you position:Home > us stock market today live cha > us stock market today live cha

Title: US Stock Marijuana: The Emerging Investment Opportunity

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

Introduction: In recent years, the marijuana industry has experienced a remarkable transformation, with several states in the United States legalizing the use of cannabis for both medical and recreational purposes. This shift has not only opened up new markets but has also created investment opportunities in the form of US stock marijuana companies. This article explores the potential of investing in the marijuana industry through stocks and the factors to consider before making a decision.

Understanding the Marijuana Industry

The marijuana industry refers to the cultivation, processing, and distribution of cannabis products. It encompasses a wide range of products, including dried flowers, edibles, concentrates, and topicals. The industry has been witnessing significant growth, driven by increasing demand, technological advancements, and regulatory changes.

Investing in US Stock Marijuana

Investing in US stock marijuana companies offers investors the opportunity to gain exposure to a rapidly growing industry. However, it is crucial to conduct thorough research and understand the risks involved before investing.

1. Market Potential

The marijuana industry has seen substantial growth in recent years, with projected to continue expanding. According to a report by Grand View Research, the global cannabis market is expected to reach

2. Company Performance

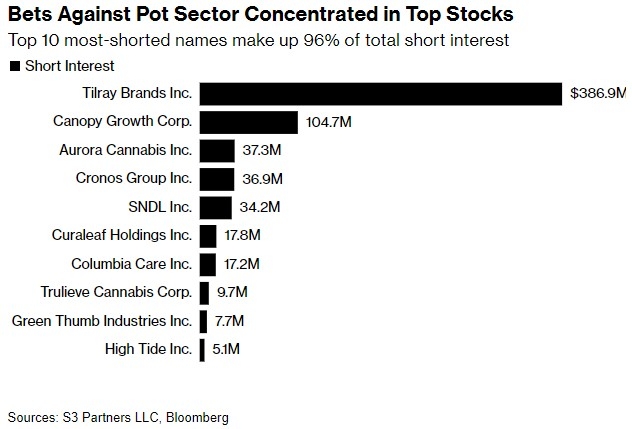

Investing in US stock marijuana companies requires analyzing their financial performance. Look for companies with strong revenue growth, profitability, and a solid business model. Some notable companies in the industry include Canopy Growth Corporation, Aurora Cannabis Inc., and Curaleaf Holdings Inc..

3. Regulatory Environment

The regulatory environment is a critical factor to consider when investing in US stock marijuana companies. While several states have legalized marijuana, the federal government still classifies cannabis as a Schedule I substance. This discrepancy can create challenges for companies operating in the industry, such as difficulties in obtaining banking services and restrictions on interstate commerce.

4. Risks and Challenges

Investing in US stock marijuana companies comes with its own set of risks and challenges. These include market volatility, competition, and regulatory uncertainties. It is essential to understand these risks and assess your risk tolerance before investing.

Case Study: Canopy Growth Corporation

Canopy Growth Corporation is one of the largest cannabis companies in the world, with operations in Canada and the United States. The company has a strong track record of revenue growth and has expanded its presence in the US market through strategic partnerships and acquisitions.

In 2018, Canopy Growth Corporation entered the US market by acquiring Steep Hill Laboratories, a leading cannabis testing and research company. This move allowed the company to gain a competitive edge in the US market and expand its product offerings.

Conclusion:

Investing in US stock marijuana companies offers investors the opportunity to gain exposure to a rapidly growing industry. However, it is crucial to conduct thorough research and understand the risks involved before making a decision. By analyzing market potential, company performance, regulatory environment, and risks, investors can make informed decisions and potentially benefit from the growth of the marijuana industry.

so cool! ()

last:Bombardier US Stock: A Comprehensive Analysis

next:nothing

like

- Bombardier US Stock: A Comprehensive Analysis

- High Momentum US Stocks: Technical Analysis Unveiled

- Title: Percentage of US Households That Hold Stocks: Understanding the Trend

- Accenture Stock Price US: A Comprehensive Analysis

- US Stock ETF List: A Comprehensive Guide to Exchange-Traded Funds

- Title: US Steel Co Stock Price Today: A Comprehensive Analysis

- Paw Patrol Stocking Toys at Toys "R" Us: The Ultimate Gift Guid

- US Defense Stocks Performance Today: A Comprehensive Overview

- US Holiday Stock Market Closed: What You Need to Know

- US Fertilizer Companies Stock: A Comprehensive Guide to Investment Opportunities

- Can You Buy Hyundai Stock in the US?

- US Stock Futures Fall Due to Potential Government Shutdown Concerns

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- US Stock Futures Rise Amid Government Shutdown"

- June 8, 2025: US Stock Market Summary"

- US Passport and Shell Stock Photo High Resolut"

- PS5 Stock Update: What You Need to Know in the"

- US Refineries Stocks: A Comprehensive Guide to"

- Daily US Stock Market Update"

recommend

Title: US Stock Marijuana: The Emerging Invest

Title: US Stock Marijuana: The Emerging Invest

Understanding US Stock Futures Charts: A Compr

US Cirremcy Paper Stock Supplier: The Ultimate

Hive Stock: A Breakdown of Its Presence on the

Title: DJ US Total Stock Market Fidelity: A Co

Jan 3, 2019: A Look Back at the US Stock Marke

Title: Stock to Buy US: Top 5 Investment Oppor

US Gypsum Stock Sale: A Comprehensive Guide to

Is the US Stock Market Open on May 1?

US Stock Brokers in South Africa: A Comprehens

Title: Small Cap Value Stocks US: Unveiling th

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Stock Futures Ticker: A Comprehensive Guide"

- Top US Defence Stocks: A Comprehensive Guide"

- Title: Unfi Stock US: Your Ultimate Guide to I"

- How to Buy Indian Stocks from the US"

- MMEN Stock Price: What You Need to Know"

- Is the US Stock Market Open on December 31? A "

- Is Trump Good for Us Stock Market?"

- Title: Small Cap Stocks US Momentum"

- Jan 3, 2019: A Look Back at the US Stock Marke"

- Title: Palantir Stock Price US: Insights and A"