you position:Home > us stock market today live cha > us stock market today live cha

US Stock Market Analysis: October 6, 2025

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

The stock market is a dynamic and unpredictable entity, constantly shifting with economic indicators, geopolitical events, and corporate earnings reports. As we delve into the analysis of the US stock market on October 6, 2025, we aim to provide a comprehensive overview of the current market trends, key factors influencing the market, and potential investment opportunities.

Market Overview

As of October 6, 2025, the US stock market is experiencing a period of volatility. The S&P 500 index is trading at 4,200, with a slight upward trend over the past month. The NASDAQ composite, on the other hand, is hovering around 14,000, reflecting a more cautious investor sentiment. The Dow Jones Industrial Average is currently at 34,000, with a moderate growth rate.

Key Factors Influencing the Market

Economic Indicators: The US economy is showing signs of recovery, with a steady increase in GDP and employment rates. However, inflation remains a concern, with the Consumer Price Index (CPI) at 3.5%. The Federal Reserve's monetary policy decisions will play a crucial role in shaping the market's direction.

Geopolitical Events: The ongoing tensions between the US and China have raised concerns about global trade and supply chains. Additionally, the situation in the Middle East has added to market uncertainty. Investors are closely monitoring these developments to assess their impact on the US stock market.

Corporate Earnings: The earnings season for the third quarter of 2025 is underway, with several major companies reporting strong results. However, some sectors, such as technology and consumer discretionary, are facing challenges due to increased competition and rising costs.

Sector Analysis

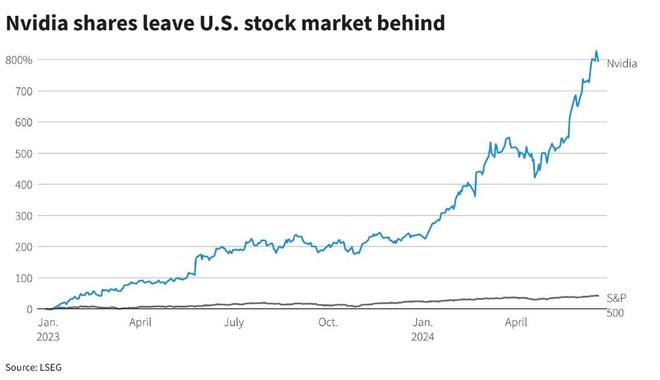

Technology: The technology sector remains a key driver of the US stock market. Companies like Apple, Microsoft, and Amazon are reporting robust earnings, driven by strong demand for their products and services. However, the sector is also facing increased regulatory scrutiny and competition from emerging markets.

Energy: The energy sector has seen a significant uptick in the past few months, driven by rising oil prices and increased demand for energy resources. Companies like ExxonMobil and Chevron are reporting strong earnings, but investors are cautious about the sustainability of this trend.

Healthcare: The healthcare sector is experiencing steady growth, driven by advancements in medical technology and an aging population. Companies like Johnson & Johnson and Pfizer are reporting solid earnings, with potential for further growth in the coming years.

Investment Opportunities

Dividend Stocks: Investors looking for stable income can consider investing in dividend-paying stocks. Companies like Procter & Gamble and Coca-Cola offer consistent dividends and have a strong track record of performance.

Value Stocks: The current market environment presents an opportunity to invest in value stocks. Companies like General Electric and AT&T are trading at attractive valuations and have the potential for significant upside.

Small-Cap Stocks: Small-cap stocks have the potential for high growth but come with higher risk. Investors looking for high-risk, high-reward opportunities can consider investing in small-cap companies in sectors like technology and healthcare.

In conclusion, the US stock market on October 6, 2025, is experiencing a period of volatility, influenced by economic indicators, geopolitical events, and corporate earnings. Investors should stay informed and consider their risk tolerance when making investment decisions. As always, it is advisable to consult with a financial advisor before making any significant investment decisions.

so cool! ()

last:US Stock Exchange Holidays 2025: A Comprehensive Guide

next:nothing

like

- US Stock Exchange Holidays 2025: A Comprehensive Guide

- "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&sy

- Title: Long Term US Stock Market Chart: A Comprehensive Analysis

- Title: Stocks Impacted by US and China Trade

- US Stock Gainers & Losers: Analyzing Market Movements

- US Antimony Corp Stock: A Comprehensive Analysis

- Ice Us Stock: Unveiling the Iceberg of Opportunities in the US Stock Market

- US Stock by Market Cap: A Comprehensive Guide

- US Stock Market Black and White: A Comprehensive Guide

- Sonoma Pharmaceuticals US Stock: A Comprehensive Analysis

- Singapore Stocks Listed in the US: A Comprehensive Guide

- AXA US Stock Price: A Comprehensive Analysis

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- US Stock Futures Rise Amid Government Shutdown"

- June 8, 2025: US Stock Market Summary"

- US Passport and Shell Stock Photo High Resolut"

- PS5 Stock Update: What You Need to Know in the"

- US Refineries Stocks: A Comprehensive Guide to"

- Title: Understanding the Real Return on Your I"

recommend

US Stock Market Analysis: October 6, 2025

US Stock Market Analysis: October 6, 2025

US and European Stocks Hit Fresh Highs During

High Dividend Energy Stocks on US Stock Exchan

US Cellular Mesmerize Stock ROM: Unveiling the

Best Performing Large Cap US Stocks This Week:

US Bank Stocks Symbol List: A Comprehensive Gu

US Foods Stock Predictions: What the Future Ho

Title: US-China Trade War Impact on Stock Mark

AphA US Stock Price: A Comprehensive Analysis

How to Play Samsung in the US Stock Market

US HIFU Stock: A Comprehensive Guide to Unders

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Steel Stock MarketWatch: A Comprehensive Gu"

- How to Buy US Stocks from NZ: A Comprehensive "

- Strive Us Energy ETF Stock: A Lucrative Invest"

- iWeb US Stocks: Your Ultimate Guide to Investi"

- Title: US Steel Co Stock Price Today: A Compre"

- US Holiday Stock Market Closed: What You Need "

- Panasonic Canada Stock Price in US Dollars: A "

- US Logistics Stocks: A Comprehensive Guide to "

- How to Buy Cannabis Stocks in the US"

- US Capitol Stock Video: Capturing the Iconic L"