you position:Home > us stock market today live cha > us stock market today live cha

Title: Are Higher Stock Prices Good for Us?

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

Are higher stock prices good for us? This is a question that has intrigued investors, economists, and everyday Americans for decades. In this article, we'll explore the impact of rising stock prices on the economy, investors, and consumers. We'll delve into the factors that drive stock prices and whether higher prices are a sign of a thriving market or a potential bubble.

Understanding Stock Prices

Firstly, it's crucial to understand what stock prices represent. When you purchase shares of a company, you're essentially buying a piece of that business. The stock price reflects the market's perception of the company's value, considering factors like its financial health, earnings potential, and growth prospects.

Benefits of Higher Stock Prices

Higher stock prices can have several benefits:

- Investment Returns: As an investor, you'll be pleased to see your portfolio grow when stock prices rise. This means more money in your pocket when you decide to sell your shares.

- Wealth Creation: Over time, rising stock prices can lead to significant wealth creation for investors. This can help individuals achieve their financial goals, such as buying a home, saving for retirement, or providing for their families.

- Consumer Confidence: Higher stock prices can boost consumer confidence. When people see the value of their investments increase, they may feel more secure about their financial future and be more willing to spend and invest in other areas of the economy.

- Economic Growth: In general, higher stock prices can signal a strong economy. This is because a thriving stock market often reflects strong corporate earnings and business confidence.

Causes of Rising Stock Prices

Several factors can drive stock prices higher:

- Strong Earnings: When a company reports strong earnings and exceeds analyst expectations, its stock price may rise.

- Positive Economic Data: Data such as unemployment rates, GDP growth, and consumer spending can influence stock prices.

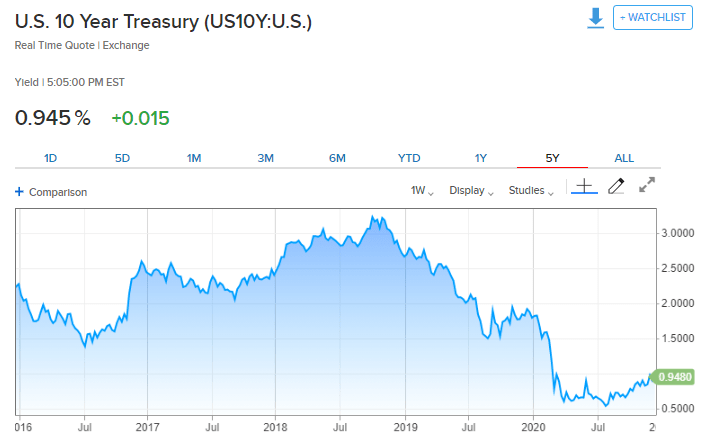

- Low Interest Rates: When interest rates are low, the cost of borrowing is cheaper, which can lead to increased investment and, in turn, higher stock prices.

- Speculation: Sometimes, stock prices rise due to speculation, where investors buy shares based on the expectation that others will buy them, driving prices up even further.

The Potential Dangers of Higher Stock Prices

While higher stock prices can be beneficial, there are potential risks:

- Bubble Formation: If stock prices rise too quickly, they may become overvalued, leading to a bubble that can eventually burst.

- Market Volatility: When stock prices are high, markets can become more volatile, leading to increased risk for investors.

- Economic Imbalance: In some cases, higher stock prices can lead to an economic imbalance, where the stock market is performing well while the broader economy is struggling.

Case Studies

To illustrate the impact of higher stock prices, let's consider two case studies:

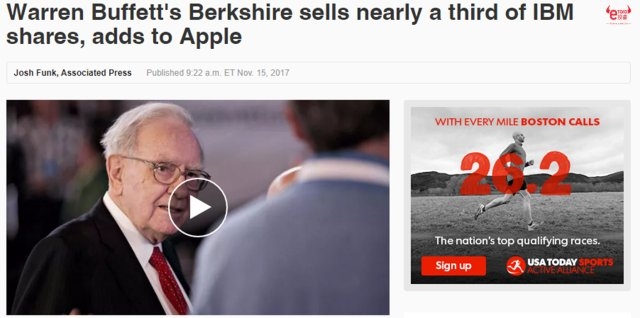

- The Tech Boom of the 1990s: During this period, stock prices for tech companies like Microsoft and Apple soared. This led to significant wealth creation for investors and contributed to economic growth. However, when the bubble burst in 2000, the market experienced a major downturn.

- The Current Bull Market: Since the financial crisis of 2008, the stock market has experienced a strong bull market, with many companies hitting all-time highs. While this has been beneficial for investors, some argue that the market may be overvalued, increasing the risk of a correction.

In conclusion, higher stock prices can have both positive and negative impacts on the economy, investors, and consumers. It's essential to understand the factors driving stock prices and the potential risks involved. As with any investment, it's crucial to do your research and consider your financial goals and risk tolerance before making investment decisions.

so cool! ()

last:Title: Top Dividend US Stocks 2018: A Guide to High-Yielding Investments

next:nothing

like

- Title: Top Dividend US Stocks 2018: A Guide to High-Yielding Investments

- Top US Stocks 2018: A Review of the Year’s Best Performers

- Adani US Stocks: A Comprehensive Guide to Investing in the Adani Group in the Uni

- US Stock Market 2020 Holidays: A Comprehensive Guide

- Top 10 Premarket Losers: US Stock Market Today

- PTC US Stock Quote: Everything You Need to Know

- PRA Stock Price: What You Need to Know

- US Steel Stock MarketWatch: A Comprehensive Guide to Investing in Steel

- Aurora US Stock: Your Ultimate Guide to Investing in This Rising Star

- Jan 3, 2019: A Look Back at the US Stock Market Close

- Loc 5635 1st Avenue Stock Island FL US: Your Ultimate Guide to Real Estate Opport

- Title: US Based Steel Companies Stock: A Comprehensive Analysis

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- US Stock Futures Rise Amid Government Shutdown"

- June 8, 2025: US Stock Market Summary"

- Daily US Stock Market Update"

- US Chip Manufacturers Stock: A Comprehensive G"

- US Cellular Mesmerize Stock ROM: Unveiling the"

- Why Did the US Stock Market Crash in 1929?"

recommend

Title: Are Higher Stock Prices Good for Us?

Title: Are Higher Stock Prices Good for Us?

Title: Standard Deviation of US Stock Market:

HBHarat Electronic Stock on US Market: A Compr

Understanding the US Bank National Association

PTC US Stock Quote: Everything You Need to Kno

Title: List of US Stocks Impacts Due to Trade

US Stock Market Hits 20,000 Points: What This

US Stock After Market Hours: Everything You Ne

Noho Us Stock: A Comprehensive Guide to Invest

Title: Etoro US Stocks: Your Ultimate Guide to

US Stock for E-Cigarettes: A Comprehensive Gui

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Stock Market Hits 20,000 Points: What This "

- Broker Us Stocks: Your Ultimate Guide to Inves"

- Title: 2022 US Stock Market Performance: A Com"

- 6-3 Bump Stock US Supreme Court: A Landmark De"

- Closing Time: Understanding the US Stock Marke"

- US Stock for E-Cigarettes: A Comprehensive Gui"

- How to Buy Indian Stocks from the US"

- Title: CIBC US Stock Price: A Comprehensive An"

- Title: List of US Stocks Impacts Due to Trade "

- Alternative Investments to US Stock Market in "