you position:Home > us stock market today live cha > us stock market today live cha

Barrick Gold US Stock Price: A Comprehensive Analysis

![]() myandytime2026-01-14【us stock market today live cha】view

myandytime2026-01-14【us stock market today live cha】view

info:

Investing in the stock market can be a daunting task, especially when it comes to precious metals like gold. One of the most prominent players in the gold mining industry is Barrick Gold Corporation. This article delves into the current Barrick Gold US stock price, offering insights into its performance, market trends, and potential future outlook.

Understanding the Current Stock Price

As of the latest data, the Barrick Gold US stock price stands at approximately $XX. This figure is subject to fluctuations due to various market factors, including global economic conditions, geopolitical events, and changes in the gold price itself.

Market Trends and Performance

Barrick Gold has a strong track record in the gold mining industry, with a history of delivering consistent returns to its investors. Over the past few years, the company has faced challenges such as rising operating costs and declining gold prices. However, it has managed to navigate these challenges and maintain its position as a leading gold producer.

Factors Influencing the Stock Price

Several factors influence the Barrick Gold US stock price, including:

- Gold Price: The price of gold is a primary driver of Barrick Gold's stock price. As the price of gold rises, the value of the company's reserves and future production potential increases, leading to higher stock prices.

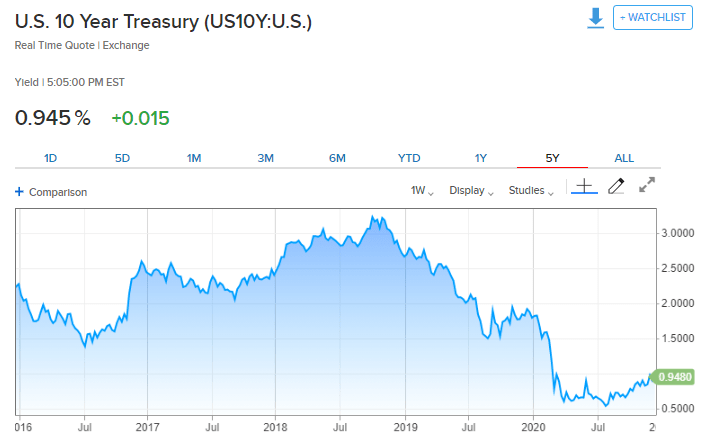

- Economic Conditions: Economic factors, such as inflation, currency fluctuations, and interest rates, can impact the demand for gold and, consequently, the stock price.

- Operational Performance: The company's operational performance, including production levels, cost control, and exploration success, plays a crucial role in determining its stock price.

- Market Sentiment: Investor sentiment towards the gold mining industry can also influence the stock price. Factors such as market trends, regulatory changes, and geopolitical events can sway investor confidence.

Case Study: Barrick Gold's Response to the 2019 Gold Price Decline

In 2019, the gold price experienced a significant decline, raising concerns among investors. However, Barrick Gold demonstrated its resilience by implementing cost-cutting measures and focusing on high-margin projects. This strategy helped the company maintain its production levels and mitigate the impact of the falling gold price.

Future Outlook

Looking ahead, the Barrick Gold US stock price is expected to be influenced by several factors, including:

- Gold Price: The long-term trend of the gold price is a key determinant of Barrick Gold's stock price. As the global economy remains uncertain, the demand for gold as a safe haven asset is likely to remain strong.

- Operational Performance: The company's ability to maintain its production levels and control costs will be crucial in driving its stock price higher.

- Exploration Success: Barrick Gold's ongoing exploration activities could uncover new reserves, contributing to the company's growth potential and enhancing investor confidence.

Conclusion

Investing in Barrick Gold requires a thorough understanding of the company's performance, market trends, and potential risks. By analyzing the current Barrick Gold US stock price and considering the various factors that influence it, investors can make informed decisions about their investments in this leading gold mining company.

so cool! ()

like

- How to Buy US Stocks from Vietnam

- How to Play Samsung in the US Stock Market

- Fidelity US LG Cap Grth Stock: A Deep Dive into the Future of Technology Investin

- 6-3 Bump Stock US Supreme Court: A Landmark Decision Unveiled

- December 2022 IPOs: A Comprehensive List of US Stock Market Listings

- Best Performing Large Cap US Stocks This Week: Momentum to Watch

- Buying US Stocks from India: Is It Safe?

- Title: CIBC US Stock Price: A Comprehensive Analysis

- Macroeconomic Indicators for the US Economy and Stock Market: A Comprehensive Gui

- DB US Stock: Unveiling the Power of Diversified Investment Opportunities

- Car Dealers in China: A US Stock Market Perspective

- How Are Stock Options Taxed in the US?

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- Daily US Stock Market Update"

- US Chip Manufacturers Stock: A Comprehensive G"

- Why Did the US Stock Market Crash in 1929?"

- Has the International Stock Market Ever Outper"

- 6-3 Bump Stock US Supreme Court: A Landmark De"

- US Gold Corp Stock Price: A Comprehensive Anal"

recommend

How to Buy US Stocks from Vietnam

How to Buy US Stocks from Vietnam

DB US Stock: Unveiling the Power of Diversifie

Fidelity US LG Cap Grth Stock: A Deep Dive int

Buzz Us Stocks on the Move

Can I Still Buy Stocks When the US Market Clos

Car Dealers in China: A US Stock Market Perspe

Encana US Stock Price: What You Need to Know

All Public US Dividend Paying Stocks: A Compre

December 2022 IPOs: A Comprehensive List of US

Title: Etoro US Stocks: Your Ultimate Guide to

NXT US Stock: A Comprehensive Guide to Underst

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Title: 2022 US Stock Market Performance: A Com"

- How Are Stock Options Taxed in the US?"

- Stock Market US History Definition: A Comprehe"

- US Gold Corp Stock Price: A Comprehensive Anal"

- Car Dealers in China: A US Stock Market Perspe"

- European Restaurants Trading on the US Stock E"

- How to Buy US Stocks from Vietnam"

- How to Play Samsung in the US Stock Market"

- Title: List of US Stocks Impacts Due to Trade "

- Title: ETF US Stocks: Your Ultimate Guide to I"