you position:Home > us stock market today > us stock market today

US Small/Mid Company Stock Index: A Comprehensive Guide

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the dynamic world of finance, the stock market is a critical area where investors and traders alike seek to capitalize on potential growth. Among the numerous indices available, the US Small/Mid Company Stock Index holds a significant place. This guide will delve into what this index entails, its importance, and how it can influence investment decisions.

Understanding the US Small/Mid Company Stock Index

The US Small/Mid Company Stock Index is a benchmark that tracks the performance of small and mid-sized companies in the United States. These companies are often overlooked by larger investors due to their size, but they often offer significant growth potential. The index is designed to provide investors with a snapshot of the market's performance within this segment.

Why is the US Small/Mid Company Stock Index Important?

Growth Potential: Small and mid-sized companies are often in the early stages of growth, making them attractive to investors looking for high returns. These companies are more agile and can adapt quickly to market changes, which can lead to substantial growth.

Market Diversification: Including the US Small/Mid Company Stock Index in an investment portfolio can provide diversification. This is crucial as it helps mitigate risks associated with investing in a single sector or stock.

Economic Indicators: The performance of the index can be a valuable economic indicator. It provides insights into the health of the US economy, particularly in sectors that are dominated by small and mid-sized companies.

How to Invest in the US Small/Mid Company Stock Index

Investors can gain exposure to the US Small/Mid Company Stock Index through various means:

Index Funds: Investors can purchase shares of an index fund that tracks the index. This provides a cost-effective way to gain exposure to a wide range of small and mid-sized companies.

ETFs: Exchange-Traded Funds (ETFs) are another option. These funds trade on stock exchanges and track the performance of the index.

Individual Stocks: Investors can also choose to invest in individual stocks within the index. This requires more research and analysis but offers the potential for higher returns.

Case Studies

Let's consider two companies within the US Small/Mid Company Stock Index: Apple Inc. and Tesla, Inc.

Apple Inc.: Once a small company, Apple has grown into one of the largest tech companies in the world. Its inclusion in the index highlights the potential for significant growth within this segment.

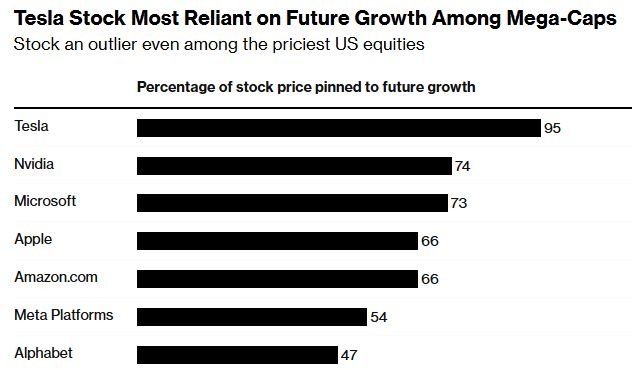

Tesla, Inc.: Tesla is another example of a small company that has become a major player in the automotive industry. Its inclusion in the index underscores the importance of innovation and technology in driving growth.

Conclusion

The US Small/Mid Company Stock Index is a valuable tool for investors looking to gain exposure to high-growth companies. By understanding its importance and how to invest in it, investors can make informed decisions and potentially capitalize on significant growth opportunities.

so cool! ()

last:US Housing vs Stock Market Appreciation: Which is the Better Investment?

next:nothing

like

- US Housing vs Stock Market Appreciation: Which is the Better Investment?

- US Stock Futures Monday: A Comprehensive Guide

- US Stock by Market Cap: A Comprehensive Guide to Understanding the Largest Compan

- http www.mdcdiamonds.com engagementdetails.cfm stock es581&country us

- US Construction Companies Stocks: A Comprehensive Guide to Investment Opportuniti

- Title: "Note 8 US Stock Unlocked Firmware: Your Ultimate Guide at SamMob

- US Automakers Stocks Overlay: A Comprehensive Analysis

- Title: Unveiling the US Housing Stock Historical Data: A Comprehensive Insight

- 1960 Gogo Years in the US Stock Market

- US Stock Market in 2003: A Year of Recovery and Resilience

- Best US Stock to Buy in 2020: Top Picks for Investors

- Live Updates: Keeping You in the Loop with the US Stock Market

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

US Small/Mid Company Stock Index: A Comprehens

US Small/Mid Company Stock Index: A Comprehens

Title: Top 25 Stock Brokers in the US Online

Primers in Stock: Your Ultimate Guide to High-

Top Drone Stocks in the US: A Comprehensive Gu

Understanding the Us Cellular Stock Price: Wha

Get List of All US Stocks: A Comprehensive Gui

Understanding the US Magnesium Stock: A Compre

The Significance of Investment in the US Stock

Schwab US Dividend Equity ETF Stock Price: A C

US Construction Companies Stocks: A Comprehens

Title: US Government Stock Market: A Comprehen

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Pyrogenesis Stock US: A Deep Dive into Investm"

- Tilt Stock: US Ticker to Watch"

- Get List of All US Stocks: A Comprehensive Gui"

- NVIDIA Stock Price in the US Market on May 23,"

- US Stock Figures: A Comprehensive Overview of "

- In the Year V: The US Stock Market Collapse"

- US Military Family Stock Photo: Capturing the "

- 1960 Gogo Years in the US Stock Market"

- Understanding IRS Capital Gains Tax on U.S. St"

- Jet's US Stock: Unveiling the Investment "