you position:Home > us stock market today live cha > us stock market today live cha

Investing in US Stocks: A Comprehensive Guide

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Are you considering investing in US stocks but feeling overwhelmed by the vast array of options and strategies? Look no further! This comprehensive guide will provide you with essential information to help you navigate the world of US stock investing.

Understanding the Basics of US Stocks

Firstly, it's crucial to understand what US stocks are. A stock represents a share of ownership in a company. When you purchase a stock, you become a partial owner of that company, entitled to a portion of its profits and assets. The value of a stock can fluctuate based on various factors, including the company's performance, market conditions, and economic indicators.

Types of US Stocks

There are several types of US stocks to consider:

- Common Stocks: These are the most common type of stock, offering voting rights and the potential for dividends.

- Preferred Stocks: These stocks do not offer voting rights but typically provide higher dividends and a fixed dividend payment.

- Blue-Chip Stocks: These are shares of well-established, financially stable companies with a history of reliable performance.

- Growth Stocks: These stocks belong to companies with high growth potential, often at the expense of current dividends.

Key Factors to Consider When Investing in US Stocks

Before diving into the stock market, consider the following factors:

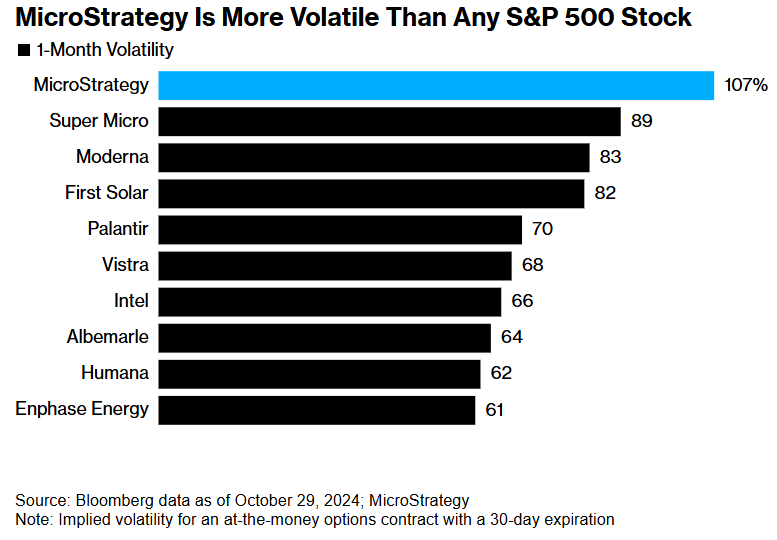

- Risk Tolerance: Assess how much risk you're willing to take. Generally, higher-risk investments offer higher potential returns but also greater potential losses.

- Investment Goals: Define your investment goals, whether it's long-term growth, income generation, or capital preservation.

- Market Conditions: Stay informed about market trends and economic indicators that can impact stock prices.

- Diversification: Diversify your portfolio to reduce risk by investing in a variety of stocks across different sectors and industries.

Strategies for Investing in US Stocks

Here are some popular strategies for investing in US stocks:

- Buy and Hold: This strategy involves purchasing stocks and holding them for the long term, regardless of short-term market fluctuations.

- Value Investing: This approach focuses on identifying undervalued stocks and holding them until their intrinsic value is recognized by the market.

- Growth Investing: This strategy involves investing in companies with high growth potential, often at a premium price.

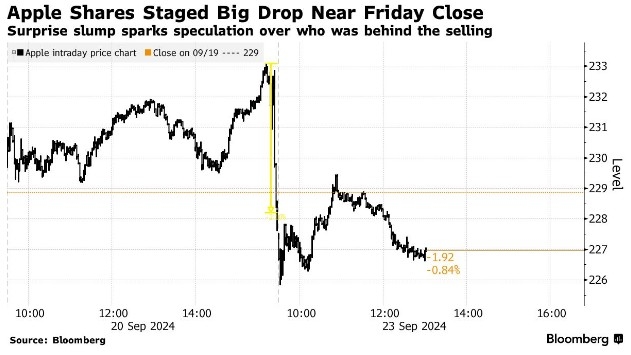

Case Study: Apple Inc.

A prime example of a successful US stock investment is Apple Inc. (AAPL). Since its initial public offering (IPO) in 1980, Apple has grown to become one of the world's most valuable companies. By investing in Apple's common stock, investors have seen significant returns over the years, driven by the company's consistent innovation and market dominance.

Conclusion

Investing in US stocks can be a rewarding endeavor, but it requires careful planning and research. By understanding the basics, considering key factors, and adopting a well-defined strategy, you can increase your chances of success in the stock market. Remember to stay informed, diversify your portfolio, and be patient as you navigate the world of US stock investing.

so cool! ()

like

- Natural Gas US Stock: A Comprehensive Guide to Investing in the Energy Sector

- Title: Total Value of the US Stock Market in 2016: A Comprehensive Overview

- US Stock Market Analysis: August 12, 2025

- Tilray US Stock Price: Everything You Need to Know

- Title: UK Stocks Listed in the US: A Comprehensive Guide

- JD US Stock: Understanding the Investment Potential

- How to Buy Samsung Stock in the US

- T-Mobile US to Give Stock to Customers: A Game-Changing Move

- US Healthcare Stock Market Trends in April 2025

- Largest Stock Market Drops in US History: A Deep Dive

- TD US Stock Account: Your Gateway to Diversified Investment Opportunities

- The Un可持续 Levels of US Stocks Debt: A Closer Look

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- US Stock Futures Rise Amid Government Shutdown"

- June 8, 2025: US Stock Market Summary"

- US Passport and Shell Stock Photo High Resolut"

- PS5 Stock Update: What You Need to Know in the"

- US Refineries Stocks: A Comprehensive Guide to"

- Title: Understanding the Real Return on Your I"

recommend

Investing in US Stocks: A Comprehensive Guide

Investing in US Stocks: A Comprehensive Guide

Accenture Stock Price US: A Comprehensive Anal

Title: Stock Market Value Over GDP: A Comprehe

US Stock Brokers in Hong Kong: Your Gateway to

Best Performing Large Cap US Stocks This Week:

Daiichi Sankyo Stock Price in US Dollars: A Co

Top Utility Stocks in the US: A Guide to Inves

Is Samsung Stock on the US Stock Market?

Title: Complete Us Stock Symbols List of Nasda

Toys "R" Us Stock: A Journey

US Companies Stock Prices: Understanding the D

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Stock Content Download Buy Us – Shares: The "

- Title: US Smokeless Tobacco Stock Price: What "

- Title: US Crude Stock Symbol: The Key to Oil M"

- Why Did the US Stock Market Crash in 1929?"

- Undervalued US Stock: Discover Hidden Gems in "

- Us Steel Up Stock Market: A Look at the Impact"

- The Un可持续 Levels of US Stocks Debt: A Cl"

- Aggressive Growth Stocks: The Ultimate Guide t"

- Top Performing US Large Cap Stocks Past Week: "

- US Stock Close: The Key to Understanding the D"