you position:Home > us stock market today > us stock market today

Can Indians Buy US Stocks? A Comprehensive Guide

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

Are you an Indian investor looking to diversify your portfolio? If so, you might be wondering, "Can Indians buy US stocks?" The answer is a resounding yes! Investing in US stocks can be a lucrative opportunity for Indian investors. In this article, we will explore the process of buying US stocks from India, the benefits, and potential risks involved.

Understanding the Basics

To begin with, it's essential to understand that Indian investors can buy US stocks through various platforms. These include online brokerage firms, mutual funds, and ETFs (Exchange-Traded Funds). The process may vary slightly depending on the platform you choose, but the general steps remain the same.

Steps to Buy US Stocks from India

Choose a Brokerage Firm: The first step is to select a reliable brokerage firm that offers access to US stocks. Some popular options include Zerodha, Upstox, and Angel One. Ensure that the brokerage firm is regulated and has a good track record.

Open an Account: Once you have chosen a brokerage firm, you need to open an account. This process involves filling out a form, providing identification documents, and linking your bank account.

Fund Your Account: After opening an account, you need to fund it. You can transfer funds from your Indian bank account to the brokerage firm's account using NEFT or RTGS.

Research and Analyze: Before investing, it's crucial to research and analyze the US stocks you are interested in. Look at factors such as the company's financial health, market trends, and industry outlook.

Place an Order: Once you have done your research, you can place an order to buy US stocks. You can choose to buy stocks directly or invest in ETFs that track specific indices or sectors.

Benefits of Investing in US Stocks

Diversification: Investing in US stocks allows Indian investors to diversify their portfolio and reduce risk. The US stock market is one of the largest and most liquid in the world, offering exposure to a wide range of sectors and industries.

Potential for Higher Returns: The US stock market has historically offered higher returns compared to the Indian market. This can be attributed to factors such as technological advancements, innovation, and strong corporate governance.

Access to Global Companies: By investing in US stocks, Indian investors can gain exposure to some of the world's leading companies, such as Apple, Microsoft, and Amazon.

Risks to Consider

While investing in US stocks offers numerous benefits, it's important to be aware of the potential risks involved:

Currency Fluctuations: Since US stocks are priced in USD, fluctuations in the exchange rate can impact your investment returns.

Political and Economic Risks: The US stock market is influenced by various political and economic factors, including trade wars, interest rate changes, and political instability.

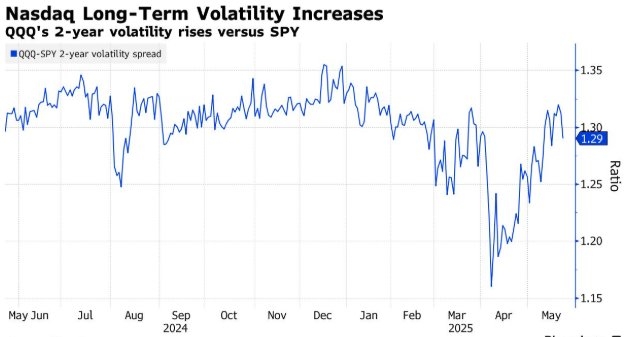

Market Volatility: The US stock market can be highly volatile, leading to significant price fluctuations.

Case Study: Investing in US Stocks through ETFs

Let's consider a hypothetical case of an Indian investor named Rohan. Rohan decided to invest in the S&P 500 ETF, which tracks the performance of the 500 largest companies in the US. By investing in this ETF, Rohan gained exposure to a diversified portfolio of leading US companies.

Over the next five years, the S&P 500 ETF delivered an annualized return of 10%. Despite the currency fluctuations and market volatility, Rohan's investment grew significantly, providing a good return on his investment.

Conclusion

Buying US stocks from India is a viable option for investors looking to diversify their portfolio and gain exposure to global markets. By following the steps outlined in this article and conducting thorough research, Indian investors can make informed decisions and potentially achieve higher returns. Remember to consider the risks involved and consult with a financial advisor if needed.

so cool! ()

like

- Tencent Stock US Yahoo: Unveiling the Potential of Tencent's American Market

- US Stock Futures Tumble: What It Means for Investors

- Unlocking Opportunities in SMR-Related Stocks: A Comprehensive Guide for US Inves

- Of Us Population Invested in Stock Market: Trends, Insights, and Opportunities&am

- Top Energy Stocks in the US: A Comprehensive Guide for Investors

- Toys "R" Us Stock Market Price: A Comprehensive Analysis

- Understanding the Impact of US Listed Chinese Stocks

- Do International Stocks Drop When US Stocks Do as Well?

- History Tells Us Stock Markets Dive: How to Prepare for the Next Market Decline&a

- Top Performing Stocks in the US Market for July 2025: A Comprehensive Insight&

- Analyst Picks: Top US Stocks to Watch in 2023

- September 1, 2025: A Glimpse into the US Stock Market Performance

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

Can Indians Buy US Stocks? A Comprehensive Gui

Can Indians Buy US Stocks? A Comprehensive Gui

Understanding the US Stock Market Breadth: A C

Title: ESSO US Stock History: A Comprehensive

Lumber Stocks: A Growing Investment Opportunit

2025 Second Half US Stock Market Outlook

Shionogi Stock US: A Comprehensive Guide to In

Denali Therapeutics: A Star Among US Biotech S

Can Stocks Transfer from Canada to US? Underst

US Shoe Brand on US Stock Exchange: A Closer L

Shipping Company Stocks: A Comprehensive Guide

NVIDIA Stock Price in the US Market on May 23,

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Coronavirus Stocks: Opportunities Amidst th"

- Nintendo US Stock Quote: A Comprehensive Guide"

- Best US Pot Stocks for 2021: Top Picks for Inv"

- Title: US Stock Market Bailout: A Comprehensiv"

- GSX US Stock: A Comprehensive Guide to Underst"

- Title: "http stocks.us.reuters.com st"

- US Stock Futures Current: A Comprehensive Guid"

- US Large Cap Stocks Momentum Leaders: Unveilin"

- Fidelity US Stocks: A Comprehensive Guide to I"

- US Open Stock: Unveiling the Opportunities in "