you position:Home > us stock market today live cha > us stock market today live cha

Current US Stock Market Capitalization: An In-Depth Look

![]() myandytime2026-01-14【us stock market today live cha】view

myandytime2026-01-14【us stock market today live cha】view

info:

In today's rapidly evolving financial landscape, understanding the current US stock market capitalization is crucial for investors and financial analysts alike. This metric not only reflects the overall size of the stock market but also provides insights into the economic health and potential growth opportunities. This article delves into the current US stock market capitalization, its significance, and key factors influencing it.

What is Stock Market Capitalization?

Stock market capitalization, often referred to as market cap, is the total value of all shares of a publicly traded company. It is calculated by multiplying the number of outstanding shares by the current market price of each share. Market cap is a vital indicator of a company's size and market influence.

Current US Stock Market Capitalization

As of the latest available data, the total US stock market capitalization stands at approximately

Key Factors Influencing US Stock Market Capitalization

Economic Conditions: The overall economic health of a country significantly impacts its stock market capitalization. Factors such as GDP growth, inflation rates, and unemployment levels play a crucial role in shaping investor confidence and market performance.

Corporate Performance: The financial performance of individual companies contributes to the overall market cap. Strong earnings reports, revenue growth, and positive outlooks from companies can drive up market cap, while poor performance can have the opposite effect.

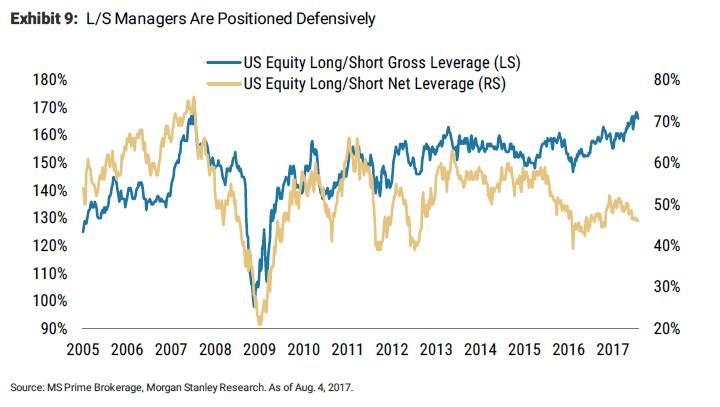

Investor Sentiment: Investor sentiment is a critical factor influencing stock market capitalization. Factors such as political instability, geopolitical tensions, and market speculation can lead to volatile market movements and fluctuations in market cap.

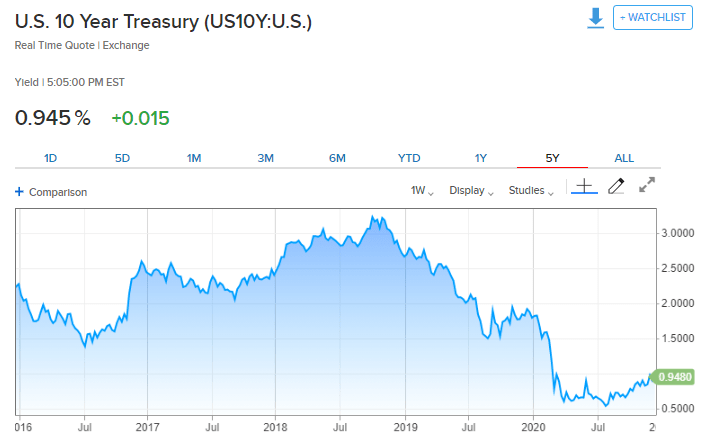

Interest Rates: Interest rates have a significant impact on the stock market. Higher interest rates can make borrowing more expensive, leading to increased corporate costs and potentially lower stock prices. Conversely, lower interest rates can stimulate economic growth and boost stock prices.

Case Study: Tech Giant Apple

To illustrate the impact of corporate performance on stock market capitalization, let's consider the case of Apple Inc. As one of the largest companies in the world, Apple's market cap has fluctuated significantly over the years. In 2018, Apple's market cap reached an all-time high of approximately

However, in 2020, Apple's market cap experienced a significant decline due to the global COVID-19 pandemic. The pandemic led to a decrease in consumer spending and disruptions in the supply chain, impacting Apple's revenue and market cap. Despite this, Apple's market cap has since recovered, reflecting the resilience of the company and the overall US stock market.

Conclusion

Understanding the current US stock market capitalization is essential for investors and financial analysts to make informed decisions. By considering factors such as economic conditions, corporate performance, investor sentiment, and interest rates, one can gain valuable insights into the market's potential growth opportunities and risks. As the financial landscape continues to evolve, staying informed about the current US stock market capitalization remains a key priority.

so cool! ()

like

- How to Buy US Stocks from Vietnam

- How to Play Samsung in the US Stock Market

- Fidelity US LG Cap Grth Stock: A Deep Dive into the Future of Technology Investin

- 6-3 Bump Stock US Supreme Court: A Landmark Decision Unveiled

- December 2022 IPOs: A Comprehensive List of US Stock Market Listings

- Best Performing Large Cap US Stocks This Week: Momentum to Watch

- Buying US Stocks from India: Is It Safe?

- Title: CIBC US Stock Price: A Comprehensive Analysis

- Macroeconomic Indicators for the US Economy and Stock Market: A Comprehensive Gui

- Barrick Gold US Stock Price: A Comprehensive Analysis

- DB US Stock: Unveiling the Power of Diversified Investment Opportunities

- Car Dealers in China: A US Stock Market Perspective

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- Daily US Stock Market Update"

- US Chip Manufacturers Stock: A Comprehensive G"

- Why Did the US Stock Market Crash in 1929?"

- Has the International Stock Market Ever Outper"

- 6-3 Bump Stock US Supreme Court: A Landmark De"

- US Gold Corp Stock Price: A Comprehensive Anal"

recommend

How to Buy US Stocks from Vietnam

How to Buy US Stocks from Vietnam

December 2022 IPOs: A Comprehensive List of US

Buzz Us Stocks on the Move

Can I Still Buy Stocks When the US Market Clos

DB US Stock: Unveiling the Power of Diversifie

NXT US Stock: A Comprehensive Guide to Underst

Encana US Stock Price: What You Need to Know

Car Dealers in China: A US Stock Market Perspe

Title: Etoro US Stocks: Your Ultimate Guide to

All Public US Dividend Paying Stocks: A Compre

Fidelity US LG Cap Grth Stock: A Deep Dive int

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Title: ETF US Stocks: Your Ultimate Guide to I"

- European Restaurants Trading on the US Stock E"

- US Gold Corp Stock Price: A Comprehensive Anal"

- How to Play Samsung in the US Stock Market"

- Car Dealers in China: A US Stock Market Perspe"

- Stock Market US History Definition: A Comprehe"

- Title: List of US Stocks Impacts Due to Trade "

- How Are Stock Options Taxed in the US?"

- How to Buy US Stocks from Vietnam"

- Title: 2022 US Stock Market Performance: A Com"