you position:Home > us stock market today > us stock market today

How China Impacts the US Stock Market

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

The relationship between the US and Chinese stock markets is a complex and dynamic one. As the world's two largest economies, any movement in one can have a ripple effect on the other. In this article, we delve into how China affects the US stock market, exploring the various factors at play.

Economic Interdependence

One of the primary reasons why China impacts the US stock market is due to the economic interdependence between the two countries. The US and China are the world's two largest trading partners, with each country being a significant market for the other's goods and services. This interdependence means that any economic turmoil in China can have a direct impact on the US stock market.

Trade Tensions

Trade tensions between the US and China have been a major factor affecting the US stock market. In recent years, the two countries have been engaged in a trade war, with both sides imposing tariffs on each other's goods. This has led to increased costs for companies that rely on Chinese manufacturing and supply chains, which in turn has affected their profitability and stock prices.

Currency Fluctuations

The value of the Chinese yuan can also impact the US stock market. A weaker yuan makes Chinese goods cheaper for US consumers, which can boost the profits of companies that sell products in China. Conversely, a stronger yuan can make Chinese goods more expensive, which can hurt the profits of US companies that rely on Chinese manufacturing.

Market Sentiment

The sentiment in the US stock market can also be influenced by events in China. For example, in 2015, the Chinese stock market experienced a significant downturn, which caused panic in the US stock market. Similarly, in 2020, the outbreak of the COVID-19 pandemic in China had a negative impact on global markets, including the US.

Case Studies

To illustrate how China affects the US stock market, let's look at a couple of case studies:

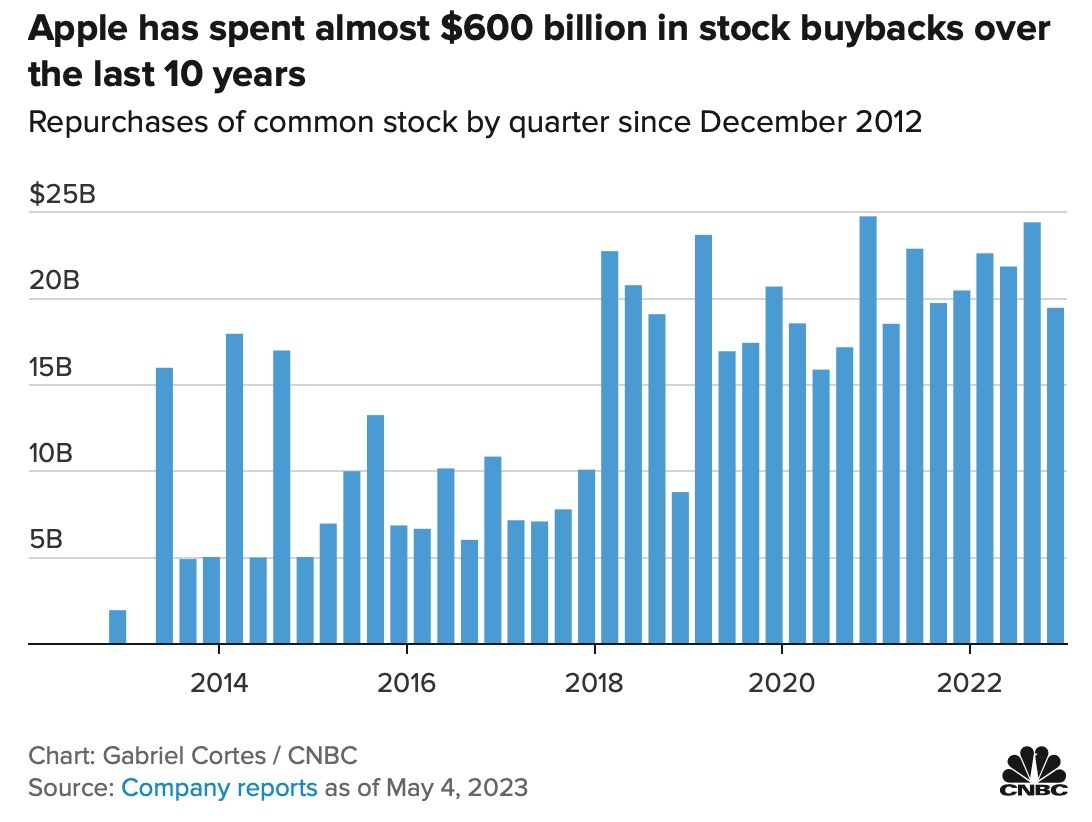

Apple Inc.: Apple is one of the largest companies listed on the US stock market, and a significant portion of its revenue comes from China. In 2019, Apple reported that China represented 20% of its total revenue. Any economic or political instability in China can have a direct impact on Apple's stock price.

Tesla Inc.: Tesla has recently expanded its operations in China, with plans to build a factory in Shanghai. The success of this factory will depend heavily on the demand for Tesla cars in China, which in turn can affect the company's stock price.

Conclusion

In conclusion, China's economic and political stability can have a significant impact on the US stock market. From trade tensions to currency fluctuations, there are numerous factors at play. As the global economy becomes increasingly interconnected, it's important for investors to stay informed about the developments in both the US and Chinese stock markets.

so cool! ()

last:Stocks in US Soft WSRE Index: A Comprehensive Guide

next:nothing

like

- Stocks in US Soft WSRE Index: A Comprehensive Guide

- Is China Buying Up US Stocks? The Truth Behind the Buzz

- Factors Influencing the US Stock Market in March 2025

- Buying Exrof Stock US: A Comprehensive Guide for Investors

- The Biggest US Stock Exchange: Discover Its Prime Location

- Historic Impact of US Presidential Elections on the Stock Market

- Unlocking Opportunities in the Penny Stock Exchange: A Comprehensive Guide

- US Government Buys Stocks: Why It's a Game-Changing Move for Investors&q

- Stock Trader Wages: What You Need to Know in the US

- Decoding the Evolution of US Gold Stocks by Year: A Comprehensive Overview&qu

- Examples of US Mid Cap Stocks: A Comprehensive Guide

- US Preferred Stock List: Top Picks for Investors in 2023"

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

How China Impacts the US Stock Market

How China Impacts the US Stock Market

Title: US Foods Stock Yards Meat Buffalo NY 14

Understanding the Impact of Foreign Ownership

US Oil and Gas PLC Stocks: A Comprehensive Ana

Top US Stocks 2020: A Deep Dive into the Marke

Crowdstrike US Stock: A Deep Dive into the Cyb

Best US Stocks for SIP: Your Ultimate Guide to

Best US Construction Stocks: Top Picks for Inv

US Hemp Roundtable Stock: A Comprehensive Guid

Title: Unveiling the Best US Office Products S

US Large Cap Stocks: Best Performers in Septem

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- 2023 US Stock Market: Predictions, Trends, and"

- Top US Momentum Stocks: Strong Performance in "

- Adani US Stocks: A Comprehensive Guide to Inve"

- Understanding US Listed Stock Options: A Compr"

- Examples of US Mid Cap Stocks: A Comprehensive"

- Title: Standard Chartered US Stock Price: A Co"

- Understanding the Impact of Foreign Ownership "

- Am US Stock: Understanding the Basics and Bene"

- Toys "R" Us Overnight Stocke"

- Unlocking the Potential of US Nuclear Power St"