you position:Home > us stock market today live cha > us stock market today live cha

Insurance Stocks in the US: A Comprehensive Guide

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In today's volatile financial market, insurance stocks have become a significant investment option for many investors. These stocks represent a slice of the insurance industry, offering a blend of stability and growth potential. This article delves into the world of insurance stocks in the US, providing an in-depth analysis of their performance, factors influencing them, and key players in the market.

Understanding Insurance Stocks

Insurance stocks are shares of companies that provide insurance services. These companies generate revenue by selling insurance policies to individuals and businesses, and then invest the premiums they collect to earn profits. The insurance industry is diverse, covering various sectors like life insurance, property and casualty insurance, health insurance, and more.

Performance of Insurance Stocks

Over the years, insurance stocks have generally provided a stable and consistent return on investment. They are often considered a "bond substitute" due to their lower risk profile compared to other sectors like technology or energy. However, their performance can vary depending on several factors.

Factors Influencing Insurance Stocks

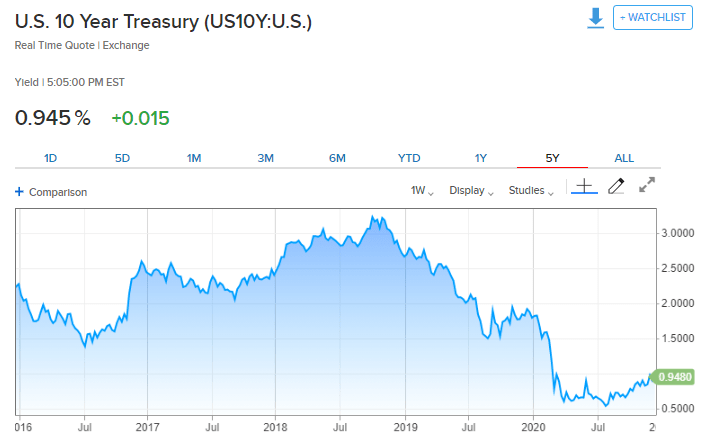

Interest Rates: Insurance companies invest the premiums they collect, and higher interest rates can lead to higher investment returns, thereby boosting their profits. Conversely, lower interest rates can have a negative impact.

Regulatory Changes: The insurance industry is heavily regulated, and changes in regulations can significantly impact the profitability of insurance companies. For instance, stricter regulations on insurance rates can limit the ability of companies to raise premiums.

Economic Conditions: The performance of insurance stocks is closely tied to the overall economic conditions. In a recession, the demand for insurance tends to decrease, affecting the profitability of insurance companies.

Market Competition: Increased competition in the insurance industry can lead to lower profitability, as companies may have to lower their premiums to attract customers.

Key Players in the US Insurance Market

Several insurance companies have made a name for themselves in the US market. Here are a few notable examples:

State Farm: One of the largest insurance companies in the US, State Farm offers a wide range of insurance products, including auto, home, and life insurance.

Geico: Known for its innovative marketing strategies and competitive pricing, Geico is a popular choice for auto and home insurance.

Prudential Financial: A leading provider of life insurance, annuities, and retirement products, Prudential Financial has a strong presence in the US market.

MetLife: A diversified financial services company, MetLife offers life insurance, annuities, and employee benefits solutions.

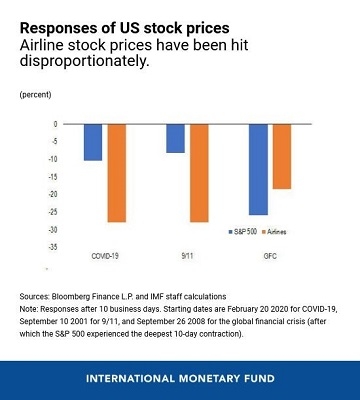

Case Study: The Impact of COVID-19 on Insurance Stocks

The COVID-19 pandemic has had a significant impact on the insurance industry. While the initial impact was negative, with lower demand for insurance due to economic uncertainty, some companies have started to see a rebound in their business.

For instance, life insurance companies have seen an increase in demand for life insurance policies as people become more aware of the importance of protecting their families. Similarly, health insurance companies have seen a surge in demand for their products as people prioritize their health during the pandemic.

In conclusion, insurance stocks in the US offer a stable and potentially profitable investment option. By understanding the factors that influence their performance and staying informed about the key players in the market, investors can make informed decisions about their investments.

so cool! ()

last:Title: Nigeria Pulled from US Stocks: What This Means for Investors

next:nothing

like

- Title: Nigeria Pulled from US Stocks: What This Means for Investors

- PS5 Stock Update: What You Need to Know in the US

- US Concrete Stock Yahoo Discussion: A Comprehensive Insight

- Title: "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&

- US Airways Flight 1549 Crash and Its Impact on Stock Market

- Superior Resources Ltd: Understanding the US Stock Symbol

- US Coal Companies Stock Prices: What You Need to Know

- Iron Ore Stocks US: A Comprehensive Guide to Investing in the Market

- Is BYD in the US Stock Market? A Comprehensive Guide

- US Cirremcy Paper Stock Supplier: The Ultimate Guide

- US Stock Futures Pre-Market: A CNBC Guide to Understanding the Market

- Toys "R" Us Seasonal Off-Hours Stock Crew Description: The Unsu

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- US Stock Futures Rise Amid Government Shutdown"

- June 8, 2025: US Stock Market Summary"

- US Passport and Shell Stock Photo High Resolut"

- PS5 Stock Update: What You Need to Know in the"

- Daily US Stock Market Update"

- How to Buy US Stocks from NZ: A Comprehensive "

recommend

Insurance Stocks in the US: A Comprehensive Gu

Insurance Stocks in the US: A Comprehensive Gu

December 2022 IPOs: A Comprehensive List of US

Encana US Stock Price: What You Need to Know

Lumber Stocks: A Growing Industry in the US

Title: ETF US Stocks: Your Ultimate Guide to I

US Stock Market 2020 Holidays: A Comprehensive

June 8, 2025: US Stock Market Summary

US Hybrid Corporation Stock: The Future of Ele

Title: Last Trading Day of First Quarter 2024

Title: Etoro US Stocks: Your Ultimate Guide to

US Stock Futures Rise Amid Government Shutdown

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- High Potential Penny Stocks US: Your Gateway t"

- Current US Stock Market Capitalization: An In-"

- December 2022 IPOs: A Comprehensive List of US"

- PRA Stock Price: What You Need to Know"

- PS5 Stock Update: What You Need to Know in the"

- US Cellular Mesmerize Stock ROM: Unveiling the"

- US Stock Market 2020 Holidays: A Comprehensive"

- Has the International Stock Market Ever Outper"

- Toys "R" Us Seasonal Off-Hou"

- August 18, 2025: US Stock Market Summary"