you position:Home > us stock market today > us stock market today

US Stock Market: The Pulse of the American Economy

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

The US stock market is often seen as the pulse of the American economy. It's a place where the dreams of investors and the fortunes of businesses intersect. Whether you're a seasoned investor or just dipping your toes into the world of stocks, understanding the US stock market is crucial. In this article, we'll delve into the ins and outs of the US stock market, highlighting key aspects that investors should be aware of.

Understanding the US Stock Market

The US stock market is a complex ecosystem, but at its core, it's a marketplace where shares of publicly-traded companies are bought and sold. The two main exchanges where this happens are the New York Stock Exchange (NYSE) and the NASDAQ Stock Market. These exchanges are where the majority of the largest and most influential companies in the world are listed.

Key Components of the US Stock Market

Stock Exchanges: As mentioned, the NYSE and NASDAQ are the primary stock exchanges in the US. The NYSE is known for its iconic trading floor and has been around since 1792. The NASDAQ, on the other hand, is known for its technology stocks and was established in 1971.

Stocks: A stock represents a share in the ownership of a company. When you buy a stock, you're essentially buying a small piece of that company.

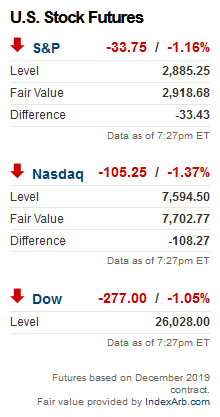

Market Indices: The S&P 500, Dow Jones Industrial Average, and NASDAQ Composite are some of the most well-known market indices. These indices track the performance of a basket of stocks and are often used as a benchmark for the overall health of the stock market.

Investing in the US Stock Market

Investing in the US stock market can be a lucrative endeavor, but it's also risky. Here are some key points to consider:

Diversification: Don't put all your eggs in one basket. Diversifying your portfolio can help mitigate risk.

Research: Before investing, do your homework. Understand the company, its financials, and its industry.

Risk Tolerance: Your risk tolerance will determine the type of stocks you should invest in. For example, if you're risk-averse, you might prefer blue-chip stocks, which are shares of well-established companies with a history of stable performance.

Long-Term Perspective: Investing in the stock market is a long-term endeavor. Don't expect to get rich overnight.

Case Study: Apple Inc.

A prime example of a company that has thrived in the US stock market is Apple Inc. When Apple went public in 1980, its stock was priced at

This case study highlights the potential of investing in the US stock market. However, it's also a reminder that investing comes with risks, and it's crucial to do your research and understand the market.

Conclusion

The US stock market is a dynamic and complex marketplace that plays a crucial role in the American economy. Whether you're an experienced investor or just starting out, understanding the US stock market is essential. By doing your homework, diversifying your portfolio, and maintaining a long-term perspective, you can navigate the US stock market and potentially achieve your investment goals.

so cool! ()

last:Understanding the Impact of Foreign Ownership of US Stocks

next:nothing

like

- Understanding the Impact of Foreign Ownership of US Stocks

- Title: Top 25 Stock Brokers in the US Online

- US Solar Penny Stocks: A Lucrative Investment Opportunity

- Top Stock Broker Firms in the US: Your Ultimate Guide to Investment Success

- How to Trade in the US Stock Market from Pakistan

- US Airline Stock Price: What You Need to Know

- US Stock Futures Rise; NASDAQ Hits Record High

- Primers in Stock: Your Ultimate Guide to High-Quality US Stock Primers

- Short-Term High Momentum US Stocks: A Guide to Investing in Rising Stars

- US Military Family Stock Photo: Capturing the Heart and Spirit of Service

- 2021 US Stock Market Predictions: What to Expect and How to Prepare

- Highest P/E Ratio Stocks in the US: A Deep Dive

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Pyrogenesis Stock US: A Deep Dive into Investm"

- Highest Dividend Yield Stocks in the US: Top P"

- Is the US Stock Market Open Today on Columbus "

- Infineon US Stock: A Comprehensive Analysis"

- US Listed Pot Stocks: A Comprehensive Guide to"

recommend

US Stock Market: The Pulse of the American Eco

US Stock Market: The Pulse of the American Eco

Today's US Stock Futures: A Comprehensive

Medreleaf Stock Price US: A Comprehensive Anal

http stocks.us.reuters.com stocks fulldescript

Infineon US Stock: A Comprehensive Analysis

Title: US Foods Stock Yards Meat Buffalo NY 14

US Large Cap Momentum Stocks: Best Performers

Title: "http stocks.us.reuters.com st

Understanding the Dynamics of a US Stock Inves

How to Trade in the US Stock Market from Pakis

PDD US Stock Price: A Comprehensive Analysis

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Stock Market Alternatives: Exploring Divers"

- Understanding US Stock Market Holidays in 2025"

- Can I Buy Aston Martin Stock on the US Stock E"

- How to Start Investing in the US Stock Market"

- Title: Foreign Corporation Ownership of US Sto"

- US Airline Stock Price: What You Need to Know"

- Pyrogenesis Stock US: A Deep Dive into Investm"

- Soybean US Stock Price: Key Factors Influencin"

- Title: US Alliance Stock Price: A Comprehensiv"

- High Dividend US Stocks 2017: A Guide to Top-Y"