you position:Home > us stock market today > us stock market today

Tencent Holdings Stock US: A Comprehensive Analysis

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In the ever-evolving landscape of the technology sector, Tencent Holdings Limited (TCEHY) stands as a prominent player. With its headquarters in Shenzhen, China, Tencent has made significant strides globally, particularly in the United States. This article delves into the intricacies of Tencent Holdings stock in the US market, offering insights into its performance, future prospects, and the factors that influence its value.

Understanding Tencent Holdings Stock US

Tencent Holdings Limited is a Chinese multinational technology company that operates in various sectors, including social media, gaming, e-commerce, and cloud computing. Its stock, traded under the ticker symbol TCEHY on the New York Stock Exchange, has garnered considerable attention from investors worldwide. The stock’s performance is a testament to Tencent’s strategic growth and market dominance.

Historical Performance

Over the years, Tencent Holdings stock has demonstrated impressive growth. Since its initial public offering (IPO) in 2014, the stock has seen significant ups and downs. However, it has managed to maintain a steady upward trend, making it an attractive investment option for many.

One of the key factors contributing to Tencent’s stock performance is its diversification. The company’s revenue streams are spread across various sectors, reducing its vulnerability to market fluctuations. For instance, WeChat, the company’s messaging app, has become a dominant force in the Chinese market, generating substantial revenue through advertisements and e-commerce.

Future Prospects

Looking ahead, Tencent Holdings stock appears poised for continued growth. The company has been actively expanding its presence in the US market, particularly in the gaming and cloud computing sectors. Its acquisition of Epic Games in 2021 further solidified its position as a global leader in the gaming industry.

Moreover, Tencent’s focus on innovation and technology development has positioned it well for future growth. The company has been investing heavily in artificial intelligence, blockchain, and 5G technologies, which are expected to drive its revenue streams in the coming years.

Factors Influencing Tencent Holdings Stock US

Several factors influence the value of Tencent Holdings stock in the US market. These include:

- Market Trends: The overall performance of the technology sector can significantly impact Tencent’s stock price. A strong market trend can lead to increased investor confidence and higher stock prices.

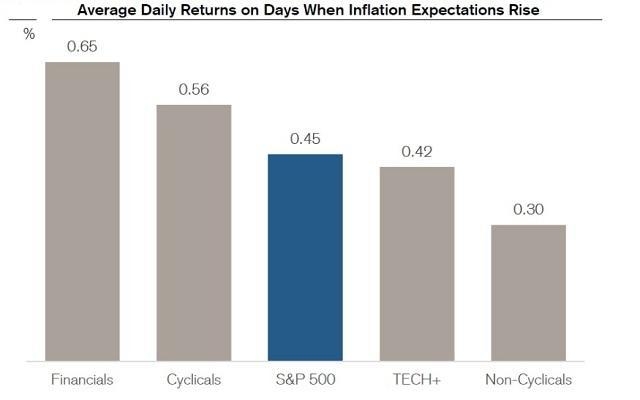

- Economic Conditions: Economic factors, such as inflation and currency fluctuations, can also affect Tencent’s stock performance.

- Company Performance: The company’s financial results, including revenue and earnings, play a crucial role in determining its stock value.

- Regulatory Changes: Changes in regulations, particularly in the technology sector, can impact Tencent’s operations and, consequently, its stock price.

Case Study: Tencent’s Acquisition of Epic Games

One notable example of Tencent’s strategic growth is its acquisition of Epic Games. This move not only bolstered Tencent’s presence in the gaming industry but also expanded its global reach. The acquisition has been a significant driver of growth for Tencent Holdings stock, as it has opened up new revenue streams and increased the company’s market value.

In conclusion, Tencent Holdings stock in the US market has proven to be a valuable investment option for investors. With its diversification, strategic growth, and focus on innovation, Tencent is well-positioned for continued success. As the technology sector continues to evolve, Tencent Holdings stock is likely to remain a key player in the global market.

so cool! ()

last:List of US Stock Market Crashes: A Comprehensive Overview

next:nothing

like

- List of US Stock Market Crashes: A Comprehensive Overview

- RTN US Stock: A Comprehensive Guide to Understanding and Investing in RealTime Ne

- Us Stock Market 100 Year Chart: A Journey Through the Decades

- US Open Stock: Unveiling the Opportunities in the Tennis Market

- Legalize Us Stock Photo: The Future of Image Licensing

- Teflon and Kevlar Material US Stock and Cost: A Comprehensive Guide

- How to Buy Stock in the US from Cambodia

- US Gold Miner Stocks: A Comprehensive Guide to Investing in the Gold Mining Secto

- US Large Cap Momentum Stocks Weekly Performance

- How to Trade Stocks in Canada for US Citizens

- Understanding US Stock Capital Gains: Everything You Need to Know

- Title: US Steel Historical Stock Splits: A Deep Dive into the Evolution of a Lega

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

Tencent Holdings Stock US: A Comprehensive Ana

Tencent Holdings Stock US: A Comprehensive Ana

Primers in Stock: Your Ultimate Guide to High-

Accurate Source for Company Balance Sheets for

Can I Buy Aston Martin Stock on the US Stock E

Best European Stocks Traded in the US: A Guide

How Will Brexit Affect the US Stock Market?

Are Stock Markets Open Today in the US?

US Data Center Stock: A Comprehensive Guide to

Top Growth Stocks to Watch in the US in 2025

Us Stock Market 100 Year Chart: A Journey Thro

US Stock Futures: A Comprehensive Guide to Und

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Stocks High Volatility: Understanding the US M"

- US Elections Impact on Stock Market: Understan"

- Analyst Short-Term Picks: Top US Stocks to Wat"

- Denali Therapeutics: A Star Among US Biotech S"

- US Steel Stock Q: A Comprehensive Guide to Und"

- Radar US Stock Price: Insights and Analysis fo"

- Title: Cannabis Companies on US Stock Market: "

- Good Stocks to Buy Now: Top Picks for Investor"

- Understanding the Dynamics of a US Stock Inves"

- US Construction Companies Stocks: A Comprehens"