for the Entire US Stock Market"

- Iron Ore Stocks US: A Comprehensive Guide to I"

- Title: ETF US Stocks: Your Ultimate Guide to I"

- US Foods Stock Predictions: What the Future Ho"

- How to Invest in US Stocks from Singapore: A C"

- http stocks.us.reuters.com stocks fulldescript"