you position:Home > us stock market today > us stock market today

Understanding the US Stock Market Benchmark Sectors

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

The U.S. stock market is a bustling hub of economic activity, with numerous sectors driving its performance. Understanding these sectors is crucial for investors looking to navigate the complex landscape of the market. This article delves into the key benchmark sectors of the U.S. stock market, highlighting their characteristics and impact on investment strategies.

1. Technology (TMT)

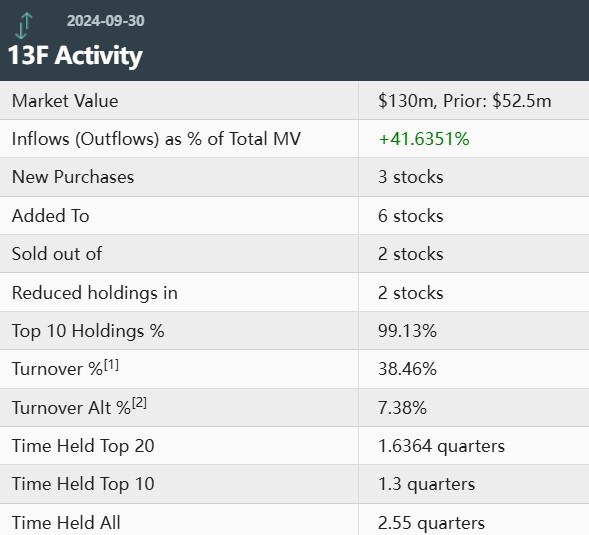

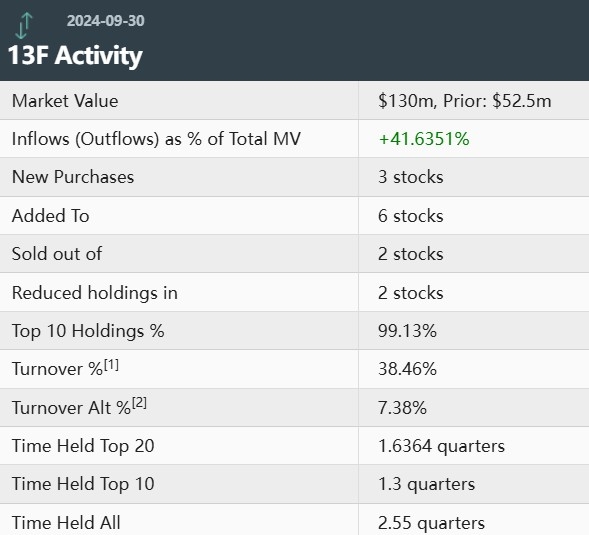

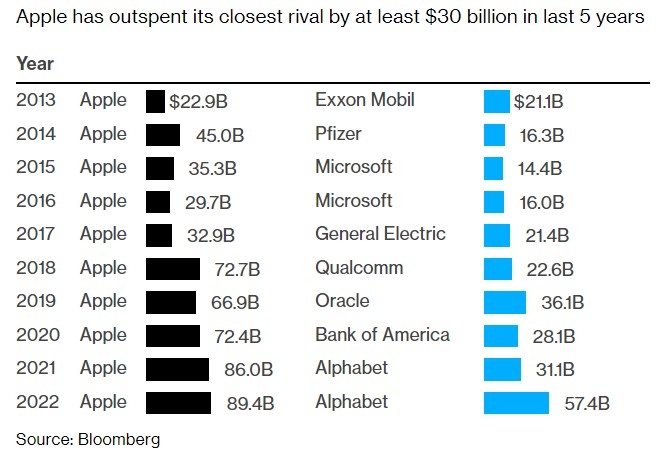

The Technology, Media, and Telecommunications (TMT) sector is a significant component of the U.S. stock market. It encompasses companies involved in the development, manufacturing, and distribution of technology products and services, as well as media and telecommunications businesses. Notable companies in this sector include Apple, Microsoft, and Amazon.

Key Features:

- Innovation: TMT companies are known for their constant innovation, driving technological advancements.

- Market Dominance: This sector is characterized by a few dominant players that control large market shares.

- Volatility: TMT stocks can be highly volatile due to rapid technological changes and market competition.

Case Study: Apple's meteoric rise in the TMT sector has been a testament to its innovative products and market dominance.

2. Financials

The Financials sector includes banks, insurance companies, and real estate investment trusts (REITs). This sector plays a crucial role in the U.S. economy by providing essential financial services to individuals and businesses.

Key Features:

- Regulation: The financial industry is heavily regulated, affecting the performance of companies in this sector.

- Diversification: Financials companies offer various services, providing investors with a diversified portfolio.

- Economic Indicators: The financial sector often serves as a barometer for the overall economy.

Case Study: JPMorgan Chase's resilience during the 2008 financial crisis highlighted the sector's ability to navigate economic downturns.

3. Consumer Discretionary

The Consumer Discretionary sector includes companies that produce non-essential goods and services, such as luxury cars, entertainment, and household goods. This sector is sensitive to economic conditions and consumer spending patterns.

Key Features:

- Consumer Sentiment: Consumer discretionary companies' performance is closely tied to consumer confidence and spending.

- Cyclical: This sector is considered cyclical, as its growth is driven by economic cycles.

- Market Leaders: Companies like Tesla and Disney dominate this sector, offering investors a range of investment opportunities.

Case Study: Tesla's remarkable growth in the consumer discretionary sector underscores the potential of innovative companies in this area.

4. Consumer Staples

The Consumer Staples sector includes companies that produce essential goods and services, such as food, beverages, and household products. This sector is known for its stability and reliability.

Key Features:

- Defensive: Consumer staples companies are considered defensive stocks, offering investors stability during economic downturns.

- Consistent Growth: These companies often generate consistent revenue and profit growth.

- Market Breadth: The sector includes a wide range of companies, providing investors with diverse investment options.

Case Study: Procter & Gamble's steady performance in the consumer staples sector exemplifies the reliability of companies in this area.

5. Industrials

The Industrials sector includes companies involved in the manufacturing, construction, and transportation of goods and services. This sector is sensitive to economic cycles and industrial production.

Key Features:

- Economic Indicators: The performance of industrials companies can serve as a leading indicator for the overall economy.

- Cyclical: This sector is highly cyclical, experiencing rapid growth during economic upswings and contraction during downturns.

- Global Exposure: Industrials companies often operate on a global scale, making them vulnerable to international economic conditions.

Case Study: Caterpillar's strong performance during the global economic recovery of the early 2000s demonstrates the sector's potential during economic upswings.

In conclusion, understanding the key benchmark sectors of the U.S. stock market is essential for investors looking to make informed decisions. By familiarizing themselves with the characteristics and performance trends of these sectors, investors can develop well-rounded investment strategies that align with their goals and risk tolerance.

so cool! ()

last:FRC US Stock: Unveiling the Power of Fractional Reserve Banking

next:nothing

like

- FRC US Stock: Unveiling the Power of Fractional Reserve Banking

- Kirkland Signature Chicken and Rice Cat Food 25 lbs – US Stock: Your Ultimate F

- Engineering Stocks: The Future of Investment in the U.S.

- 1958 US Stock Prices: A Look Back at a Decade of Market Dynamics

- Google is the US Stock Market Closed Today? Understanding the Impact

- US Stock Crash Prediction: How to Navigate the Volatile Market

- Stock Trading for Non-US Citizens: A Comprehensive Guide

- Is Giyani Metals Listed on the US Stock Market? A Comprehensive Guide

- The Rising Influence: Foreign Ownership of U.S. Stocks"

- Total Value of US Stock Markets: Understanding the Dynamics and Impact

- How to Open a Stock Account in the U.S.

- Us Cannabis Stocks: A Comprehensive Guide to Investing in the Green Rush

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

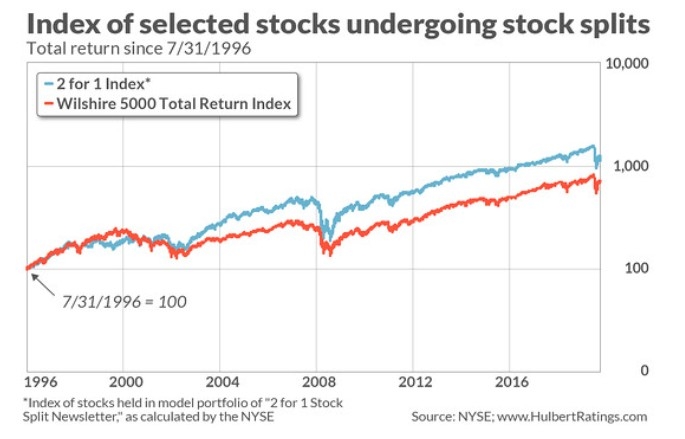

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

Understanding the US Stock Market Benchmark Se

Understanding the US Stock Market Benchmark Se

Title: Stock Market Hours US: A Comprehensive

Strong U.S. Stocks Fundamentals: The Pillars o

High Dividend Stocks US 2022: Top Picks for In

Title: "http stocks.us.reuters.com st

Most US Focused Stocks: Top Picks for 2023

Jollibee Stock in the US: A Comprehensive Anal

Nintendo US Stock Quote: A Comprehensive Guide

US Hexo Stock Price: A Comprehensive Analysis

Best European Stocks Traded in the US: A Guide

June 22, 2025 US Stock Market Summary

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Best US Utility Stocks to Watch in 2025"

- Cpg Us Stock: A Comprehensive Guide to Investi"

- Best US Stock to Buy in 2023: A Strategic Inve"

- High Dividend Stocks US 2022: Top Picks for In"

- Title: The Effect of US Interest Rate Cut on J"

- "http stocks.us.reuters.com stocks fu"

- Title: US Steel Historical Stock Splits: A Dee"

- Title: US Stock Brokers for Non-Residents: You"

- Is NASDAQ an US Stock Index?"

- QCOM US Stock Price: A Comprehensive Analysis"