you position:Home > us stock market today > us stock market today

Is the US Stock Market Cheap? A Comprehensive Analysis

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In recent years, investors have been grappling with the question: "Is the US stock market cheap?" This query is especially pertinent given the current economic climate and the fluctuating market conditions. In this article, we delve into the factors that determine whether the US stock market is undervalued or overvalued, providing a comprehensive analysis to help you make informed investment decisions.

Understanding Stock Market Valuation

To assess whether the US stock market is cheap, it is crucial to understand the concept of stock market valuation. Valuation measures the worth of a company or the overall market by comparing it to certain financial metrics. Common valuation metrics include the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and the cyclically adjusted price-to-earnings (CAPE) ratio.

Current Valuation Metrics

As of now, the US stock market is trading at a P/E ratio of around 18, which is slightly below the long-term average of 22. However, when considering the CAPE ratio, which adjusts for cyclicality, the market is currently valued at 28. This indicates that the market is not necessarily cheap, as it is still trading at a premium to its historical averages.

Factors Influencing Market Valuation

Several factors can influence the valuation of the US stock market. Here are some key factors to consider:

1. Economic Growth: Strong economic growth can lead to higher corporate earnings, driving up stock prices and potentially making the market appear more expensive.

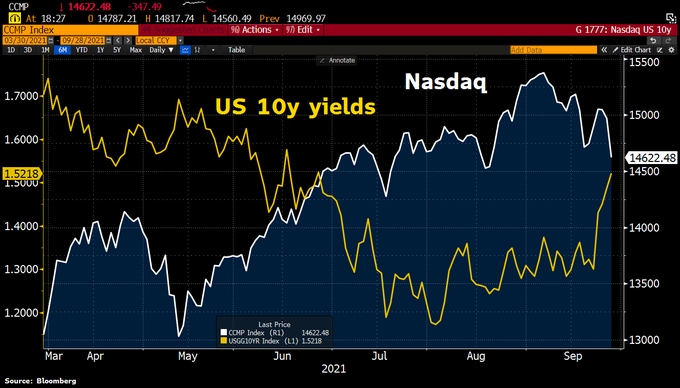

2. Interest Rates: Lower interest rates can make stocks more attractive relative to fixed-income investments, pushing stock prices higher.

3. Inflation: High inflation can erode purchasing power, leading to lower stock prices. Conversely, low inflation can support higher stock valuations.

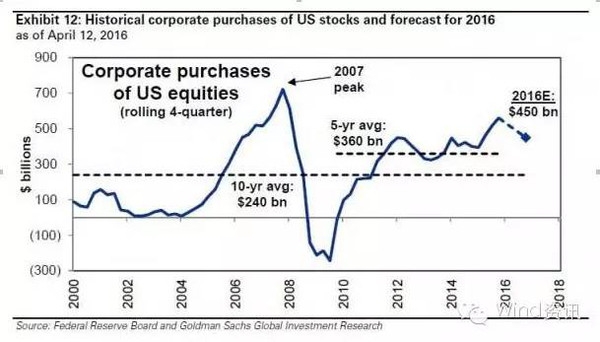

4. Corporate Earnings: Robust corporate earnings can boost stock prices, making the market appear more expensive.

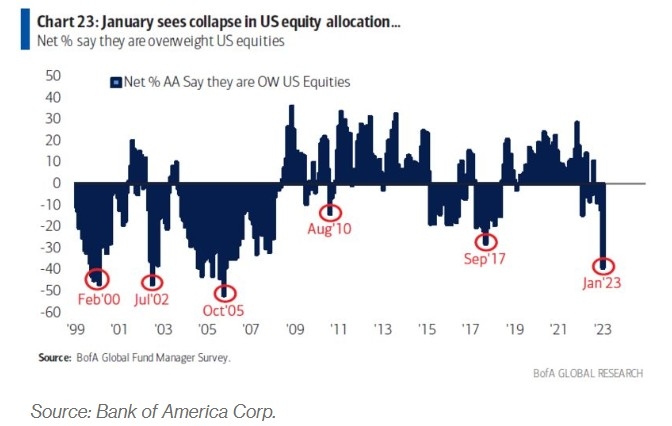

5. Market Sentiment: Investor sentiment can significantly impact stock prices, sometimes leading to overvaluation or undervaluation.

Case Studies

To illustrate the impact of market valuation, let's consider two historical periods:

1. Dot-Com Bubble (2000): During the late 1990s, the US stock market experienced a significant bubble, driven by the rapid growth of the internet sector. The market was overvalued, with the P/E ratio soaring to over 40. This eventually led to a dramatic market correction in 2000.

2. Financial Crisis (2008): In the lead-up to the financial crisis, the US stock market was also overvalued, with the P/E ratio reaching around 25. The crisis exposed underlying weaknesses in the financial system, leading to a sharp decline in stock prices.

Conclusion

In conclusion, while the US stock market may not be considered cheap based on current valuation metrics, it is essential to consider various factors that can influence market valuation. By analyzing economic indicators, corporate earnings, and market sentiment, investors can make more informed decisions regarding their investments. As always, it is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

so cool! ()

last:Total US Stock Market Vanguard: A Comprehensive Guide

next:nothing

like

- Total US Stock Market Vanguard: A Comprehensive Guide

- US Stock Earnings Surprise, AI Semiconductor Partnership News July 2025

- Are U.S. Stock Markets Closed Tomorrow?

- UAE Shorting US Stocks: Understanding the Trend and Its Implications

- US Canada Flag Stock Photo: Discover the Perfect Image for Your Needs

- Outlook for the US Stock Market in 2024

- Title: US Bancorp Direct Stock Purchase: A Comprehensive Guide

- Title: US Made L1A1 Stock: The Ultimate Choice for Firearms Enthusiasts

- US Stock Market on February 8, 2019: A Look Back

- Title: Best Twitter Accounts for US Stock Market News

- Canopy Growth Stock Price: What You Need to Know

- Current US Stock Market Outlook: September 2025

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

Is the US Stock Market Cheap? A Comprehensive

Is the US Stock Market Cheap? A Comprehensive

Title: Best Bank Stock in US: Top Picks for 20

Reddit US Stock Market: The Emerging Trendsett

Most Volatile US Stocks in 2022: A Deep Dive

Chart Us Index: Understanding the Stock Market

How to Buy US Stocks in Thailand

US Stock Market Bubbles: Understanding the Ris

US Stock Earnings Surprise, AI Semiconductor P

Daytona Road Star GTX Boots Size 42 US Stock:

Title: Penny Stocks: The Thrilling World of Mi

Constructing a US Stock Market Portfolio with

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Navy Vietnam Veteran Stocking Cap: A Symbol"

- Title: Tax on US Stocks for Indian Investors: "

- Canopy Growth Stock Price: What You Need to Kn"

- Title: Unveiling the US Housing Stock Historic"

- Trading US Stock Options in Singapore: A Compr"

- US Stock Futures Halted: What You Need to Know"

- Live Updates: Keeping You in the Loop with the"

- US Quantum Stocks: The Future of Innovation an"

- Good Stocks to Buy Now: Top Picks for Investor"

- Average Dividend Yield of US Stocks: A Compreh"