you position:Home > us stock market today live cha > us stock market today live cha

Title: CIBC US Stock Price: A Comprehensive Analysis

![]() myandytime2026-01-14【us stock market today live cha】view

myandytime2026-01-14【us stock market today live cha】view

info:

In today's fast-paced financial world, keeping an eye on stock prices is crucial for investors and traders alike. One such stock that has been attracting considerable attention is the Canadian Imperial Bank of Commerce (CIBC) in the United States. This article aims to provide a comprehensive analysis of the CIBC US stock price, its factors influencing it, and its potential future trends.

Understanding CIBC US Stock Price

The CIBC US stock price is denoted by the ticker symbol "CM." It represents the value of a single share of the bank's stock in the US market. To understand the stock price, it is essential to consider several factors:

- Market Conditions: The overall market conditions play a significant role in determining the stock price. Factors such as economic growth, inflation, and geopolitical events can impact the market sentiment, leading to fluctuations in stock prices.

- Company Performance: The financial performance of CIBC, including its revenue, earnings, and growth prospects, is a crucial factor that influences the stock price.

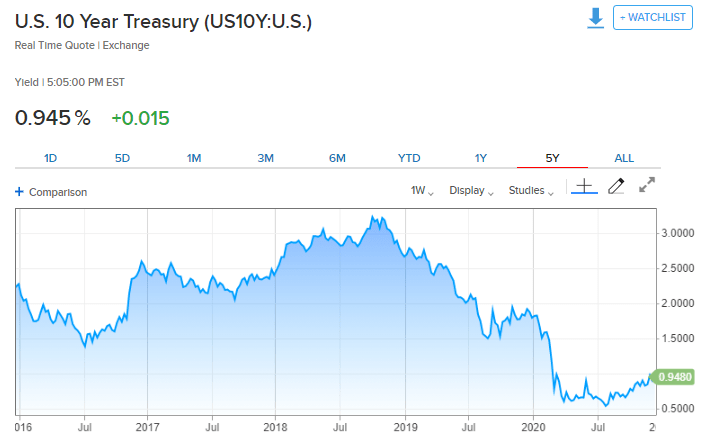

- Interest Rates: Interest rates in the US economy affect the banking sector, including CIBC. Changes in interest rates can impact the bank's profitability and, consequently, its stock price.

Influences on CIBC US Stock Price

Several factors have influenced the CIBC US stock price over the years:

- Economic Growth: As the US economy grows, businesses expand, leading to increased demand for loans and financial services. This has a positive impact on CIBC's revenue and earnings, subsequently boosting its stock price.

- Regulatory Changes: Changes in regulations can affect the profitability of banks. For instance, the implementation of the Dodd-Frank Act led to increased compliance costs for CIBC, which impacted its stock price.

- Interest Rates: Fluctuations in interest rates can impact CIBC's net interest margins, which in turn affect its profitability and stock price.

Potential Future Trends

Predicting the future of the CIBC US stock price is challenging, but several factors suggest potential trends:

- Economic Recovery: As the US economy continues to recover from the COVID-19 pandemic, the demand for financial services is expected to increase, potentially boosting CIBC's stock price.

- Interest Rates: If the Federal Reserve continues to raise interest rates, it may negatively impact CIBC's profitability. However, higher interest rates can also benefit the banking sector through wider net interest margins.

- Competitive Landscape: The competitive landscape in the banking sector can affect CIBC's market share and profitability, potentially impacting its stock price.

Case Studies

To illustrate the impact of various factors on the CIBC US stock price, consider the following case studies:

- 2008 Financial Crisis: During the financial crisis, the CIBC US stock price plummeted as the market sentiment soured. However, the bank's strong financial foundation helped it recover quickly.

- Dodd-Frank Act: The implementation of the Dodd-Frank Act led to increased compliance costs for CIBC, negatively impacting its stock price in the short term. However, the bank's ability to adapt to the new regulations helped mitigate the long-term impact.

In conclusion, the CIBC US stock price is influenced by various factors, including market conditions, company performance, and regulatory changes. While predicting future trends is challenging, monitoring these factors can help investors make informed decisions. By staying informed and adapting to changing market dynamics, investors can capitalize on opportunities in the CIBC US stock market.

so cool! ()

like

- How to Buy US Stocks from Vietnam

- How to Play Samsung in the US Stock Market

- Fidelity US LG Cap Grth Stock: A Deep Dive into the Future of Technology Investin

- 6-3 Bump Stock US Supreme Court: A Landmark Decision Unveiled

- December 2022 IPOs: A Comprehensive List of US Stock Market Listings

- Best Performing Large Cap US Stocks This Week: Momentum to Watch

- Buying US Stocks from India: Is It Safe?

- Macroeconomic Indicators for the US Economy and Stock Market: A Comprehensive Gui

- Barrick Gold US Stock Price: A Comprehensive Analysis

- DB US Stock: Unveiling the Power of Diversified Investment Opportunities

- Car Dealers in China: A US Stock Market Perspective

- How Are Stock Options Taxed in the US?

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- Daily US Stock Market Update"

- US Chip Manufacturers Stock: A Comprehensive G"

- Why Did the US Stock Market Crash in 1929?"

- Has the International Stock Market Ever Outper"

- 6-3 Bump Stock US Supreme Court: A Landmark De"

- US Gold Corp Stock Price: A Comprehensive Anal"

recommend

How to Buy US Stocks from Vietnam

How to Buy US Stocks from Vietnam

All Public US Dividend Paying Stocks: A Compre

Encana US Stock Price: What You Need to Know

Can I Still Buy Stocks When the US Market Clos

December 2022 IPOs: A Comprehensive List of US

Car Dealers in China: A US Stock Market Perspe

DB US Stock: Unveiling the Power of Diversifie

NXT US Stock: A Comprehensive Guide to Underst

Buzz Us Stocks on the Move

Fidelity US LG Cap Grth Stock: A Deep Dive int

Title: Etoro US Stocks: Your Ultimate Guide to

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- How to Play Samsung in the US Stock Market"

- How to Buy US Stocks from Vietnam"

- Title: 2022 US Stock Market Performance: A Com"

- US Gold Corp Stock Price: A Comprehensive Anal"

- Title: ETF US Stocks: Your Ultimate Guide to I"

- European Restaurants Trading on the US Stock E"

- Stock Market US History Definition: A Comprehe"

- Title: List of US Stocks Impacts Due to Trade "

- How Are Stock Options Taxed in the US?"

- Car Dealers in China: A US Stock Market Perspe"