you position:Home > us stock market today > us stock market today

How Much US vs. International Stocks: A Comprehensive Comparison

![]() myandytime2026-01-14【us stock market today live cha】view

myandytime2026-01-14【us stock market today live cha】view

info:

Investing in stocks is a crucial component of any diversified portfolio. However, investors often face the dilemma of choosing between US stocks and international stocks. This article aims to provide a comprehensive comparison of the two, highlighting the key factors that investors should consider when making their decisions.

Understanding the Difference

Firstly, it's important to understand the fundamental difference between US stocks and international stocks. US stocks are shares of companies that are publicly traded on American stock exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ. On the other hand, international stocks are shares of companies that are based outside of the United States but are also publicly traded on American stock exchanges.

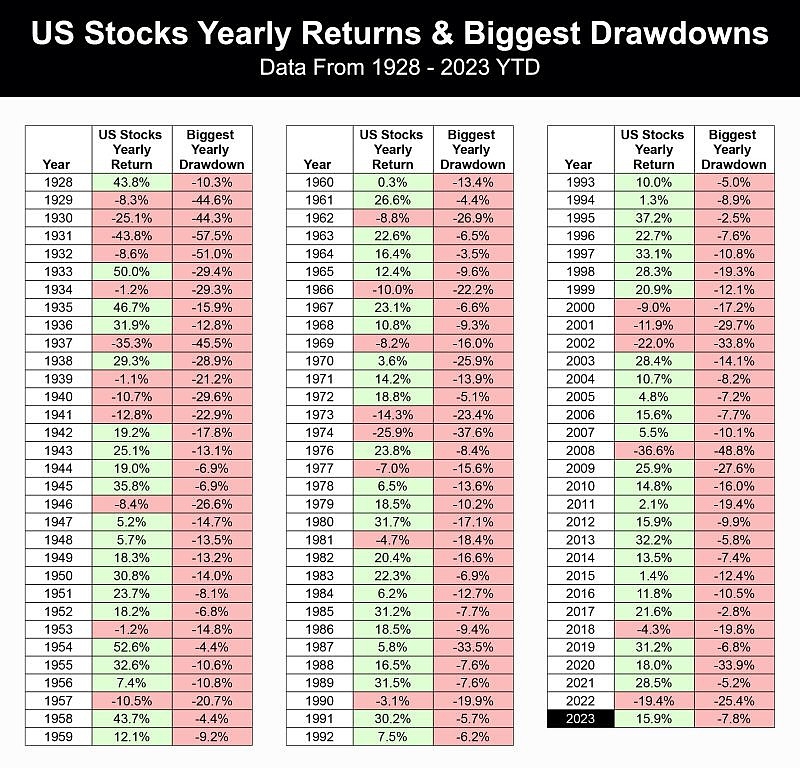

Market Performance

One of the primary reasons investors choose between US and international stocks is based on market performance. Historically, the US stock market has been known for its robust performance, with the S&P 500 index being a benchmark for the overall market. However, international stocks have also shown strong growth, particularly in emerging markets like China and India.

Diversification

Diversification is a key principle in investing, and it's important to consider the geographical diversification of your portfolio. Investing in international stocks can provide exposure to different economies and currencies, which can help reduce the risk of your portfolio being negatively affected by a single country's economic downturn.

Risk and Return

Investing in international stocks often comes with higher risk compared to US stocks. This is due to factors such as political instability, currency fluctuations, and economic uncertainties. However, the potential for higher returns in some international markets can make the risk worthwhile for many investors.

Currency Fluctuations

One significant factor to consider when investing in international stocks is currency fluctuations. The value of the US dollar can impact the returns on international investments. When the dollar strengthens, the returns on international stocks may be reduced, and vice versa.

Tax Considerations

Tax implications are another important aspect to consider. US investors may be subject to capital gains tax on profits from international stocks, which can vary depending on the country of the underlying company. It's important to consult with a tax professional to understand the potential tax implications of investing in international stocks.

Case Studies

To illustrate the differences between US and international stocks, let's consider two companies: Apple Inc. (AAPL) and Tencent Holdings Ltd. (TCEHY).

Apple Inc. is a well-known American company that has shown consistent growth over the years. Investing in Apple provides exposure to the US stock market, which is known for its stability and strong performance.

Tencent Holdings Ltd. is a Chinese company that operates in the technology and entertainment sectors. Investing in Tencent offers exposure to the rapidly growing Chinese market, which is characterized by high growth rates and innovation.

Conclusion

In conclusion, the decision between US and international stocks depends on several factors, including market performance, diversification, risk, and return. While US stocks have historically offered strong performance, international stocks can provide exposure to different economies and potentially higher returns. Investors should carefully consider these factors and consult with a financial advisor to make an informed decision that aligns with their investment goals and risk tolerance.

so cool! ()

like

- Title: Highest Dividend US Stocks: Your Guide to Maximizing Returns

- Title: US Stock Market Performance on May 9, 2025

- PDD US Stock Price: A Comprehensive Analysis

- Jet's US Stock: Unveiling the Investment Potential in America's Emergin

- Auro Canibui US Stock Quote: Unveiling the Investment Potential

- How Much Is the Total US Stock Market Worth?

- When Does the US Stock Market Close Today? Understanding Market Hours and Closing

- 107 Stockings Brook Rd, Berlin, CT, US: A Prime Real Estate Gem in the Heart of C

- Best US Rare Earth Mining Stocks: A Comprehensive Guide

- Nintendo Stock Symbol: US

- Novonix Stock US: A Comprehensive Analysis

- Does Among Us Have Stock? A Comprehensive Guide

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest Dividend Yield Stocks in the US: Top P"

- Does Among Us Have Stock? A Comprehensive Guid"

- How to Buy a US Stock: A Step-by-Step Guide"

- Timings of the US Stock Market: A Comprehensiv"

- Title: ETF US Stock: A Comprehensive Guide to "

- Delek US Holdings Stock Price: A Comprehensive"

recommend

Title: Highest Dividend US Stocks: Your Guide

Title: Highest Dividend US Stocks: Your Guide

Is the US Stock Market Open Next Monday?

How to Buy MediaTek Stock in the US

Ericsson Stock US: A Comprehensive Guide to In

Title: ETF US Stock: A Comprehensive Guide to

Nintendo US Stock Quote: A Comprehensive Guide

Does Among Us Have Stock? A Comprehensive Guid

April 15, 2018: A Pivotal Day in the US Stock

Highest Dividend Yield Stocks in the US: Top P

Current US Stock Market Valuation Metrics: CAP

Nintendo Stock Symbol: US

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Major US Stock Market Indices: Understanding t"

- Canadian Cannabis Traded in US Stock Market: A"

- When Does the US Stock Market Close Today? Und"

- Nintendo Stock: A Dive into the US Dollar Mark"

- Ericsson Stock US: A Comprehensive Guide to In"

- Can I Buy Aston Martin Stock on the US Stock E"

- Is the US Stock Market Open Next Monday?"

- When Does the US Stock Market Open?"

- Current US Stock Market Valuation Metrics: CAP"

- Is NASDAQ an US Stock Index?"