you position:Home > us stock market today live cha > us stock market today live cha

High Momentum US Stocks: Technical Analysis Unveiled

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the dynamic world of stock trading, identifying high momentum stocks can be the key to substantial returns. This article delves into the realm of technical analysis to explore how investors can pinpoint these high-performing US stocks. By understanding the nuances of momentum and utilizing effective technical analysis techniques, traders can make informed decisions and capitalize on market trends.

Understanding High Momentum Stocks

What is High Momentum?

High momentum stocks are those that have seen significant price gains over a short period. These stocks are often in the spotlight due to their rapid appreciation, making them attractive to traders seeking quick profits. Identifying these stocks requires a keen eye and a solid understanding of market dynamics.

Why Technical Analysis?

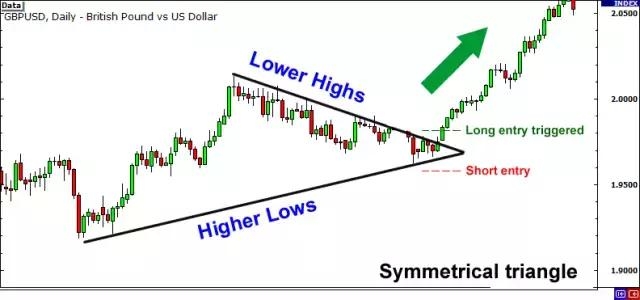

Technical analysis is a method used by traders to predict future price movements based on historical market data. By analyzing patterns, trends, and indicators, traders can gain insights into the potential direction of a stock. This approach is particularly useful for identifying high momentum stocks, as it allows traders to capitalize on market trends before they become widely known.

Key Technical Indicators for High Momentum Stocks

1. Moving Averages (MAs)

Moving averages are one of the most popular technical indicators. They help traders identify the direction of the trend and the strength of momentum. Exponential Moving Averages (EMA) are often preferred for high momentum stocks, as they react more quickly to price changes.

2. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. A high RSI reading (typically above 70) indicates that a stock may be overbought and due for a pullback, while an RSI below 30 suggests that a stock may be oversold and due for a rebound.

3. Bollinger Bands

Bollinger Bands consist of a middle band, an upper band, and a lower band. They help traders identify the volatility and potential overbought/oversold levels of a stock. When the price touches the upper band, it may indicate an overbought condition, while touching the lower band may suggest an oversold condition.

Case Study: Amazon (AMZN)

Let's take a look at a real-world example to illustrate how technical analysis can be used to identify high momentum stocks. Amazon (AMZN) has been a high momentum stock for several years, and its technical chart reveals several key patterns.

1. Rising Moving Averages

As shown in the chart, Amazon's 50-day and 200-day moving averages have been consistently rising, indicating a strong bullish trend. This aligns with the company's impressive growth and market dominance.

2. Overbought Conditions

In late 2020, Amazon's RSI reached an overbought level, suggesting that the stock may be due for a pullback. However, the stock quickly recovered and continued its upward trend, showcasing the potential of high momentum stocks.

3. Bollinger Band Convergence

At various points, Amazon's price has touched the upper Bollinger Band, indicating an overbought condition. Traders who monitored these patterns could have taken advantage of pullbacks to enter or exit positions.

Conclusion

High momentum US stocks can offer substantial returns, but they require careful analysis and a disciplined approach. By utilizing technical analysis techniques like moving averages, RSI, and Bollinger Bands, traders can identify these high-performing stocks and capitalize on market trends. However, it's important to remember that no investment strategy is foolproof, and traders should always conduct thorough research and manage risk appropriately.

so cool! ()

like

- Title: Percentage of US Households That Hold Stocks: Understanding the Trend

- Accenture Stock Price US: A Comprehensive Analysis

- US Stock ETF List: A Comprehensive Guide to Exchange-Traded Funds

- Title: US Steel Co Stock Price Today: A Comprehensive Analysis

- Paw Patrol Stocking Toys at Toys "R" Us: The Ultimate Gift Guid

- US Defense Stocks Performance Today: A Comprehensive Overview

- US Holiday Stock Market Closed: What You Need to Know

- US Fertilizer Companies Stock: A Comprehensive Guide to Investment Opportunities

- Can You Buy Hyundai Stock in the US?

- US Stock Futures Fall Due to Potential Government Shutdown Concerns

- Title: US Stock Market 2 Year Chart: A Comprehensive Analysis

- Title: Stocks of U.S. Aggregate Producers: A Comprehensive Overview

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- US Stock Futures Rise Amid Government Shutdown"

- June 8, 2025: US Stock Market Summary"

- US Passport and Shell Stock Photo High Resolut"

- PS5 Stock Update: What You Need to Know in the"

- US Refineries Stocks: A Comprehensive Guide to"

- Daily US Stock Market Update"

recommend

High Momentum US Stocks: Technical Analysis Un

High Momentum US Stocks: Technical Analysis Un

Title: Nigeria Pulled from US Stocks: What Thi

Title: US Growth Stocks 2022: The Next Wave of

DFS Stock Price: A Comprehensive Guide to Unde

Aurora US Stock: Your Ultimate Guide to Invest

US Penny Stocks High Volume: A Comprehensive G

US Steel Stock Price Future: What Investors Ne

Public Cannabis Stocks: A Guide for Investors

2024 US Stock Market Flows: Predictions, Oppor

Can U.S. Military Invest in Weed Stocks? A Com

Docebo Stock US: A Comprehensive Analysis

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Mortgage Stocks: A Comprehensive Guide to U"

- Car Dealers in China: A US Stock Market Perspe"

- Broker Us Stocks: Your Ultimate Guide to Inves"

- Us Bancorp Stock Price Today Per Share: A Comp"

- Momentum Stocks: US Large Cap August 2025 Outl"

- August 18, 2025: US Stock Market Summary"

- OpenDoor Stock: A Breakdown of the Emerging Re"

- Soybean Stocks US: The Current State and Futur"

- US Government Shutdown Impact on Stock Market "

- Top Momentum Stocks: Large Cap US Market This "